We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

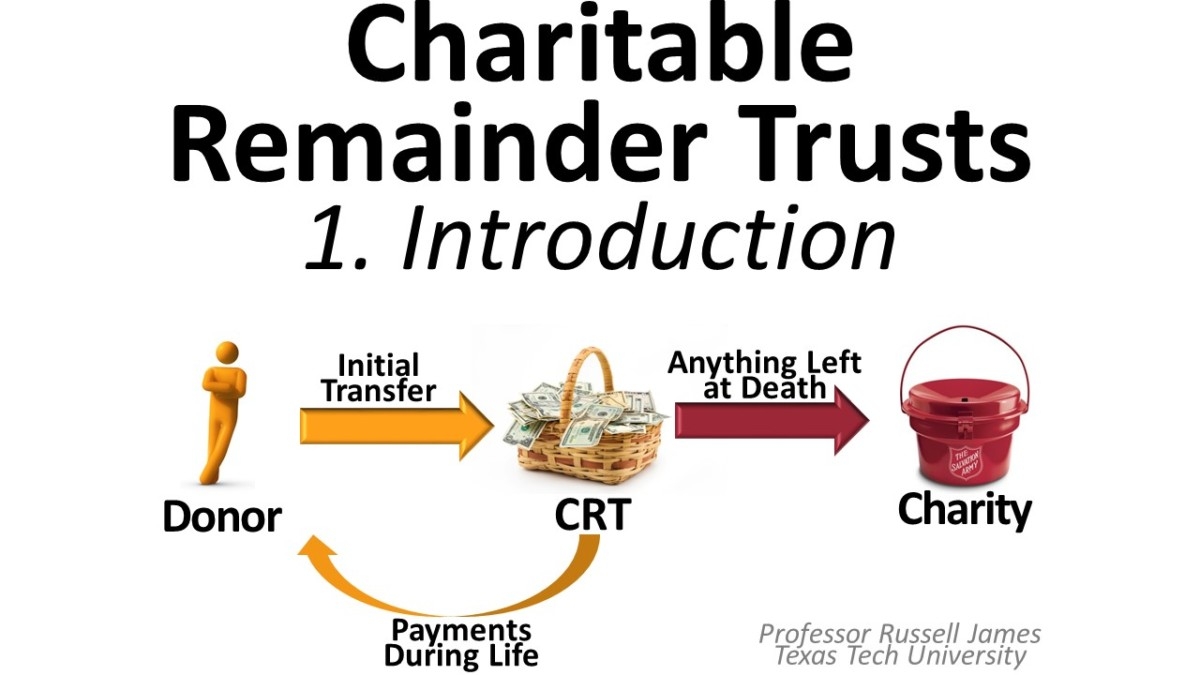

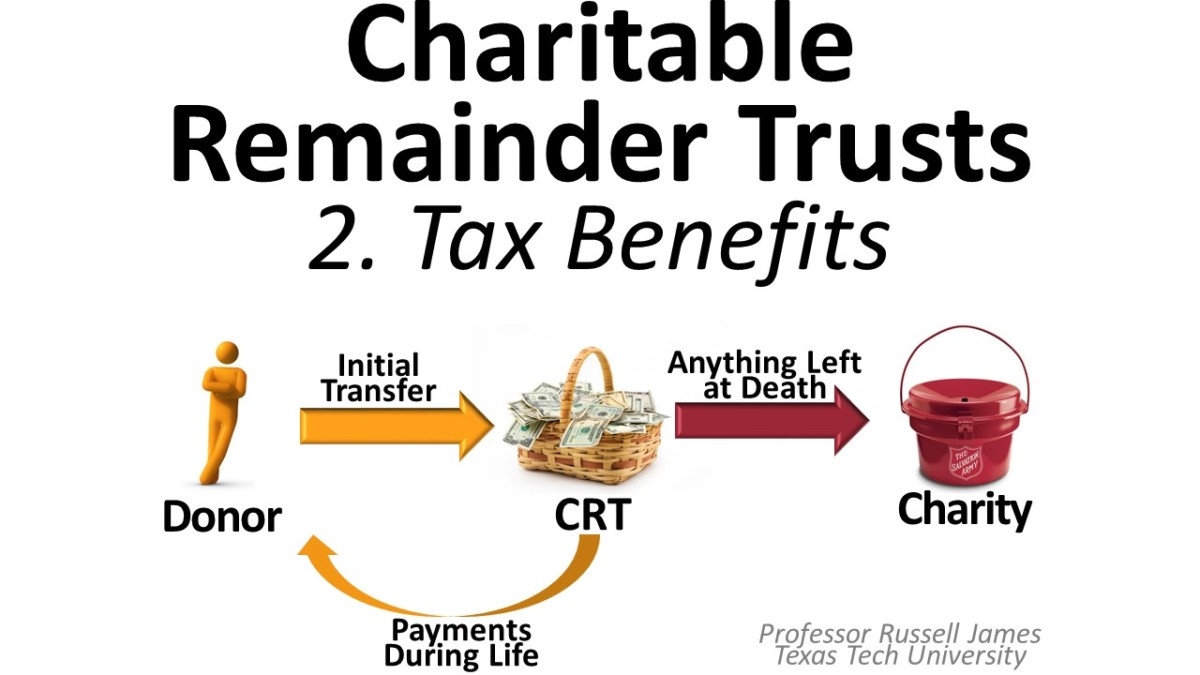

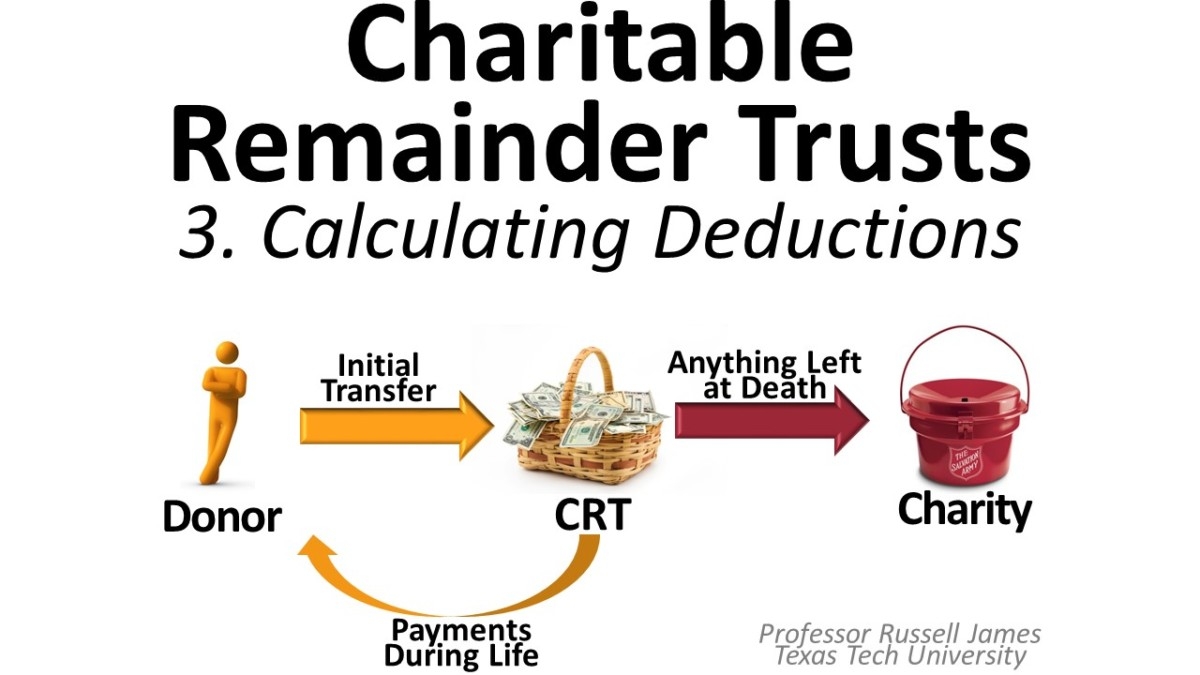

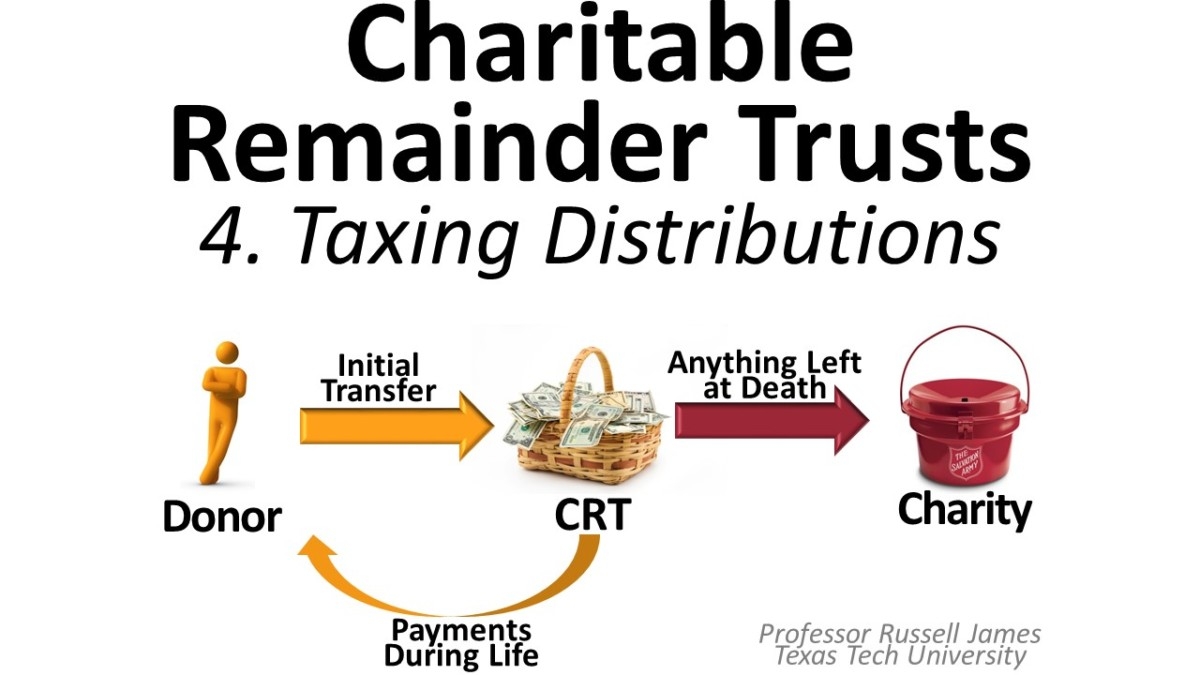

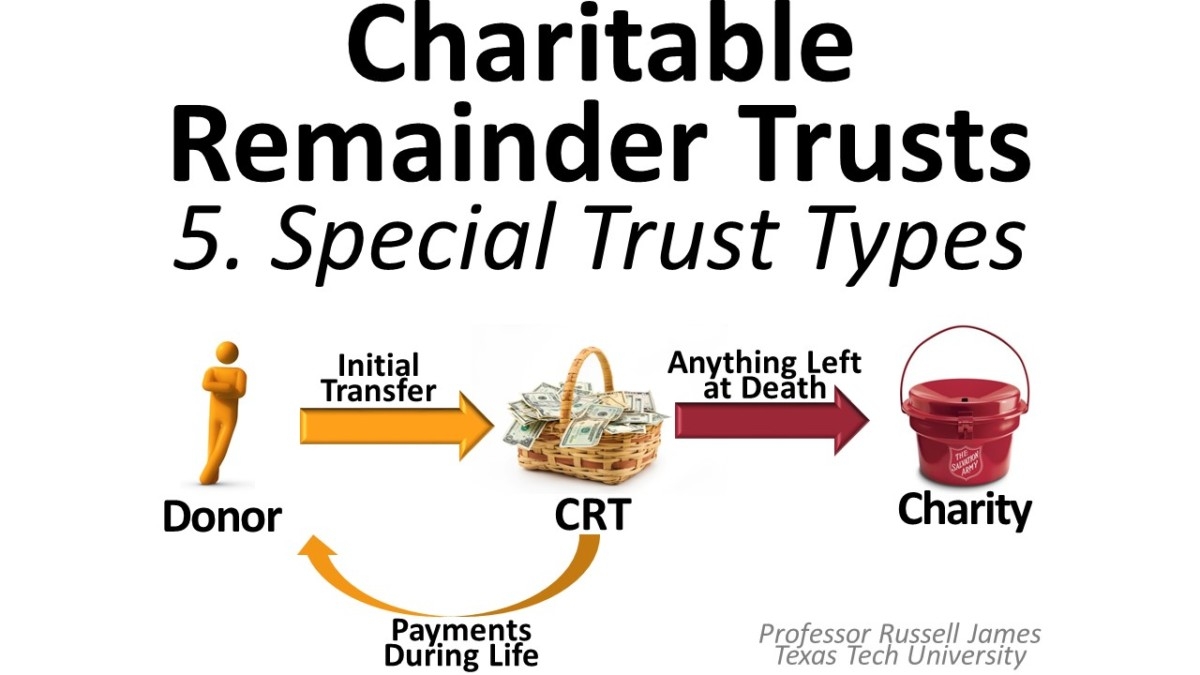

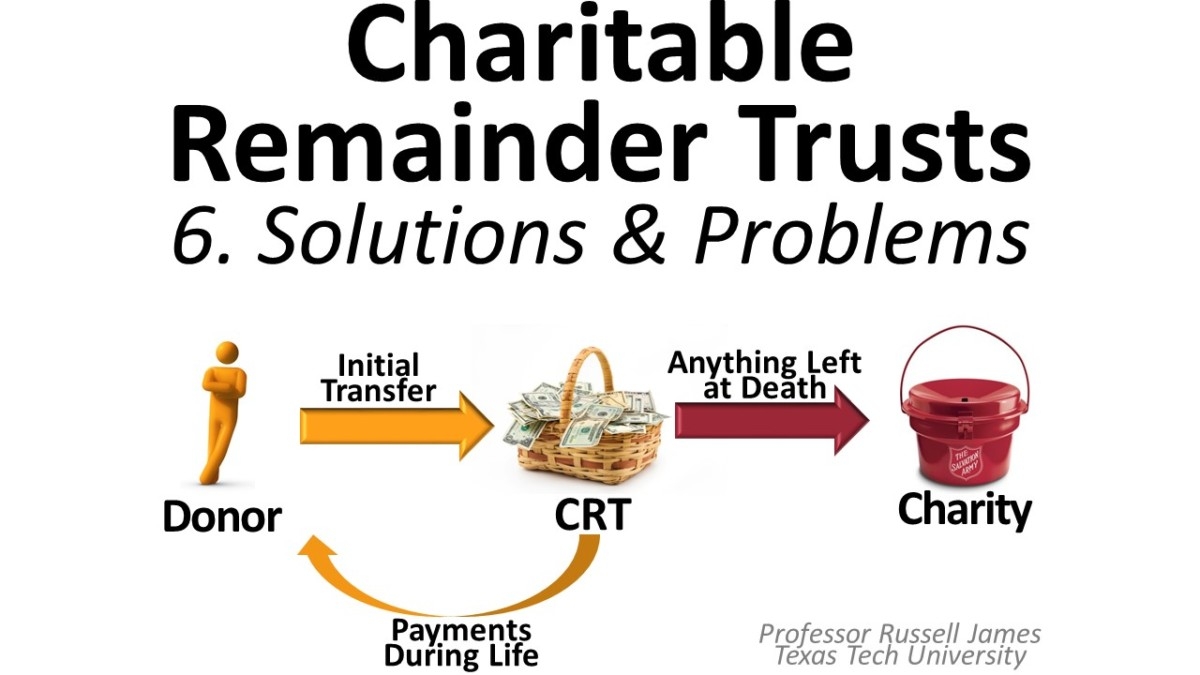

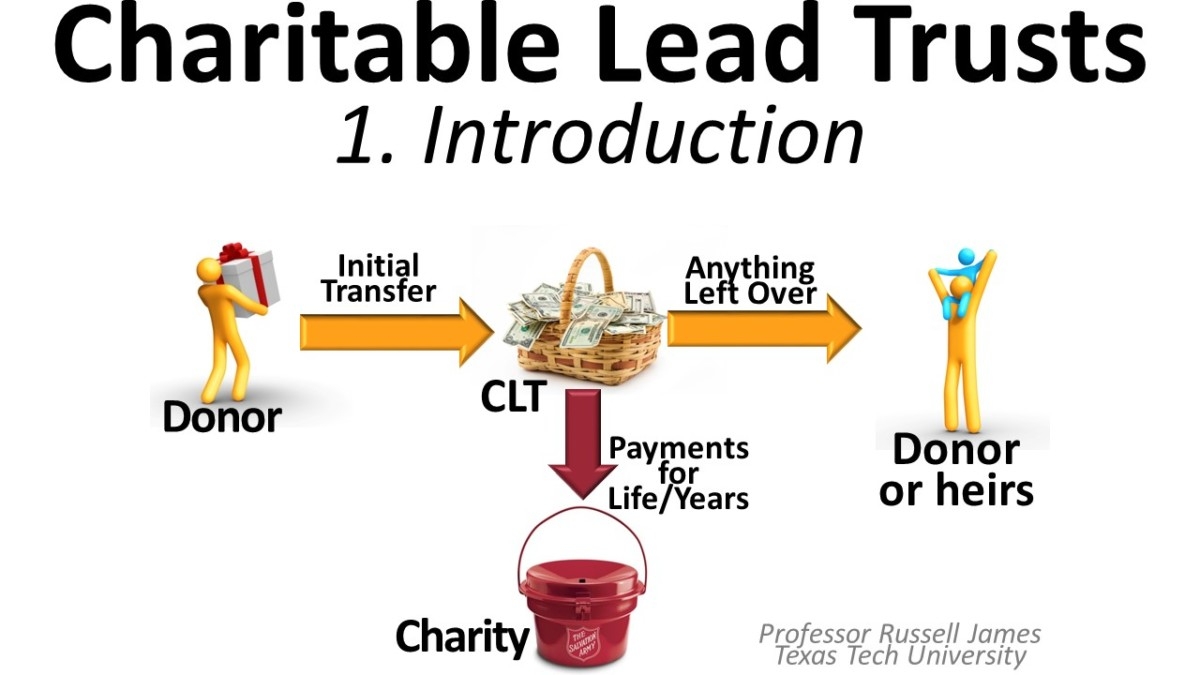

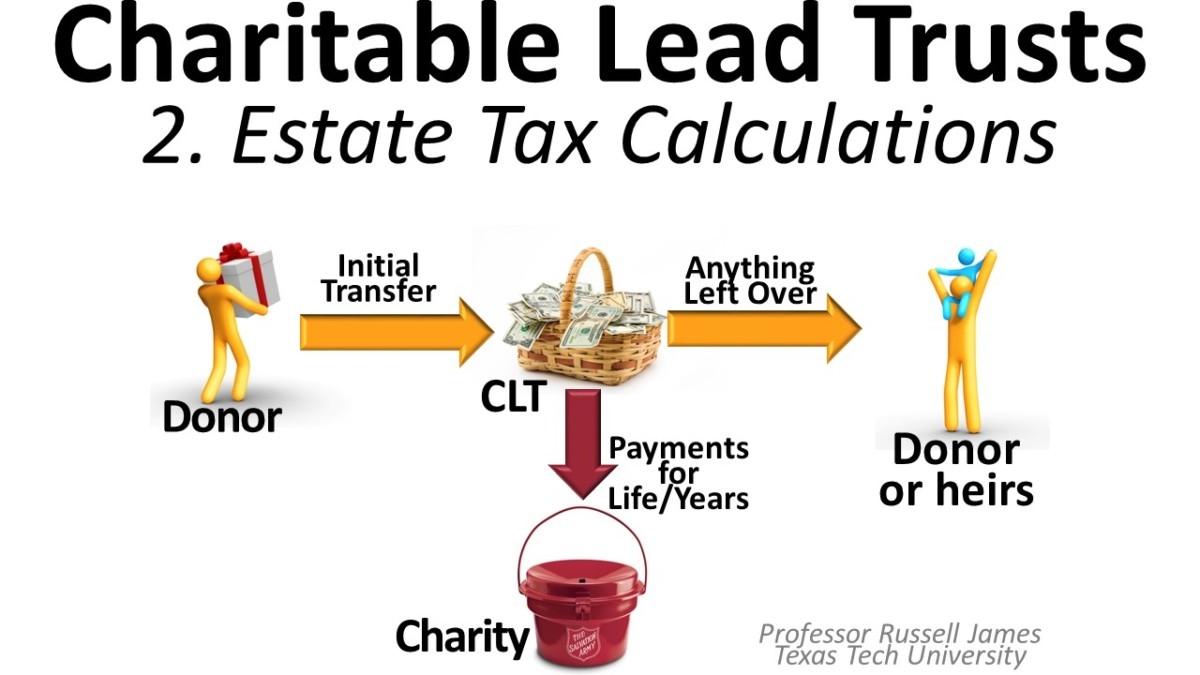

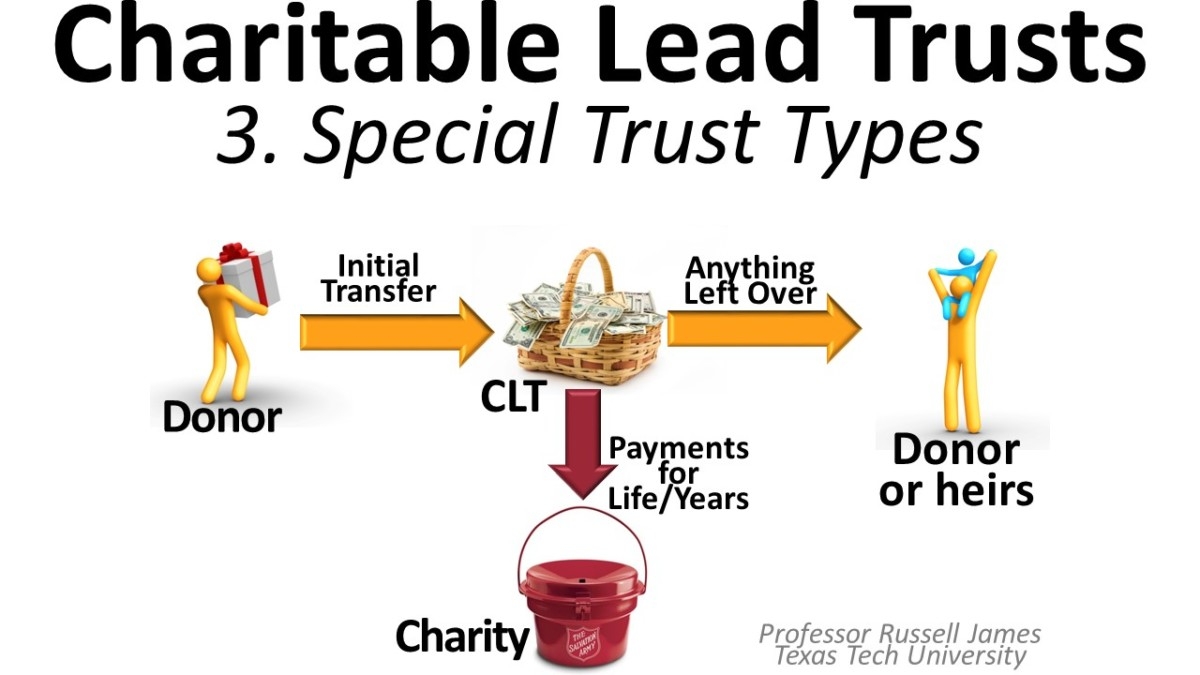

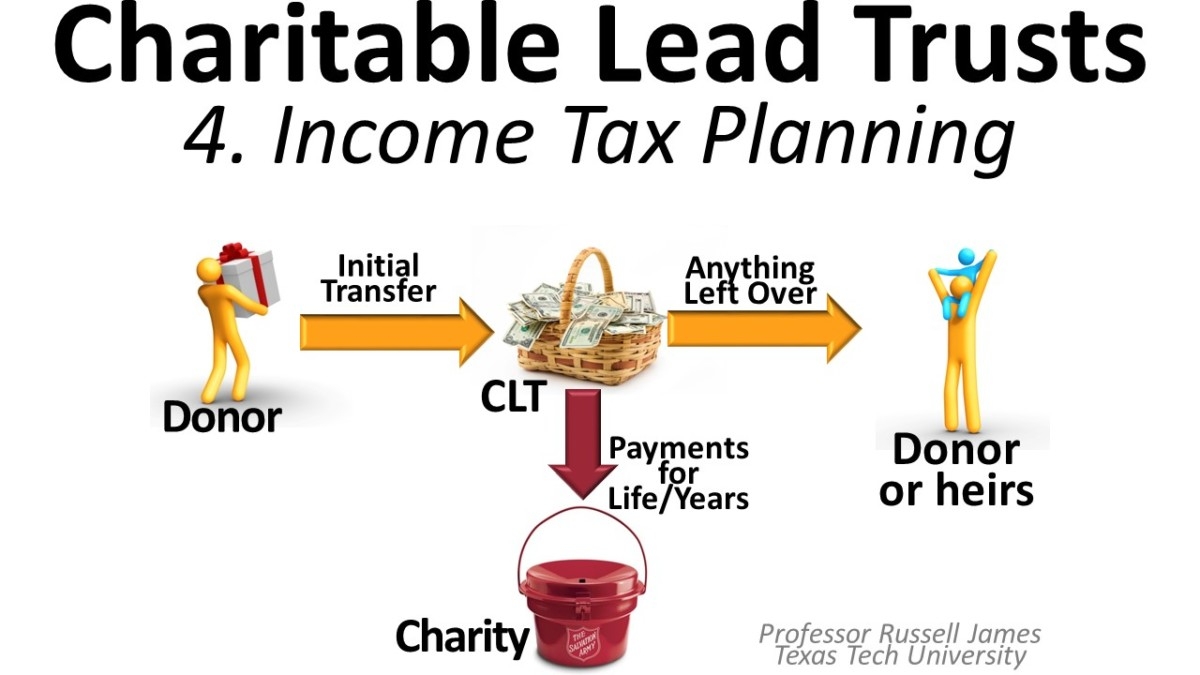

The Law and Taxation of Charitable Gift Planning

An Online Series Presented By Dr. Russell James

PLEASE NOTE: This lecture corresponds with the book “Visual Planned Giving: An Introduction to the Law and Taxation of Gift Planning.” Feel free to download a copy. It will help guide you through this course.

PLEASE NOTE: This lecture corresponds with the book “Visual Planned Giving: An Introduction to the Law and Taxation of Gift Planning.” Feel free to download a copy. It will help guide you through this course.1. Introduction: The Secret to Understanding Planned Giving

A lecture describing “the secret to understanding planned giving,” a review of charitable gift planning tools and motivations by Professor Russell James at Texas Tech University. This lecture corresponds with the book “Visual Planned Giving: An Introduction to the Law and Taxation of Gift Planning”.

3. Elements and Timing of a Charitable Gift

A lecture introducing the elements necessary for a deductible charitable gift in the U.S. federal tax system by Professor Russell James at Texas Tech University. This lecture corresponds with the book “Visual Planned Giving: An Introduction to the Law and Taxation of Gift Planning”.

4. How to Document Charitable Gifts

A lecture introducing the documentation requirements for a deductible charitable gift in the U.S. federal tax system by Professor Russell James at Texas Tech University. Part one of a three-part lecture on documentation requirements corresponding with the book “Visual Planned Giving”.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!