We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Donor Surveys: The Ultimate How-to Guide for Nonprofits

Updated for December 2019

Welcome! You’re about to learn A LOT about donor surveys. At MarketSmart, we’ve spent the past 10 years conducting donor surveys for our hundreds of clients. During that time we’ve figured out what donor survey questions work and which don’t.

VERY IMPORTANT: Before we begin, read this!

Of course, you probably found this page because you want to send your donors a survey. However, our research has shown that surveying donors without a properly crafted follow-up engagement plan actually harms donor relationships and drives donations down.

You can learn much more about this here. However, if you don’t have time to read that page, just realize that fundraising is different from product marketing. Donors think of charities and other nonprofits as part of their family and an integral part of their life story. Trust is essential.

When trust is diminished or dissolved altogether, donations dry up.

Your supporters are not research targets. They are caring, giving human beings. Asking them for advice takes up the most valuable resource they have—their time.

Plus, if you invite them to give you feedback and they later notice that you failed to listen to them after they expressed their wants, needs, concerns and desires, they’ll determine that you don’t care about them—that you used them and wasted their time. Then, they’ll either stop giving altogether (and find another partner to help them change the world) or they’ll give less.

We learned this the hard way. So be very careful. Don’t ever survey your well-meaning donors, supporters, advocates and volunteers if you don’t have a carefully developed follow-up plan that engages each and every respondent in an ongoing, personalized and relevant way that proves to them that heard them and you care about them. IGNORE THIS WARNING AT YOUR OWN RISK.

Ok, no more warnings…

Below, you’ll find a table of contents. Whether you’re here to learn about a planned giving survey, an alumni engagement survey, or any type of donor survey in between, you’ve come to the right place. Click on any of the links below to jump to that section of the guide. Or, scroll down to begin!

Please enjoy, and please share on Twitter, LinkedIn, or Facebook, or with anyone who you think might find this information valuable.

Why survey donors?

If you Google search “big data,” you’ll find nearly seven billion results. When it comes to “hot topics” in our industry, none may be more in the spotlight than data (okay, maybe artificial intelligence, or machine learning, but they’re all eerily similar).

Why is “big data” important? There are myriad articles that explain that.Instead, I’d like to reference a quote from the book Moneyball by Michael Lewis: “People … operate with beliefs and biases. To the extent that you can eliminate both and replace them with data, you gain a clear advantage.”

To put it bluntly, the organizations that are more able to leverage data in their decision making will survive (and thrive) better than their peers. In our sector, our focus is on relationship building. I don’t think anyone disagrees that relationships are the premise for all fundraising; however, data and relationship building don’t appear (on the surface) to go hand-in-hand.

This is why we conduct donor surveys.

Data comes in many different forms. You might not know it, but Amazon offers a service (the AWS Data Exchange), where you can subscribe to data from a vast array of suppliers for a small fee. If you want data, you can have data.

Yet, as with all things in life, the path of least resistance is generally not going to yield the most optimal result. The same holds true here. You may spend a few thousand dollars purchasing wealth data for your prospect list, but are you really any closer to knowing why that individual cares about your organization, or which aspect of your mission they’re most aligned with? Not quite.

This, in the traditional fundraising workflow, is where donor discovery comes into play. As a fundraiser, it is your responsibility to connect with this prospect and learn more about their interests, values, and unique connection to your organization. Then, of course, you need to solicit a gift.

Data-driven decision making, right?

Sort of. With wealth data in hand, we only have a partial portrait of our prospect. This is where surveying your donors can be powerful.

What if you knew the influential person that brought this prospect to your organization in the first place? Better yet, what if you knew which specific programs meant most to them? Or, best of all, what if you knew their likelihood to meet with you right now?

Would this data be compelling?

Of course it would, and it’s all achievable thanks to donor surveys.

Donor survey questions you should be asking

It all started with Charles the Great in 800 A.D.

Before we get into the nitty-gritty of conducting your own donor survey at your organization, it’s important to understand where surveys originated.

Charles the Great supposedly conducted the first survey around 800 A.D. in Western Europe. Here are some of the questions the king sought to understand:

- Why are so many men refusing to join the military service to defend the borders of the realm?

- Why are there so many disputes in the kingdom with one party attempting to take the property of another?

