We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Donor-Advised Funds: The Ultimate Guide for Nonprofits

Updated for December 2019

When it comes to “hot” topics in the nonprofit sector, none may be more prevalent than donor-advised funds (DAFs). You seemingly can’t go to any conference, board room, or webinar without the mention of a “DAF,” and with good reason.

Yet, as with most things in life, when there is a three-letter acronym, there is generally confusion that comes with it. Donor-advised funds prove to be no exception. DAFs are not new, and they’re not particularly complex relative to their peers either (i.e. trusts, foundations, etc.). Also, they’re incredibly popular with donors (especially wealthy ones).

These three reasons (plus many more) build a strong case for why you and your organization should be familiar with donor-advised funds. Fortunately for you, our team at MarketSmart has been supporting our clients with marketing to donors who have money in donor-advised funds for years. We’ve even built widgets and tools to help make giving through a DAF more seamless and frictionless for the donor. When it comes to donor-advised funds, we’ve tried to stay at the tip of the spear.

What does that mean for you? Well, we thought we should share some of our knowledge with the rest of the nonprofit world. DAFs aren’t going away anytime soon, so if you work in the nonprofit sector (specifically in fundraising), you’ll want to buckle down and read this guide. What are donor-advised funds? Who uses them? How can you solicit DAFs? We’ll answer these questions and many more below.

Click on any of the links below to jump to that section of the guide. Or, scroll down to begin!

Please enjoy, and please share on Twitter, LinkedIn, or Facebook, or with anyone who you think might find this information valuable.

The ABCs of donor-advised funds (DAFs)

Would you believe me if I told you that the first donor-advised fund was created in the 1920s? You shouldn’t. The first DAFs were created in the 1930s! Although regulatory recognition came a few decades later through the Tax Reform Act of 1969, donor-advised funds have long-standing roots in our society.

What is a donor-advised fund?

A donor-advised fund is a giving vehicle. When someone says “DAF,” you should instantly think “giving vehicle.” Other giving vehicles, such as a private foundation or a charitable remainder trust, may be more “familiar” to you, but know that DAFs are of the same stock as those entities — they’re simply another entity for individuals to move money into to facilitate their philanthropy.

You can also think of DAFs like a special bank account. If you were to log in to your personal online banking portal you’d most likely see at least two “accounts” for you to choose from: a checking and a savings. It is appropriate to think of a DAF as a third account, one for your philanthropy.

However, what is special about a donor-advised fund is that you can’t simply open one at Bank of America. Instead, the account must be created at and sponsored by a 501(c)(3) organization. Once you make a contribution to your DAF (or you could refer to it as a donor-advised account), the sponsoring organization has legal control over the funds. As the donor, however, you retain advisory privilege for how to invest the contributions and direct grants out of the account to other charities.

This, at its core, is a donor-advised fund.

How do donor-advised funds work?

Obviously, donor-advised funds are different than other giving vehicles and traditional checking or savings accounts. If they weren’t, we wouldn’t spend so much time thinking and talking about them! What makes a donor-advised fund unique is how it works.

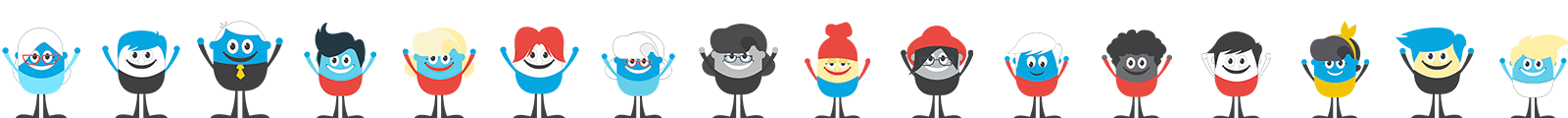

As a donor, you follow this process:

- Research and select a sponsoring organization.

- Open a donor-advised fund account with the sponsoring organization.

- Make an irrevocable contribution to the account.

- Immediately receive the maximum tax deduction that the IRS allows.

- Select how you want the funds invested while they’re in the account.

- At any time, recommend a grant from your account to any other 501(c)(3) organization.

In a nutshell, that’s how DAFs work. Simple, eh?

