We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

The number one reason why you aren’t getting your share of dollars from donor advised funds

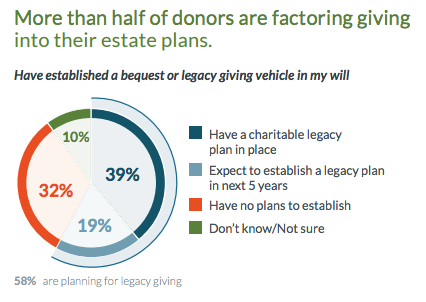

According to Fidelity Charitable, most donor-advised fund account holders included or will include a bequest in their estate plans.

You might not think that matters much when you consider the fact that Fidelity says their median donor-advised fund account only holds $16,097 and 60% of their accounts hold less than $25,000. But, on the flip-side, they say 5,500 of their accounts hold more than $250,000.

hold less than $25,000. But, on the flip-side, they say 5,500 of their accounts hold more than $250,000.

Add to that the fact that the average donor-advised fund for Single-Issue charities holds $230,375. Community Foundation DAF’s average $420,155 and DAF’s at National Charities average $230,375. So, you might begin to wonder what you can do to get more legacy gifts from those accounts.

Just keep in mind that those averages might be warped a bit by some very large accounts. I couldn’t find stats on the medians for those sponsor types.

So what’s the number one reason why you aren’t getting your share of the pie? Because you aren’t promoting the fact that you accept gifts from donor-advised funds.

It’s really pretty simple. If you want to get more gifts from these funds, you have to let your supporters know that this is an option for them. You need to make it easy and convenient for them. You need to be available to answer questions for them.

If you aren’t willing to do this, you won’t get the gifts. Period.

Related Posts About Donor Advised Funds

>> Two Steps to Make the Best of Donor Advised Funds

>> Stop Ignoring This Amazing Source of Contributions

LIKE THIS BLOG POST? PLEASE SHARE IT AND/OR SUBSCRIBE

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

Greg – How are DAF gifts generally processed? Often, these gifts are treated as any other grant, with the result that development officers are neither advised of the gift nor the individual owner of the DAF account. What can I do to properly steward these donors for future giving?

Hi Karen,

This is tricky. First please know that I’m not a traditional consultant who has worked at a nonprofit. I think those folks might know better about how DAF gifts are processed. But I believe the answer depends on the software you are using AND whether or not the donor decided to remain anonymous. My clients tell me that about 80%+ do not remain anonymous. But that doesn’t mean that you get their contact information. You may only get their name… not enough for stewardship.

Having said all that (and this is a very self-serving way to answer your question), I believe it’s important to try to find out who among your current donors currently have DAFs. Our clients here at MarketSmart use our platform to uncover that vital piece of information.

Once you know who has a DAF, then you should market to them properly to inspire DAF giving (“recommendations” to be technical).

Then, finally, you’d be able to conduct proper stewardship.

This won’t solve your precise problem since you might be talking about people who wish to remain anonymous. But I believe, finding out who has a DAF first puts you ahead of the game.

Hope that makes sense.