- Why are people refusing to offer refugees shelter?

Charles the Great had burning questions, and he needed answers. His 800 A.D. survey was ahead of his time! With the feedback of his constituency, the king knew he could be more informed in his decision-making process.

Today, we know that feedback helps us in a variety of ways:

- A captain on a ship uses feedback to alter course;

- Children in school get feedback in the form of grades;

- Employees get feedback from peer reviews;

- Politicians get feedback from constituents;

- And many other ways as well.

Why do we gather this feedback? So that we can adjust and do better. The premise behind surveying is to learn more about something from someone and then use that information to influence the changes we make.

There are three primary methods for collecting feedback that we are most accustomed to:

-

Polls

- Provide quick insight into one specific question.

-

Reviews & Ratings

- Provide free-flow or unstructured feedback on a specific idea, concept, product, or experience.

-

Surveys

- Provide guided feedback on a specific idea, concept, product, or experience.

Obviously, our focus is on surveying to collect feedback, and when it comes to designing a survey you have many considerations to keep in mind. Donor surveys that are too long will yield poor responses. Donor surveys that are all about “me” and not about “you” (the recipient) will foster few meaningful replies. Surveys that have leading questions will skew results. Who knew creating a donor survey was so complicated?

Learn how MarketSmart can help you create a high performing donor survey.