Let’s focus in on a key term I used: sponsoring organization. It’s important to recognize the role of the sponsoring organization when it comes to donor-advised funds. Unlike a checking account, you cannot go to your local credit union and open up a donor-advised fund account. You could if the credit union has a 501(c)(3) entity that they use as the sponsoring organization of the DAF account, but odds are, they don’t.

That begs the question, “who does?” You don’t have to look too far to find out. Have you ever heard of Fidelity Investments? What about Goldman Sachs? Maybe Charles Schwab? What if I told you that each of those for-profit companies operated a separate nonprofit organization where you could open a donor-advised fund account? That’s the truth, and not too surprisingly, they’re popular. The Fidelity Charitable Gift Fund, the Goldman Sachs Philanthropy Fund, and the Schwab Charitable Fund (all 501(c)(3) organizations) represent three of the largest ten nonprofits in the world.

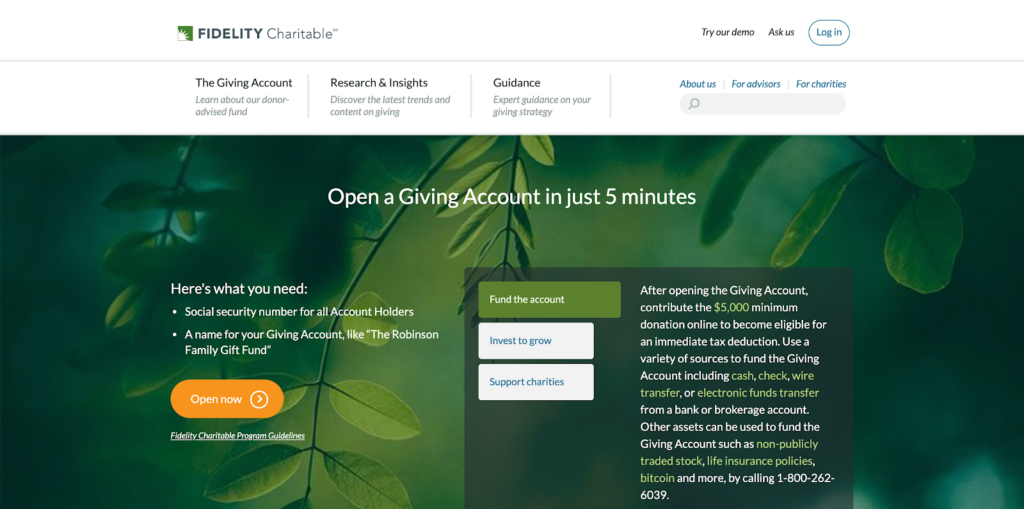

Let’s use the Fidelity Charitable Gift Fund as an example of how a sponsoring organization works. As a donor, if I am interested in opening up a donor-advised fund, I can go to Fidelity Investments website, use their main navigation to select “Charitable Giving,” and begin the process of opening a DAF account.

As their website so eloquently suggests, I can open my DAF account in “just 5 minutes,” the only requirement being that I am able to meet the minimum required contribution of $5,000.

This is how a donor-advised fund works.

