We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

It was bound to happen sooner or later, here’s why and what to do…

If you have not yet heard the news, Fidelity Charitable now sits at the top of the Philanthropy 400 list that ranks nonprofits according to the amount of money they raise from private sources.

It was bound to happen sooner or later.

I know some folks have their gripes with donor-advised funds. I’ll save that stuff for another blog post. The SmartIdeas blog is about marketing. So today I’m going to help you understand why the growth of donor-advised funds persists and what nonprofits need to do to get their piece of the growing pie.

First, you simply have to understand why donors like DAFs so much. Here are a bunch of reasons:

- By putting money into donor-advised funds, individuals can get a tax deduction right away (as soon as they transfer their cash, appreciated securities or other assets to their fund).

- The money can grow tax free (while appreciation of foundation dollars can face an excise tax on investment income of up to 2%).

- The money in the DAF is not subject to estate tax.

- Unlike creating a foundation, with a DAF there’s no rule forcing an individual to distribute the money right away. This is attractive to people who want to be less impulsive and, rather, more thoughtful and strategic about their giving— making donation “recommendations” when it feels best for them.

- People love convenience! DAFs make it convenient for people to move their assets around without the need for lots of paperwork or legal wrangling.

- DAFs often have systems in place to help people turn assets (that would otherwise face capital gains taxes) into cash to be used for philanthropy. For instance, rather than paying capital gains tax on 20 shares of Apple that have been held for a long time, an individual can turn those shares into dollars for charity. Otherwise, the supporter would have to give by check or credit card and that would surely yield a smaller donation than 20 shares of Apple. Many DAFs will also help people turn other assets like cars, jewelry, antiques or collectibles into cash. Note: All nonprofits can and should accept these kinds of gifts.

- Supporters give to charities yet may remain anonymous (so they don’t get badgered with email, direct mail, telephone calls and requests for visits).

And, here’s what to do:

Most importantly, you’ve got to find out who, among your supporters, volunteers, advocates, members, alumni, etc., has a donor-advised fund. The best, fastest and most cost-effective way to do that is with a donor survey. Full disclosure: I invented the most robust and most powerful nonprofit donor survey platform in existence. It actually raises current dollars while uncovering information you simply cannot buy.

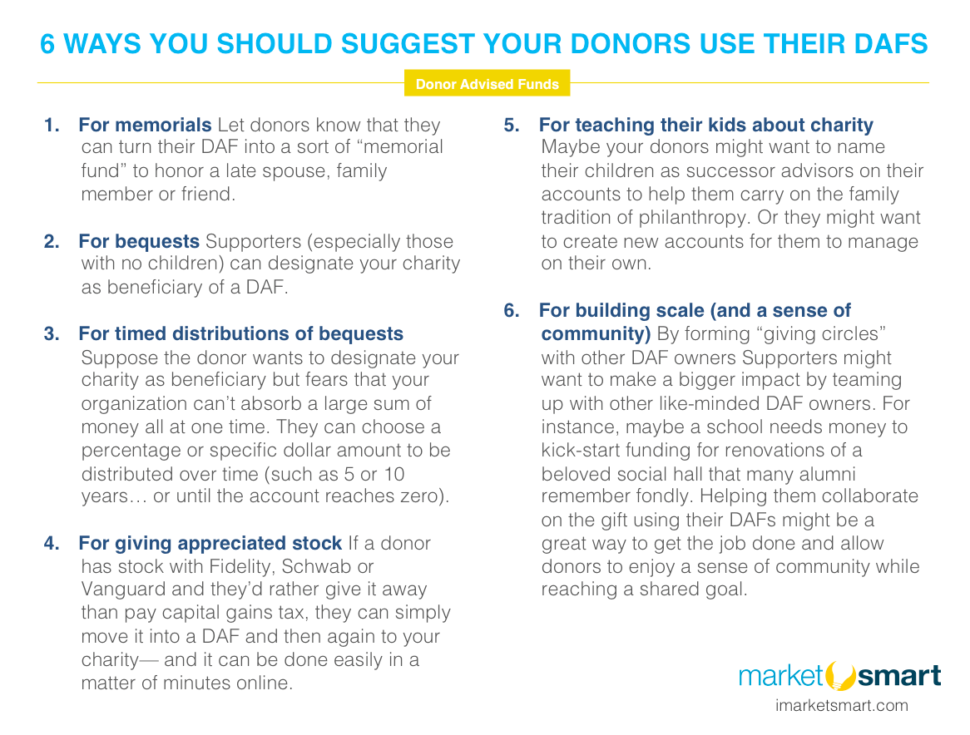

Once you know who has a DAF, then you can send relevant, helpful messages to those supporters to (for instance):

- Encourage them to create in memoriam funds to support causes a widow or spouse was passionate about.

- Suggest they list their donor-advised fund on a death notice so loved ones can gift to the DAF in lieu of flowers.

- Propose the fund be distributed to your charity upon death.

- Remind them that they can turn assets into cash with their DAF that can then be granted to your nonprofit.

- Point out that they can use the fund to teach their children about philanthropy.

- Recommend they combine their DAF resources with other likeminded donors (as a “giving circle” or club) to make a greater impact.

Don’t fight the flow of dollars finding their way to donor-advised funds. Instead, go with the flow and you’ll get more donation dollars from individuals.

Feel free to share this tile below with your staff.

LIKE THIS BLOG POST? SHARE IT WITH YOUR PEERS AND/OR LEAVE YOUR COMMENTS BELOW!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

Awesome post, Greg. You’ve given me a list of clever DAF action-items that I’ll put to work right away!

My pleasure Mark. Glad I could help!

Very interesting, thank you! This is very clear, helpful information and will be a lot of help to many charities, especially at this end of year time when there is a big push for donations, especially legacy donations and so on. DAFs can be better for the charity and for the donors so it’s very important to make people aware of them.

Thanks Madison. Glad I could help.

A question – under ways donors may use their DAFs, #2 you suggest that “supporters (especially those with no children) can designate your charity as a beneficiary of a DAF. The word “designate” would imply that the donor has maintained control over the asset in the fund and this could negate the original deducted gift as a DAF to the community foundation or other recipient? Could this raise a question with the IRS? If, however the donor made a “suggestion” to the recipient that the funds go to a specific charity upon the donor’s passing, this might keep it within the DAF rules. In the alternative, does the establishment of the fund allow for the donor to designate a different testamentary charitable recipient.

second question if a donor passes away without additional advisories for the ultimate destination for the fund, would the recipient then be able to apply it as their own board decides?

Thanks for this posting. It like all your others is most helpful.

Thanks for these great questions John.

I understand your concern with regards to “designations” but according to the National Philanthropic Trust website as an example (https://www.nptrust.org/donor-advised-funds/faq), “You can designate one or more charitable organizations as account beneficiaries. Or, you can distribute the account’s assets to one or more charitable organizations.” So, I don’t think designations need to be “recommended” or “suggested” but I should make it clear that I am not an attorney.

Also their FAQ’s say, “If you don’t select either option, NPT can annually distribute 5% of your account’s balance to the charitable organizations that have previously received grants. If you have not recommended grants, the donor-advised fund account’s entire balance will be transferred to the NPT Giving Fund.”

I believe that’s the same for all DAFs. I hope that helps.

Outstanding post Greg!

Now we’ve got to fight the wanna be regulators to keep DAFS like they are.

I agree with your suggestion that DAFs are an excellent potential source of support for charities, and are far from a passing fad. I also agree with most of the points you’ve raised. I just want to address your assertion that “supporters donate to charities yet remain anonymous” when they give via their DAF. I also once believed that myth until I learned the following facts:

Vanguard Charitable reports that 95 percent of its grantmakers share their name with the charities they support. Schwab Charitable, another large DAF management organization, says that 97 percent of its grantmakers share their name. Fidelity Charitable reports that 92 percent of its grantmakers provide information for nonprofit acknowledgment. This means that charities are able to continue to cultivate and steward these donors. While some donors obviously welcome the chance to remain anonymous, the vast majority of grantmakers are perfectly willing to engage with the charities they support.

Thanks Michael. Great points. I didn’t realize the percentages were that high.

Great points. Another point that may be of interest to your audience is that donors legally cannot fulfill pledges to specific organizations with recommended distributions from DAFs. This is because once they’ve gifted money to their DAF, and received their charitable deduction, they are technically no longer in control of the money (as pointed out by John). So donors can “recommend” only. [From a practical perspective, almost all recommendations are granted, but trustees of DAFs are required to do “due diligence” to assure they aren’t distributing charitable assets to fly-by-night charities].

Be sure your donors with DAFs don’t make written annual “pledges” to you that they intend to fulfill with DAF recommendations. And also don’t send thank you letters to your donors that say “Thank you for your gift from your Fidelity Donor Advised Fund in fulfillment of your $1,000 pledge.”

Ah. Thanks Claire.