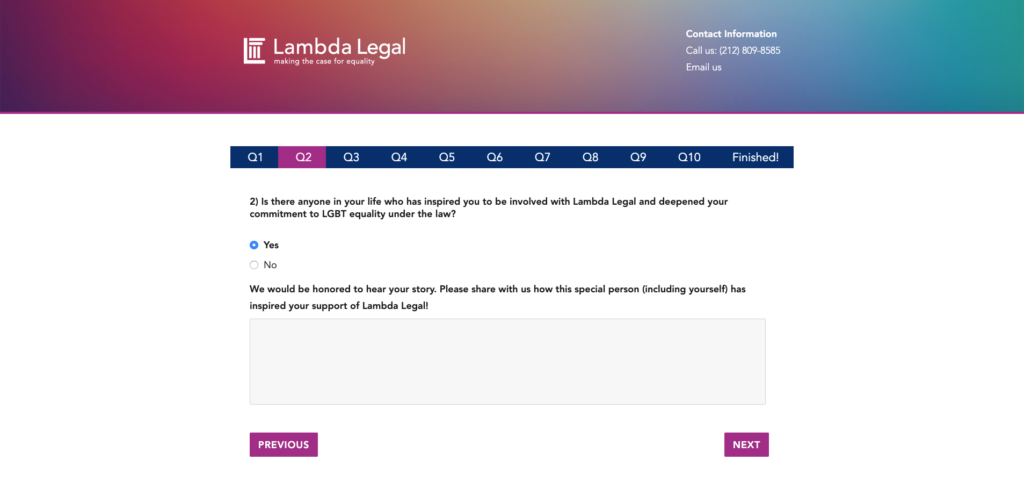

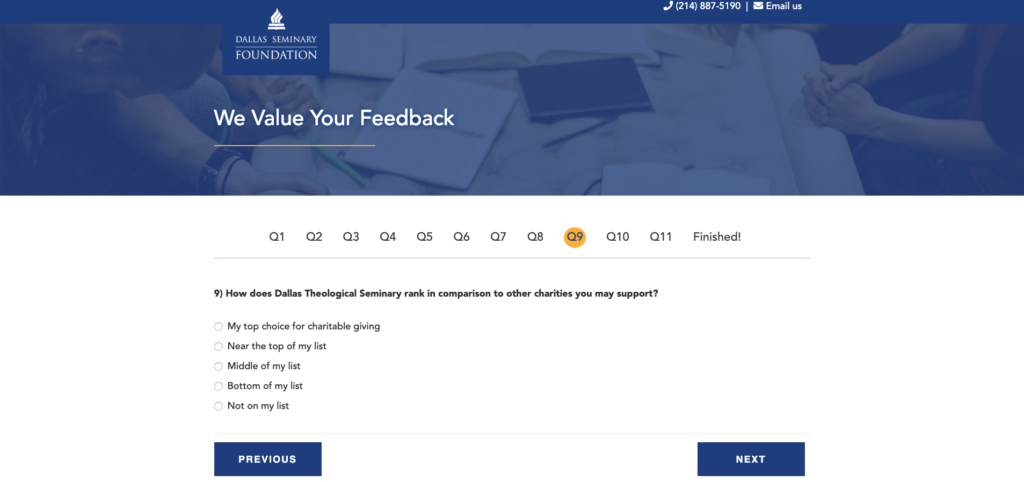

Learn MoreAt MarketSmart, we’ve been privileged to conduct hundreds of donor surveys over the years, and we’ve found that a few questions make it into nearly every survey we conduct. Those are:

- Which aspect of our mission is most important to you?

- In what ways do you interact with our organization?

- Where does our charity rank relative to others you support?

There are a few more that we typically include; however, these three cover your bases in terms of learning about a donor’s interests and values, as well as where your organization ranks relative to the other charities they support.

Donor survey questions to avoid

No matter how many “good” survey questions you have, an entire donor survey can be made obsolete by including one “bad” question. When it comes to conducting a donor survey, whether it be for planned giving, alumni engagement, or anything in between, there are a few core tenets you should keep in mind:

Don’t write leading questions

- Survey questions should never be written in a way that could sway the reader’s frame of reference.

- Bad question: How excited are you about the incoming president?

- Good question: How would you describe your sentiment towards the incoming president?

Avoid double-barreled questions

- Never design a survey question that requires two answers.

- Bad question: How satisfied or dissatisfied are you with our after school program and our school lunch program?

- Good question: How satisfied or dissatisfied are you with our after school program? How satisfied or dissatisfied are you with our school lunch program?

No “absolutes”

- When designing a question, that has a Yes/No answer, avoid including words such as “always,” “all,” “every,” “ever,” etc.

- Bad question: Do you always support the athletics department?

- Good question: How often do you support the athletics department? (Annually, Quarterly, Monthly, I do not support the athletics department)

Avoid jargon and get to the point

- When designing survey questions, use your audience’s language and ask your question.

- Bad question: For 100 years, we have served the underprivileged, the wounded, the needy, and more. Our exceptional program offerings meet ADA standards, abide by HKS (Harvard Kennedy School) guidelines, and support tens of thousands of individuals. How would you describe your feeling towards our 2019 impact?

- Good question: How satisfied or dissatisfied are you with the impact we made in 2019?

Planned giving surveys

To this point, we’ve covered why you should survey your donors (#bigdata), questions you should be asking, and questions (and techniques) you should avoid. Now, let’s get specific.

Let’s say you want to conduct a planned giving survey. What does that look like?

First, you need to ask yourself “why?” Actually, if you’re up for it, you should ask “why” five times. More on that here.

If your answer is, “to get information about our constituents’ estate plans,” then you need to take a step back. For years, gift planning professionals have been frustrated by low planned giving survey response rates. Unbeknownst to them, the reason was right in front of them: the survey is designed to learn about constituents’ estate plans and not too much else!

If you answer the “why” question and said something along the lines of, “to help our constituents think about their legacy with our organization,” then we’re on to something! Remember, surveys, especially planned giving surveys (as our friend Dr. Russell James has taught us), need to be about the donor, and their life story, not about you and your need to know about their estate plans. It’s a tough pill to swallow. However, it’s well worth it, I promise. The results prove it.

Next, when it comes to planned giving surveys, you need to be cognizant of our subject matter (i.e. death). James’ research tells us that individuals do not like to think about their own demise. With that in mind, there are a few tactics we can employ to help the survey respondent “ease into” questions about their estate. First and foremost, you should use the beginning of the survey to help your respondents think about their connection with your organization. Questions like, “Do you believe in our mission?” and, “How do you engage with us?” are great “warm-up” questions.

After a series of questions that allow the donor to reflect on their relationship with your organization, you can then begin to ask “your” questions. For example, for many of our clients, we include questions like, “Many people like to include charitable gifts in their will to support important causes in their life. Would you consider making such a gift to ______ to benefit future generations?”

Answers should range from: “I have already included ______ in my will, trust, or beneficiary designation,” to “I am not interested in this type of gift.”