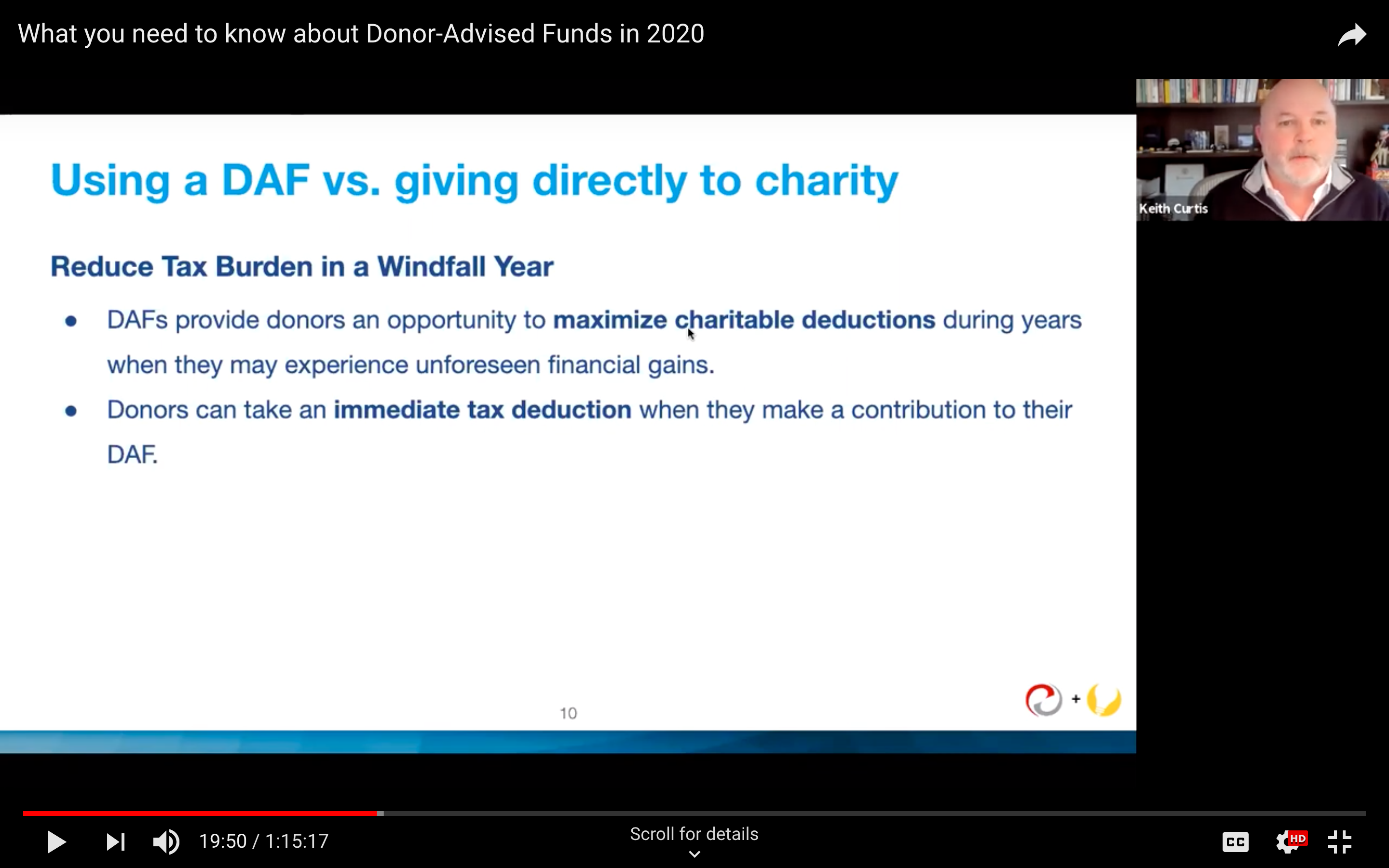

What you need to know about donor-advised funds in 2020

Watch nowWhy do donors choose donor-advised funds?

Now that you have a clear understanding of what DAFs are and how they work, it’s incredibly important to understand why donors choose to open donor-advised funds. What is their rationale? Why not just give directly to a charity or a cause they want to support? The answer isn’t as simple as we’d hope.

The psychology of charitable giving is well-researched. Donors give because it makes them feel good, provides a sense of purpose in their lives, and more. Then, why do donors give to DAFs instead of cause-oriented charities? There are two primary drivers:

- Avoid taxes that would decrease the amount of funds a charity receives.

- Uncertainty about where to give their funds, but a desire to claim the tax benefit and grow their assets tax-free.

The National Philanthropic Trust has great resources on the tax advantages of DAFs. I highly recommend reviewing their webpage on that topic here: https://www.nptrust.org/what-is-a-donor-advised-fund/daf-tax-consideration/

As for the second driver of DAF growth, donors frequently are unsure where they want to invest their philanthropic dollars. However, they do know they want to “give” during the year. By opening and contributing to a donor-advised fund, the donor is able to meet their giving needs while also deferring the commitment of granting those funds to a specific cause. This provides the donor with more control over the giving process and allows them time to vet charities that seek their funds.

Who uses donor-advised funds?

DAFs are frequently associated with wealthier individuals. Think back to our Fidelity example above. There is a minimum contribution of $5,000 you have to make to open the account. Other sponsoring organizations have different thresholds (some higher, although $5,000 is typical). The concept of a minimum contribution certainly separates those who cannot afford to open a DAF from those who can.

