We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Can you tell your supporters that a CGA can deliver "GUARANTEED" income or not?

I attended a local monthly planned giving event a while back and learned a lot about how not to market charitable gift annuities.

During the presentation, one of the attendees stood up and gave everyone a thorough dissertation on the dangers of using the words “guaranteed” and “investment” in your charitable gift annuity marketing. He sternly warned that using those words is very dangerous, off-limits, and would probably result in a lawsuit against your organization.

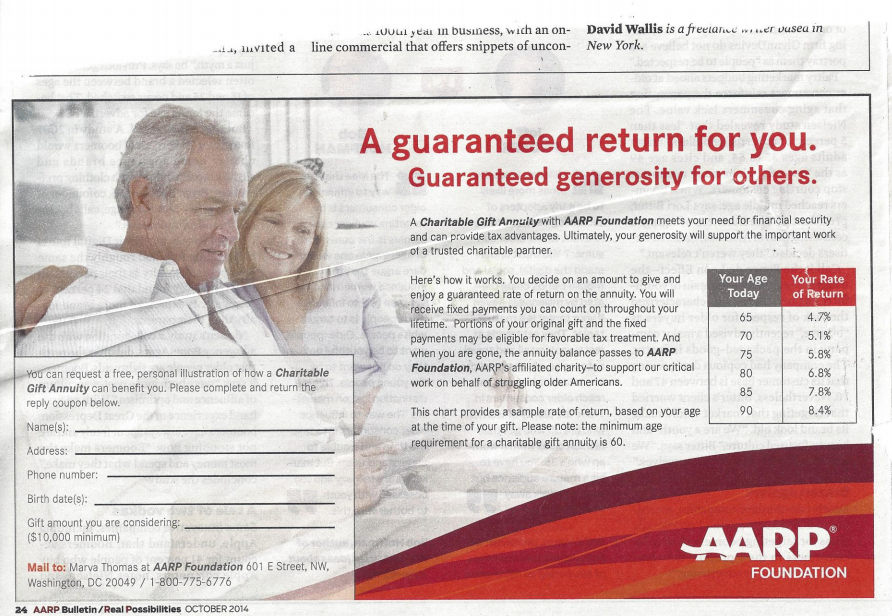

Then one of my pals sent me the ad below straight out of AARP’s magazine.

So what gives? Do we listen to the attendee or do we follow one of the largest nonprofits in the United States?

Is this ad dangerous?

PLEASE LEAVE YOUR COMMENTS BELOW!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

What was the rationale behind not using that type of terminology? The income is guaranteed via the Charitable Gift Annuity Contract, which at many institutions, is also backed by an insurance policy granting the annuitants income in the event the nonprofit ceases to exist, for any number of reasons. There is not necessarily a guarantee to the nonprofit on how much of the principal remains depending on variances in life expectancies, market crashes, etc. But I always thought the annuitant was in a favorable position. I’m not a planned giving expert so am curious to see others answers. I did planned giving mailings and we used terms similar to the AARP ad (maybe use words like promise, granted, fixed).

Hi Laurel. Basically he said the word could lead to legal issues. Let’s see what others say.

Great question Greg!

Charitable Gift Annuities are nothing but a simple, but enforceable contract with the nonprofit organization offering the CGA. In exchange for the transfer of assets from the supporter to the organization, the issuing institution is promising to comply with the terms of the agreement. By law, the issuing nonprofit backs the promise with the assets of the organization. Absent a situation where the issuing organization has absolutely no assets, the terms of the contract will force the issuer to make the payments to the supporter according to the terms agreed to by both parties.

Referring to it in marketing efforts as an “investment”, a “contractual mandate”, a “promise”, a “warranty”, an “assurance,” a “decree” or a “guarantee” should make no difference. Barring insolvency, the payments to the supporter WILL be made. Legal action in the case of a default will make little difference if there are no remaining assets to recover. I guarantee it.

Terrific, detailed response Steve. Thanks so much!!

Greg –

I believe John’s point about not using “investment” deals with the fact that to sell investment’s one has to be licensed. To offer something as an “investment” without being licensed is what creates the problem (fraud?) as I understand it. Now who would take action to pursue that is another question but if there were any problems with payments, all marketing materials, claims, “selling points” could be called into question…especially by a family member who may think mom or dad may have been taken advantage of. Those of us who’ve been around long enough have already lived through that situation in Texas which “iced” CGA’s for some organizations for a while. So challenges can and do occur!

BTW – for those who may be unfamiliar with John, he is very knowledgeable and highly respected in our business; a very reliable authority from whom to learn!

Tim Strawn

Senior Development Officer – Planned Giving

Mount Carmel Foundation

Thanks Tim. Appreciate that point.

Forgive me if this information has already been shared (or addressed in reference to last year’s tax law). Of course, charities have in the past been required to register with and often provide annual reports to the states departments of insurance for approval to offer charitable gift annuities. If the process is still largely unchanged, as I suspect it may be, the remarks you heard concerning the advisability of utilizing particular marketing practices representing this type of gift in the same light as various types of regulated investments may be connected to The Philanthropy Protection Act of 1995, enacting following the case.

The following excerpt appears in an article accessible at the Sharpe Group website entitled “Is There Security in Planned Giving?,” although I’m sure there are more recent treatments of this topic to which many many here would be happy to provide links.

Quote:

“Some will remember a notorious lawsuit in Texas known variously as the “Ozee” case or simply the “Texas Lawsuit.” In this case a class action suit claimed that gift annuities, charitable remainder trusts, and other plans that were issued by a charity were, in fact, unregistered securities. The suit also claimed that charities were violating antitrust laws by acting through the American Council on Gift Annuities to set recommended gift annuity rates.”

This protracted lawsuit may be the legal action to which you heard reference, Greg.

Thanks so much Erin. Very much appreciated!!