As responses to this survey come in, it’s easy to focus all your attention on those who inform you they have made a legacy gift to your organization. That is where your immediate attention should go. However, keep in mind everyone else still needs to be acknowledged and cultivated after they respond, even those who show no or deferred interest in a planned gift. Completing a survey, a planned giving one at that, is not an easy task, and it’s incumbent upon your organization to have a cultivation plan in place for when responses start to roll in.

Blended giving surveys

Unlike pure “gift planning surveys,” blended giving surveys typically require approval and sign off from both legacy and major gift departments within an organization. Whereas a legacy giving survey focuses on learning only about individual’s estate plans, a blended giving survey takes a wider approach to learn about estate plans as well as current giving vehicles (think donor-advised funds, qualified charitable distributions, supporting a campaign, meeting with a gift officer, etc.)

In practice, we recommend our clients take a blended approach to their surveys. Remember, the reason we survey is not to get estate planning and gift-giving information. Rather, it’s to provide the respondent with an opportunity to self-actualize with our organization. However, since we have their attention (i.e. they are responding to the survey), we might as well learn more about their comprehensive giving.

We recommend including a question such as, “Would you consider furthering our work in any of the following ways?” Then, follow that up with a Likert scale with multiple giving options.

Why do donors respond to surveys?

Up to now, nothing we’ve shared with you should feel too unfamiliar. We’re all accustomed to seeing polls, ratings, and surveys. The question then becomes why do people (and in our case, our supporters), complete these feedback devices? There are seven primary reasons why people respond:

- They are interested in the topic

- They’re curious about what questions they’ll be asked

- They have affection for the company or organization asking the questions

- They want to shape the organization to their liking

- They want to be heard

- They want to reciprocate (especially if they are offered an incentive to participate)

- They simply want to be helpful

If you’re concerned that you will design a great survey but no one will answer it, our recommendation would be “don’t be!” It may sound cliche, but the proof is in the data. After conducting hundreds of surveys for organizations of all sizes, scopes, and mission alignments, we see time and time again that supporters will respond.

Learn how MarketSmart can help you create a high performing donor survey.

Learn MoreThe exception to this rule is if your supporters have been overwhelmed with communications and solicitations. If your “list” has been mistreated over the years, don’t expect a high response rate. Building trust and rapport with your constituents takes time (they’re real human beings on the other end of those emails and direct mail pieces). If that trust has been lost, response rates for your donor survey may be low.

Why donor surveys are so powerful

Your supporters like surveys; they really, really do. Why? Because they can…

- Engage, get involved, give feedback, enter into a two-way conversation, feel that their input counts;

- Tell nonprofit about preferences (e.g. time of year to be asked for a gift, what they like/don’t like or want/don’t want);

- Tell your nonprofit why they care (Charity is a form of extended family. Supporters want to “talk it out” with their favorite charities. For instance, I care because my mother had breast cancer);

- Tell your nonprofit how they might consider helping the cause (e.g. by getting involved, donating jewelry, making a gift in a will, etc.)

Over the past ten years, we’ve had the privilege of surveying tens of millions of individuals at MarketSmart. Our average response rate? 5%. Surveys work because individuals like to share their stories. You know the old saying, if you ask for money, you’ll get advice; if you ask for advice, you’ll get money. It’s really the truth.

There is a variety of benefits your organization can derive from conducting a donor survey. They include:

- Raise money (YES! Survey respondents will actually give more)

- Find new volunteers, re-engage alumni, and re-inspire past donors

- Identify your 80/20 and zero in on your best major or planned gift opportunities by analyzing the key traits of your most profitable donors

- Recruit leaders for Board positions

- Find new major donors via referrals from passionate supporters

- Make your supporters feel valued and appreciated because your organization actually sought their opinion

- Get feedback on ideas, initiatives, concepts, or policies

- Measure donor satisfaction and interest in particular giving opportunities

- Establish benchmarks so you can monitor trends

- Clean up your list

- Capture demographic information you simply cannot buy

What’s stopping you?

There are seven common reasons we see why nonprofits don’t survey their donors:

- Don’t know what questions to ask and/or what specific words work best

- Don’t know how to design a survey that will get a high completion rate

- Don’t have the time

- Don’t have the expertise to ensure that your supporters’ feathers won’t get ruffled

- Don’t have the technological capabilities

- Don’t want other departments to get involved

- Don’t want to start office drama/politics

But all of the potential negatives are easily offset by the positive outcomes of surveying. Don’t take our word for it though. This is what others are saying:

Creating your first donor survey

By now, we’ve hopefully convinced you that surveying your donors is worthwhile, right? So what’s next? If you’re going to go for a survey effort, there are a few things you should keep in mind to get the most out of it.

Be strategic

Donor surveys work best when you have an end goal in mind, and no, that end goal can’t be to solicit a respondent after they’ve completed the survey. Instead, think about why you want to conduct the survey. What are you hoping to accomplish?

Who are the stakeholders? What will you do with the information? Who are you going to be surveying: all donors in your database or a select segment?

The more you consider these questions, the better off you are. Your survey will feel more complete, coherent, and connected if you address the points above.

Be donor-centric

Donor centricity expands well beyond the world of surveying, but it is of the utmost importance in the context of a donor survey. When an organization acts in a donor-centric way, they put trust-building with the individual above all else. There are a few ways you can accomplish that in your donor survey:

- Limit the number of questions

- Only ask questions that are absolutely necessary to attain the objective (remember from above, you need to set an objective!);

- Be honest and up-front. For example: Let your supporters know up-front how long it will take (be realistic);

- Use simple words and short sentences (avoid jargon and long paragraphs no matter how highly educated you think your audience is);

- Design it so it’s easy to complete on desktop, mobile or tablet devices, and in print;

- Always use big fonts in dark colors on light backgrounds with easy-to-click buttons;

- Make sure the flow seems logical;

- Allow supporters to come back to an incomplete survey and complete it at a later time;

- Put related questions in groups and describe what those groups are;

- Employ a progress bar so people know how many questions they have answered and how many remain;

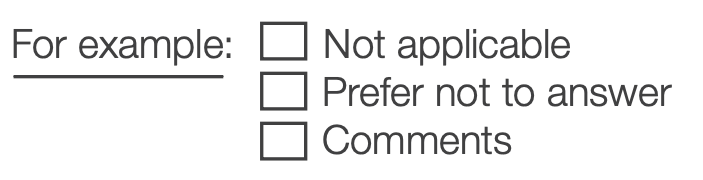

- Avoid “requiring” questions to be answered before continuing unless absolutely necessary;

- Use mostly closed-ended questions so your donors don’t have to think too much. For example: In the case of a hair salon…

NOTE: You may use open boxes for elaboration but do so sparingly since long-form answers require more thought, energy and time..

These are just a handful of tactics you can (and absolutely should) employ in your donor survey. There are more, but foundationally, these are the ones you should aspire to include.

Ways to increase your completion rates

There are several tactics for increasing survey completion rates. After all, you need this input to improve your nonprofit. For example, try the following:

- Tell them why you need their input and explain how your organization will benefit in a way that also benefits the respondent

- Explain why you selected the respondent to answer the survey

- Tell them that their opinion matters and could make a difference

- Start with easy and interesting questions to get them in the groove then progress to greater complexity (but never too challenging!)

- Use the word “you” to emphasize that you are focused on them

- Create a sense of urgency by mentioning that you need their response by a specific date

- For sensitive questions, be sure to explain why you are asking the question and provide options so your supporters don’t feel boxed-in

- Make sure your survey is branded so your supporters feel that it’s trustworthy and credible. NOTE: Services such as Survey Monkey can’t do this and using low-end services will result in dramatically reduced completion rates.

- Include your contact information so they can reach out to you directly (phone & email of a real person along with a link to your website)

- Include your privacy policy (especially as it relates to the information you are collecting)

- Wait to put any demographic checkboxes near the end

- Employ back-end form filling to get them to hit “submit.” In other words, fill the last page with information you already know about them such as name, address, phone number, email address, etc. Do this so that they don’t have to spend time typing in all of the information you already have/should already know. NOTE: MarketSmart employs this technology for clients.

