We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

10 reasons why donors and fundraisers like Rollover IRA giving

We’re getting pretty good at marketing rollover IRAs here at MarketSmart.

Here are some of the things we’ve learned as we’ve crafted a value proposition that generates massive amounts of money for good causes.

NOTE: If you haven’t cracked the code on seriously turning up the dial with your rollover IRA marketing, maybe it’s time you contacted us?

Why donors like Rollover IRAs

- Giving away the money they saved helps them feel good when they make a gift to support a cause they believe in;

- Many people over 70 1/2 years old find that they do not need their IRA funds to support themselves, so they might find themselves taking one, lump-sum required minimum distribution (RMD) each year (usually in the 4th quarter). Instead, they could make a qualified charitable distribution (QCD) to avoid paying tax on the RMD (since it will increase their adjusted gross income). Then the QCD transferred directly to charity will likely also reduce their taxable income;

- They also might like the fact that a QCD will probably simplify their tax returns;

- Getting their ‘custodian’ (the institution responsible for safeguarding their financial assets) to transfer the funds is relatively easy;

- Plus giving a QCD might make them happier because their yearly gift from their IRA is likely to be larger than their usual end-of-year donation by check or credit card. And, they can even give up to $100,000 annually per person so they can feel good knowing they are doing more to support a cause in which they believe.

- And, leaving the IRA to a charity as a beneficiary in their estate plan is pretty darn easy and could reduce their taxable estate (if they need it to be below $11.2 million) while doing so might entitle the supporter to benefits you afford only to legacy society members.

Why fundraisers like Rollover IRAs

- Qualified charitable distributions (QCDs)

- QCD’s might usually be much larger than a supporter’s regular yearly (annual fund) donations;

- QCD’s could be ‘gateway’ gifts leading to larger major gifts during the supporters’ lifetime or a bequest (assuming the fundraisers build relationships with the QCD donors);

- Legacy gifts by beneficiary designation

- The charity could get to keep what remains of the IRA when the donor dies if the charity is the sole beneficiary (although keeping a portion and splitting it with heirs is usually not so bad either);

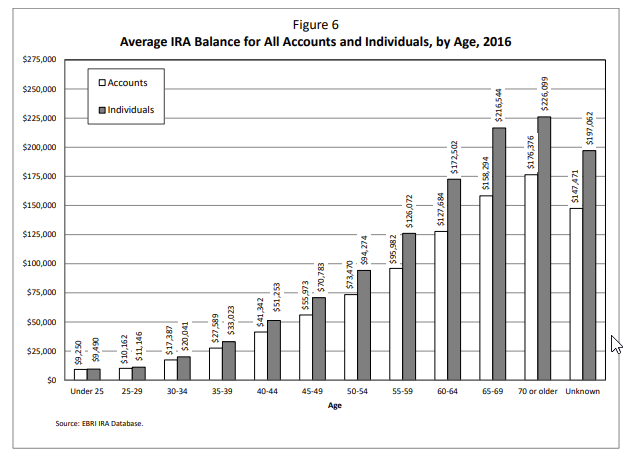

- IRAs tend to hold hundreds of thousands of dollars and continue to grow. Therefore IRA gifts to charity by beneficiary designation tend to be quite large.

Related Posts:

>>How to market the charitable IRA rollover?

>>Donors aren’t stupid

LIKE THIS BLOG POST? LEAVE YOUR COMMENTS BELOW AND/OR SHARE IT WITH YOUR PEERS!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

Hi Greg,

As always, you provide thought-provoking content. May I make one small suggestion? For pt. 6, you said, <> Maybe it would be better just to leave it at “reduce their taxable estate”? Citing a figure could give rise to confusion because: (1) it’s not accurate for single persons (or for some persons whose spouse is deceased); (2) There’s a reasonable chance that the figure will change by year-end in the present political environment; and (3) even if there is no legislative change, the figure is likely to change in January because of inflation indexing.

On the other hand, perhaps it could be possible to provide a tad more information about how doing the QCD can simplify a tax return? I wasn’t aware of this, and it would be good to know about in discussions with donors.

Thanks, as always, for your thought-provoking content.

These are great points. Thank you Sheila.