We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Donor-advised Funds Are Misunderstood, Bound to Be Regulated, and Not Going Anywhere

“Have you read this one?”

“Zach, hold on I didn’t even finish the other articles you sent me yet.”

I guess I was being a bit overwhelming.

“Okay, yeah, I’m sorry. It’s just there is SO much out there on DAFs right now. It’s hard to keep up.”

I was peppering my colleague, Jeff Giannotto with articles on donor-advised funds in preparation for his webinar on DAFs. For the past few weeks, Jeff and I had both been staying up to date with relevant donor-advised fund news. The one issue? There was seemingly too much news to keep track of.

Just last week I sent three separate articles to Jeff:

- ‘How to Land Donor-Advised Fund Gifts’ from the Chronicle of Philanthropy (which disappointingly didn’t provide much of any insight into how to land gifts from DAFs, although that’s a topic for a different day);

- ‘Donor Advised Funds Were Up Almost 300 Percent This Decade. Why?’ written by Eileen Heisman, the CEO of National Philanthropic Trust, and;

- ‘Google’s Larry Page gave $400 million in Christmas donations. Not a penny went straight to charity.’ from Teddy Schleifer at Vox.

Already this week (I’m writing this on Monday, January 20th), there are more newsworthy developments that I need to convey to Jeff in advance of his webinar. Most notably California’s General Assembly AB-1712 on donor-advised funds. AB-1712 is the first regulation proposed around donor-advised funds (and in my estimation it is far from the last). The bill’s scope is limited to DAFs geographically located in California, however the proposed legislation could serve as a framework for other states (or even Congress).

The bill would introduce new reporting requirements for donor-advised fund sponsoring organizations “for the purpose of helping the Attorney General determine whether the funds or accounts managed by the donor-advised fund are being administered properly.” This is an interesting proposition, one that will surely engender well-intentioned conversation, but regardless of the bills passage or not, it is clear as day that the world of donor-advised funds is equal parts misunderstood, bound to be regulated, and most certainly not going away anytime soon.

Philanthropy and regulation

Giving money to charity is a seemingly altruistic cause. However, as with most things in life, there is more to be uncovered the deeper you dig.

Government’s around the globe regulate philanthropy. Here in the United States, The Tax Reform Act of 1969 (TRA69) introduced many reforms to philanthropy that are still in place today. Spurred by a desire to hold nonprofits accountable for the benefits they receive from the tax code, The Tax Reform Act of 1969 serves as an interesting guide for how donor-advised funds may be regulated in coming years.

The issues TRA69 served to address are eerily similar to the concerns many of the general public have today (if you haven’t already read the article from Vox linked above, I highly suggest you do). TRA69 brought to fruition:

- 4% tax on investment income (reduced to 2% in 1978)

- 5% minimum distribution of income

- Limit of 20% ownership of the stock holdings of a business

- Prohibition on the attempt to influence legislation or elections

- Taxation on unrelated business income

- Prohibitions on “self-dealing”; officers and donors could not benefit financially from their transactions with the foundation

- Enhanced reporting requirements, including grants awarded; public access to all of this information guaranteed

The final bullet point is where California’s AB 1712 is focusing their attention. It’s logical to assume that future proposals will also include rules on “self-dealing,” minimum distributions to charities, and more.

But are DAFs misunderstood?

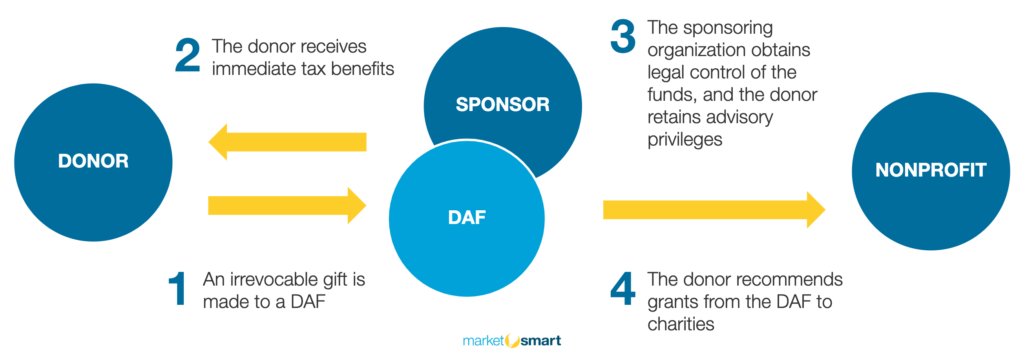

However, amidst all the noise surrounding DAFs, I have a legitimate concern that they are not entirely understood by the public. Recently I published an overview of donor-advised funds for free on the MarketSmart website to help educate nonprofit professionals on what DAFs are and what they aren’t.

The webinar that Jeff, and Keith Curtis, President of The Curtis Group, are presenting on January Wednesday, January 22nd, that too is designed to spread awareness and educate the sector on donor-advised funds. As a business, we stand to make no money from donor-advised funds (with the exception that our clients are able to learn which of their donors have DAFs, which is valuable and proprietary), however we see it as our service to help educate the sector when it comes to how donor-advised funds work.

As National Philanthropic Trust has shown, donor-advised funds are growing rapidly, and without fail, they’ll most likely grow again this year. The “bad rap” that DAFs are receiving is in part justified, however for many philanthropists, donor-advised funds make a lot more sense than creating a private foundation, or giving directly to a charity.

Donor-advised funds are nothing more than a giving vehicle. Yes, they are a bit convoluted. Yes, mega-wealthy individuals can use them to receive tax breaks without actually dispersing their wealth to a “boots on the ground” charity. And yes, they do serve a legitimate purpose in today’s society.

Among the articles I’ve read on donor-advised funds, and the conversations I’ve had over the past five years with nonprofit professionals, seemingly everyone shies away from our industry’s dwindling donor retention rates.

The quarterly reports from the Association of Fundraising Professionals Fundraising Effectiveness Project show donor retention decreasing. Our Live Benchmarks from Fundraising Report Card show a drop in donor retention. The annual Giving USA report indicates a similar trend. You don’t have to look far to see the “relationship building” challenge our sector faces. Maybe that has something to do with antiquated marketing methods such as “spray and pray” mailings and list swapping, or maybe it stems from somewhere else… I don’t have an answer for that.

However, I do have a theory for why donor-advised funds have increased in popularity at the same time as donor retention rates have decreased.

Donors want to give money to their favorite charities, but they aren’t satisfied with the relationship they’ve built with them. As such, donors are moving more money to DAFs, knowing that someday they’ll give it to a charity that ultimately “treats them right.” Plus, donors want to self-educate and move on their own timeline. By allocating funds to a DAF, a donor receives their tax benefit today, while also allowing themselves to operate on their own philanthropic timeline in the future.

When you think about DAFs and retention rates in this way, you can start to see why they’re so appealing to donors.

The future of donor-advised funds

No one has a crystal ball. The future of donor-advised funds is unmistakably murky. State and federal regulation could turn the donor-advised fund into something that’s obsolete within a few short years, or we could instead continue to see a dramatic rise in DAF contributions. Either way, we’ll be watching.

In the interim, as change occurs around us, it’s important to recognize that a lot of donor dollars are tied up in donor-advised funds. The principles of Engagement Fundraising still apply to DAFs. If nothing else, treat your donors with respect, authenticity, and provide valuable opportunities for engagement.

In my estimation, DAFs are here to stay, but regardless if they are or not, these core principles will still serve you well.

What do you think will happen over the coming years? Will DAFs continue to grow, or will regulation reshape the landscape of philanthropy once more? I look forward to hearing your thoughts.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

Zack, there is a lot of food for thought here. Your theory may be correct that donors are unsatisfied with the relationships they have with charities and are thus turning to DAFs. My own hunch is that the changes brought about by the Tax Cuts and Jobs Act will be a much larger motivator, at least over the next few years. (Let’s not forget that it expires in 2025.) It would be interesting to see some information (if available) along the following lines:

1. Of total giving to DAFs, what % goes to traditional community foundations (CFs), and what % to the community foundations that are sponsored by Schwab, Fidelity, et al.? (For ease of reference, I’ll call them vendor-sponsored DAFs.)

2. Any statistics on how the outflow from DAFs (in the form of grants) compares with the inflow of new donations? And are there statistics that would show whether the inflow/outflow ratio is significantly different between traditional DAFs and vendor-sponsored DAFs? (This sounds as though I’m beating up on vendor-sponsored, and I don’t mean to. I think they provide a very valuable service in reaching an audience that may not learn of DAFs through more traditional channels.)

3. Any way to compare the donor-relations services provided by CFs to the vendor-sponsored DAFs, esp. in terms of post-gift communications aimed at encouraging grants?

4. Any way to obtain statistics about whether a DAF served a short-term or one-time purpose (i.e., bunching deductions) and those that seem to be permanent fixture? One proxy might be “expired” DAFs (i.e., funded and now exhausted). I predict we will see more in the “expired” category, because once donors turn 72 and face RMDS (if not earlier, when they turn 70.5 and are eligible for QCDs) the tax incentives to bunch deductions will be gone, and donors will be incentivized to give directly to their charities (since they can’t do a QCD to a DAF).

I’d go so far as to suggest that there is probably material for a Master’s thesis in the answers to those questions.