- Allow them to update their contact information so your follow-up outreach is successful

Before the survey

- Prepare for the responses

- Train staff (create cheat sheets for what to say to whom based on the response you might anticipate receiving)

- Involve departments (let everyone know what’s happening so they aren’t surprised by calls or emails)

After the survey

Hopefully you did not survey your donors just for your benefit. If you did, then you might have done more harm than good. A survey should rarely only be used for ‘research.’ Rather, it should be used to help bring you and your supporters closer together. Therefore, make sure you have a plan to follow-up with your supporters politely and persistently (also known as cultivation) with highly personalized and relevant communications based on what you gleaned from the survey.

If you fail to do that, you might make them angry because you took their time without providing anything in return. Never forget, time is your donors’ most valuable asset. If you waste their time, you’ll upset them. You can learn more on this topic here.

- Provide valuable offers to the respondents. Make sure that they are relevant and personalized based on their needs and desires described in their responses (this is done most easily online).

- For example:

- Provide opportunities for respondents to sign up for newsletters and/or alerts

- Help them send a letter to their Congressman

- Allow them a chance to donate immediately or through their Donor-Advised Funds

- Offer information (eBooks or downloads) that align with their self-described desires

- Give them a chance to share their story with you, or spread information about your mission

- Respond to everyone but prioritize them by first reaching out to the people who seem to have issues or problems that need to be resolved right away

- Analyze the data to determine whether or not your survey helped you achieve your strategic objectives

- Determine the next steps!

- Set meetings with passionate, high- capacity prospects and planned giving leads

- Steward new Legacy Society members

- Reach out to referrals

- ENGAGE!

Frequently asked questions

Question 1

What information can major and planned gift fundraisers attain from surveys that cannot be provided inexpensively or at all otherwise?

Answer

- Childlessness

- Self-reported age

- Donor-Advised Fund ownership

- Complaints/Discrepancies a donor may have with your organization

- Interests, passions, desires

- Updated contact information

- Insights into emotional triggers

- Names of people your supporters might want to memorialize or honor with a gift

- Etc.

Question 2

What should be done with the information?

Answer

Although this was written above, it bears repeating.

First and foremost, you should never survey your donors without a plan to follow-up with them (also known as cultivation).

At MarketSmart, our research has found that it is quite counterproductive to survey your donors without showing them (later) that you used the information to provide them with a better donor experience.

In other words, if you survey them but fail to cultivate the relationships properly, you’ll only end up making them angry. That’s because time is your donors’ most valuable asset. Waste their time and you’ll upset them. So, make sure you have a cultivation plan in place before you even consider surveying your donors. More can be found on this topic here.

Otherwise, here are some other less important actions you might consider taking once you capture information from your supporters.

- Update your records! This is the cheapest way to clean up your list (Note that MarketSmart customers find that 16.7% of their donors actually update their contact information for their organizations automatically using our turnkey, seamless System. Plus we add prioritization scores to ‘contact updater’ records since they are clearly signaling their passion and interest in the cause)

- Engage with your supporters. Show ‘em that you care (If you need help learning how to do that, consider downloading MarketSmart’s free report titled Top 10 Tips for Landing More Meetings with High-Value Major & Legacy Donor Prospects or you can watch the recorded webinar on the topic here)

- Take note of complaints and deal with problems head-on (more on this here)

- Personalize your future outreach so you show ‘em that you know ‘em (Use the information gleaned from the survey to be relevant; just make sure you don’t act spooky!)

- Spot trends in the results (It is recommended that you survey your donors each year so you can see who is moving up in the consideration process)

- Share results with others (possibly to realign budgets in your favor)

Question 3

What if we are concerned that we won’t get enough responses?

Answer

Don’t worry… you will! In fact, your supporters are wondering right now why you haven’t asked for their opinions. And, they are giving more to nonprofits who are already surveying their interests and desires.

Question 4

What if we are concerned that we’ll get too many responses?

Answer

This is certainly a good problem to have and one that our clients experience frequently. Don’t be concerned about too many responses. It’s never a bad thing. Just make sure you are well organized, and your methods for tracking data are efficient. Contact us and we will show you our automated cultivation system!

Question 5

How often should we survey?

Answer

You should survey your donors at least every 12 months (yearly). However, you can continue to reach out to non-responders several times a year (people get really busy and intend to take the survey later but forget).

More free resources

Over the years, we’ve accumulated a lot of resources on this topic. See the list below of related readings: