We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Two Powerful Types of Questions You Should NOT Ask Major Gift Donors Until Trust Is Established

At some point in your engagement with donors and supporters there comes a magical moment when you realize a person trusts you. At that moment, your role shifts from curious chameleon to collaborator, guiding sage and ally.

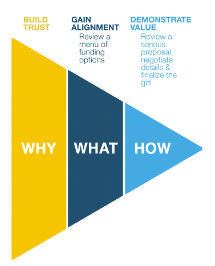

This is the moment when you are no longer just getting to know one another. You have already uncovered WHY they care about your cause. Now you’re determining WHAT part of your mission they’d like to support (your programs or capabilities) or you’re solving problems and working through the details of giving while helping them give wisely to get what they want (HOW).

Before this point, asking these two types of questions can make people feel uncomfortable and suspicious. They’ll worry that you are moving too fast and don’t sincerely care about them; you just want their money and you’ll risk losing whatever trust you built up.

Let’s look at these two sets of questions to understand why you need to hold back from asking them until you are sure trust has been built.

1. Collaboration Questions

Collaboration questions work once trust has been established because they position you as a problem-solver for the donor. You should wait to ask them once you determine that they are willing to discuss making a major gift but sense that something is holding them back. Perhaps it’s purely logistical.

At this stage, you’re pretty sure they have a reason to give (motivation), but they expressed that they aren’t sure what impact they want to make or they have complicated financial assets and aren’t sure how to liquidate them.

Here are some examples of collaboration questions you’ll ask in situations like this once you’re sure you’ve gained their trust:

- You mentioned you’re going to be passing the business to your kids (or selling your practice). Would you be interested in charitable options that may save you money on your transaction?

- You’ve been so generous to this cause in the past. Would you be interested in learning how to give more at a lower cost by using the best assets for the gift?

- Since you mentioned that you have no children, what will you do with what you’ve accumulated over your lifetime?

- What’s holding you back from reaching your charitable giving goals?

- What if it was possible to make a gift and still accomplish your financial goals? Would you mind if I shared some options with you?

These are great questions, but only if they’re asked at the right time. Asking collaboration questions too soon drives discomfort and distrust. WHY questions always need to come before WHAT and HOW questions.

2. Forthright (Direct, Blunt, Nitty Gritty) Personal Finance Questions

I always feel uncomfortable when I go to see a doctor and someone I just met tells me to take off all of my clothes and put on a hospital gown. Or, when I meet a financial professional for the first time and they ask me how much I earn and how much I’ve saved. But then I remind myself of the setting I’m in and the fact that these folks are professionals. That’s why they can be so direct and blunt. Society has made it acceptable.

You, on the other hand, are a different story altogether because people have not been made to be familiar with what you do. In fact, they might have good reason to be wary of you and your approach based on prior experience with others in your role working for competing causes.

So you can’t ask these types of questions right out of the gate or early in the donor journey. If you do, your donors and supporters will feel like you’re an interrogator, not a collaborator.

Here are some examples of forthright questions that you would never ask before the right time:

- How do you give? Through a company? Private foundation? Some other way?

This is a powerful question to use once trust has been established because most people only know how to give the way they have always done it. But, as you know, there are usually many other ways. Find out their norm, and then you can intrigue them with other options but only if they are ready for your support.

- Do you normally give appreciated assets?

This question is a particularly valuable one, because most wealthy people own the majority of their wealth as assets, not cash. Assets include things like property, retirement accounts, owned businesses, art, and stock options from a company they or a relative worked for. But imagine asking this question as soon as your first visit begins. You’ll probably be shown the door.

However, asking this at the right time is a good idea because many wealthy people don’t think about giving from their assets when first considering charitable gifts. And when gift officers don’t engage this topic, they are forgoing access to what is likely the lion’s share of that person’s net worth.

Plus, wealthy people perceive assets differently than the money in regular bank accounts. They can’t just take out money from company stock options, for example. They have to sell them. That has tax implications. If they can donate some of that money to charity, take a lower tax bite, and still come out with a big surge of cash, they’re going to feel great about it – much greater than if they just wrote you a check for the same amount.

- How is your business structured?

- Can it be used to satisfy your philanthropic interests?

- Is it difficult to get profits out due to tax concerns?

If this prospect owns a business, they might have spent a large part of their life building it. It could be their most prized possession. Something they invested time, blood, sweat and tears into.

Asking these kinds of questions too soon will take the conversation to the core of their life’s work, potentially causing a shock to their system. So be careful here.

Recognize that these questions let you go deep inside of their life story. You’ll understand what’s at stake if they were to pass on or sell their business.

These are good questions that will open up longer discussions that can be carried on with follow-up questions. You’ll have an opportunity to show them ways they can save money on taxes through charitable giving and such. But only if you recognize that they are at the HOW stage of the process and the timing is right.

- Do you have any life insurance policies you no longer need?

Life insurance can sometimes offer a great way to avoid taxes and still produce a financial windfall – for the donor as well as the nonprofit. The details here get complicated, but usually, life insurance proceeds do not get taxed, and that opens up a lot of opportunities for situations where everyone wins.

But questions about life insurance also make people think about their own death, and no one really enjoys that! So, be sure to reserve this kind of question for the HOW stage of their journey with you.

Remember When to Use These Questions

The main thing here is to not use questions like this until permission has been granted to “go there.” Remember that WHY questions must always precede WHAT and HOW questions. You can’t skip steps!

BONUS: 6 Other Types of Powerful Fundraising Questions

Well before you get to the questions in this article, you’ll have been through several rounds of phone calls, meetings, and conversations. Getting to the point where you can ask the questions in this article is a greater challenge.

There are six types of fundraising questions that help you get through the various stages of conversation, from permission questions to identity questions to reflective summary questions and more.

See all 6 types of fundraising questions here.

Related Resources:

- The Importance of Asking Permission to Ask More Questions

- The Ultimate Source for Fundraising Questions – From Permission to Confirmation

- Finally, the questions you should ask that have been proven to lead to gifts from wealth

- Why answering “no” to these four questions guarantees failure in your fundraising efforts

LIKE THIS BLOG POST? SHARE IT AND/OR LEAVE YOUR COMMENTS BELOW!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!