We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

The 80-20 Rule is DEAD!

It’s no longer 80-20 but, rather, 70/.7

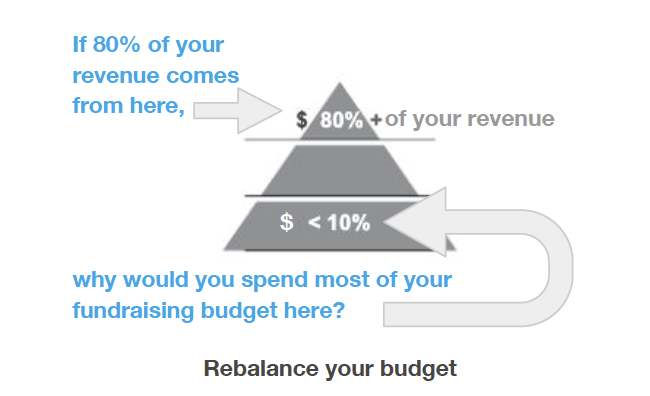

According to our research, tons of nonprofits spend most of their fundraising budget on efforts focused on acquiring low dollar donors. Yet they only make up 7% of all donation revenue year after year.

Meanwhile, 70% of nonprofit revenue (on average) comes from just .7% of their donor base. Don’t believe me? Go here: www.fundraisingreportcard.com

I realize that organizations need to acquire new donors. But a bottom-heavy budget strategy leaves big dollar opportunities overlooked or neglected.

That’s why I recommend re-balancing your budget with a focus on the .7 to yield exponentially greater returns on your investment dollars— because high dollar donors retain at double the rate of low dollar donors (40.63% vs. 20.45%) and their lifetime value is almost $74,000 (vs. $42). You can see these benchmarks here: www.fundraisingreportcard.com/benchmarks

What do you think?

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

Makes perfect sense! Thanks for sharing.

Thanks Carolyn.

While the math may be correct, it does not answer the question: Where do all those top end donors come from? Do they magically appear on a donor file? No! The answer is right there in your diagram. These donors come from the bottom of the donor pyramid, and over time, work themselves into being a major donor. Do they all become major donors? No. But we don’t know who will or who won’t. Statistically (and there are studies on this) a donor capable of making a $1000 gift will not do so for 7 years. Why? Because they want to date before getting married. An organization that does not spend money on acquiring new donors will die. Again, those donors at the top may retain at higher rates, but if you lose 20% of them a year and don’t replace them, you are out of donors in 5 years. Period. End of story. So don’t lead fundraisers down the path of: Just pay attention to your major donors and your funding problems are solved. It just does not work that way in the real world of donors and cultivation.

Good points Christopher.

However, I did not say (nor did I mean to imply) that an organization should ONLY pay attention to major donors. I suggested they should re-balance their budgets with a more enhanced focus on the .7 of donors with great potential. We have seen many organizations do just that and benefit tremendously. Happy to share their stories with you anytime.

Please note that I recently met with an organization that spends $31 million per year on fundraising and $29 million of it was budgeted for low-dollar acquisition and renewals.

I believe just a bit more emphasis on retention, stewardship, and cultivation for major gift lead generation and qualification would be fine. Revenue would likely increase and not much would be lost at the bottom since it doesn’t cost very much to add some focus for folks who have capacity.

Also, we have seen more and more ways to acquire major donors from the get-go from low-cost channels such as Facebook— thereby reducing the need for expensive low-dollar acquisition and debunking the idea that major donors can only come from being ‘moved up’ the pyramid. If you want to see those case studies, just let me know.