If a donor has a DAF that means they donated at least $5,000 in one year to their DAF. Would a $5,000 gift to your organization constitute a major donor? That’s one way to think about DAFs — they’re being funded by individuals who are capable of giving at least $5,000 at a time.

Types of donor-advised fund sponsors

We’d be remiss not to talk about the three general types of donor-advised fund sponsors. As you’ll recall, a DAF sponsor organization is a 501(c)(3) that has chosen to sponsor a donor-advised fund. Of the estimated 1.56 million registered public charities in the United States, less than 1/10th of one percent sponsor donor-advised funds. Although, to some, DAFs may feel like the Wild West. It’s true that over the past few years, hundreds of DAF sponsors have cropped up. Primarily, donor-advised funds come from three types:

- Community Foundations

- Single-Issue Charities

- National Charities

Community foundation donor-advised funds

Across the United States, more and more community foundations are becoming DAF sponsor organizations. Created by and for the people in a local area, these independent nonprofit organizations are perfectly structured to become DAF sponsors. Community foundation sponsored DAF accounts allow donors to help and sustain people and places within a certain geographic area.

National Philanthropic Trust’s 2019 research analyzed donor-advised fund data from 603 community foundations. These 603 community foundations house 77,234 donor-advised funds and assets totaling $33.87 billion.

Unlike our example above with Fidelity, minimums for community foundation sponsored DAFs will vary widely across the spectrum. Fees and investment options will also be different from one community foundation to another.

Single-Issue donor-advised funds

Single-issue charities work in a specific topic area. In an effort to mobilize their members around a certain identity, faith, or cause, these organizations have become a primary sponsor of donor-advised funds. Some of the earliest DAFs trace their roots to single-issue charities.

Single-issue charities mostly include universities and hospitals, faith-based organizations (such as Jewish federations or Catholic community foundations), Rotary foundations, and issue-specific nonprofits.

The National Philanthropic Trust analyzed data from 332 single-issue charity sponsors. This type of charitable sponsor held 57,973 donor-advised fund accounts with charitable assets totaling $15.19 billion.

National donor-advised funds

National charities encompass the largest swath of DAF sponsorship (in terms of assets under management). These organizations exist solely to sponsor donor-advised funds.

There are two subsets of national charities: commercial gift funds and independent non-commercial organizations.

As referenced above, the Fidelity Charitable Gift Fund, the Goldman Sachs Philanthropy Fund, and the Schwab Charitable Fund are all examples of commercial gift funds.

The American Endowment Foundation, National Philanthropic Trust, United Charitable, and national faith-based organizations (such as the National Christian Foundation or the Jewish National Fund) all serve as examples of independent non-commercial organizations.

The National Philanthropic Trust’s report analyzed donor-advised fund data from 54 charities of this type. Combined, national charities accounted for 593,356 donor-advised funds with total charitable assets of $72.35 billion in 2018.

How can you build a list so you can engage and solicit DAF donors & prospects?

By now, it should be clear that you can’t simply “snap your fingers” and receive a report of individuals in your donor database who have donor-advised funds. Unlike real-estate data, board appointments, or stock trades from public companies, nonprofits aren’t able to purchase this type of information. So how do you know who among your supporters has a DAF, and more importantly, how you can solicit them?

First, let’s go over a solution to the “Who has a DAF?” question. Over our ten years of existence, at MarketSmart we’ve figured out one very powerful, tried and true way to learn who has a donor-advised fund. A survey!

Surveying your donors and including a question or two about DAF ownership and interest in giving (making a grant recommendation) to your organization is not only entirely acceptable, it’s recommended. If you haven’t already, click here to read our full guide on conducting donor surveys.

NOTE: These very smart discovery questions are routinely included in the survey Systems MarketSmart provides to hundreds of nonprofits around the world.

As a result of surveys, savvy fundraisers are uncovering who has a donor-advised fund by simply asking them (1) if they have a DAF and (2) if they would considered giving (recommending a grant) from their DAF. For our customers, the results have been astounding.

Another way to discern those supporters that might have a DAF is to track their digital body language online. Using sophisticated technology, nowadays you can see who among your supporter base (by name) is clicking on your web pages, clicking on links in emails, viewing online videos, downloading information, forwarding or sharing information, etc. And if they are engaging with your DAFwidget or other content, you can make a pretty safe bet that they are doing so because they have a DAF and are considering giving. Powerful stuff!

Lastly, there is one other tactic to determine who within your supporter database has a DAF and might recommend a grant. When you receive a grant from a donor-advised fund you can expect the check to be from the sponsoring organization. They are the ones responsible for the funds after all. Typically, in addition to this check, you’ll receive a short letter that states which “advisor” directed the grant to your organization. As Fidelity Charitable Fund proudly asserts on their website, “92% of grants include the donor’s name and address.”

What you need to know about donor-advised funds in 2020

Watch nowOnce you know who has a donor-advised fund, you can begin to prepare your engagement and solicitation strategies. Of course, it’s not my recommendation that you simply build a list of individuals who have DAFs and then solicit them to distribute a grant from their fund to your organization right away.

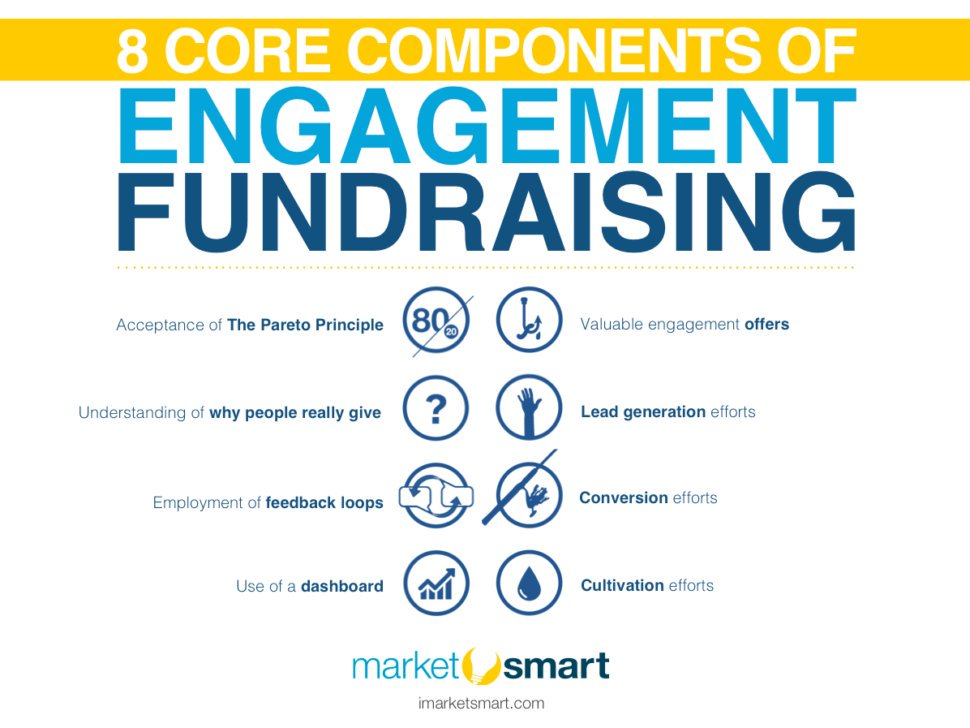

As we frequently preach here at MarketSmart, and as Greg Warner wrote in his book, Engagement Fundraising, we need to be respectful, authentic, and non-solicitous in our efforts to build relationships with donors (especially including those with DAFs) if we aspire to secure major gifts. What does that look like in practice? Refer to the 8 core principles of Engagement Fundraising:

- Accept the Pareto Principle;

- Understand why people really give;

- Employ feedback loops so you can listen to your supporters (including surveys and click tracking technologies);

- Use a dashboard so you can sort and prioritize the data collected from your feedback loops;

- Provide valuable engagement offers that are relevant to each individual based on what you learned about them from your feedback loops;

- Encourage supporters to set appointments with your or opt-in for more engagement with lead generation efforts;

- Make sure to help supporters move themselves forward in the consideration continuum with conversion efforts;

- And, employ cultivation efforts to ‘nurture’ the relationship so supporter trust in your and your organization grows over time.

Acknowledging gifts from donor-advised funds

Let’s say you receive a grant from a donor-advised fund. What do you do next? What’s the best way to acknowledge the gift? Is it any different than a normal individual gift? How should you enter it in your database?

These are the types of questions I hear all the time when meeting with clients or attending conferences. Let’s address them here.

First, understand that each sponsoring organization will have different procedures for how they inform you of a grant from one of their donor-advised fund accounts. The check you receive will come from the sponsor organization. However, the accompanying letter (if they send one at all) will most certainly differ from sponsoring organization to sponsoring organization.

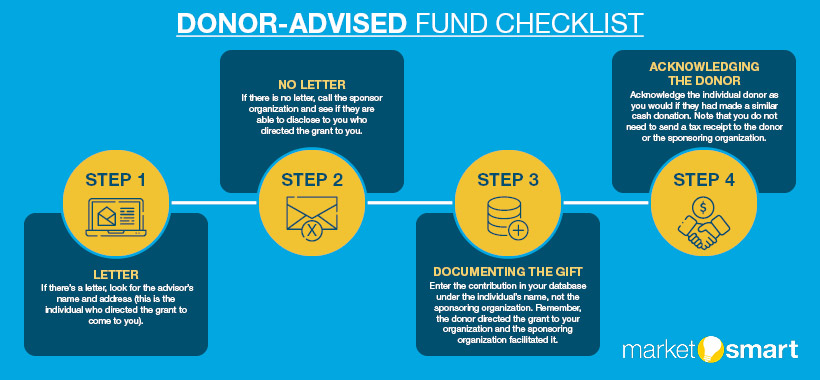

With that in mind, here is the “checklist” you can run through when you receive a gift from a donor-advised fund:

- If there’s a letter, look for the advisor’s name and address (this is the individual who directed the grant to come to you).

- If there is no letter, call the sponsor organization and see if they are able to disclose to you who directed the grant to you.

- Some recommend you log the contribution in your database under the individual’s name, not the sponsoring organization. Remember, the donor directed the grant to your organization and the sponsoring organization facilitated it. With that in mind, would it make sense to say Fidelity Charitable Fund donated $1,000 to you, or Jane Doe donated $1,000 to you? However, according to Joanne Beam (a fundraising consultant at Beam Outcomes), “most accountants tell you to credit the organization that holds the DAF and give soft credit to the person who directed the gift. You do list the person who directed the gift in your annual report and you acknowledge their gift. Bottom line the check came from the supporting organization so the gift needs to be recorded accordingly.”

- Acknowledge the individual donor as you would if they had made a similar cash donation. Note that you do not need to send a tax receipt to the donor or the sponsoring organization. Instead, focus on executing your normal “post-donation” acknowledgement process for the individual donor.

Frequently asked questions

Question 1

How can I get a list of donors who have donor-advised funds?

Answer

Unlike other forms of data that many companies sell, there is no “clearinghouse” for donors with donor-advised funds. Because of the way that DAFs are opened, there is no public repository of individuals who have DAF accounts.

NOTE: The only way to build a solid list of DAF donors is through the employment of the MarketSmart System that includes a survey tool and digital body language tracking technologies.

Question 2

If I know a donor has a donor-advised fund should I solicit them, or their fund?

Answer

As you know, when a donor transfers money into a donor-advised fund they hand over ownership of that money to the sponsoring organization, however, the donor still retains advisory privileges. With that in mind, you should address your solicitations and your cultivation messages to individuals, not their fund’s sponsor. Don’t be surprised if the donation you receive is from their DAF, however all donor relations strategies need to be tailored to the individual or family.

Question 3

Are there alternatives to DAFs?

Answer

Yes. Many individuals of great wealth will construct a private foundation rather than open a donor-advised fund. Also, upstart companies, such as Charityvest are upending the traditional donor-advised fund space with their no-minimum DAF offering.

Question 4

Should my nonprofit sponsor donor-advised funds?

Answer

The answer to this question is highly dependent on your organization. We’ve seen many of our largest, most robust clients offer sponsorship to donor-advised funds at their organization, yet in the same breath, we’ve seen others defer to the existing DAF sponsors. This question is one that needs to be answered in the boardroom at your organization.

More free resources

Over the years, we’ve accumulated a lot of resources on donor-advised funds. See the list below of related readings: