I sincerely hope I’m wrong. After all, I’m no economist. But it’s becoming more and more difficult for me to ignore the storm clouds gathering on the horizon.

I’m not talking about Fundraising Climate Change. I’ve been sounding the alarm about that for over a decade now. That’s the term I assigned to the worldwide growing distrust of charitable organizations, along with a collection of other issues I believe will negatively affect charitable giving over the next decade and beyond.

Now, I have a greater concern: inflation (and possibly hyperinflation)

I worry that inflation (and possibly hyperinflation) could change everything for nongovernment organizations, and I don’t think anyone in the charitable sector is ready for it.

Inflation is the increase in prices and the cost of living in a country. It makes everyone poorer. Everyone! But it affects the middle class (the majority of your donors) and the poor much more than it affects the wealthy. Of course, when costs increase relative to income, people with higher incomes and more wealth won’t feel the pinch from inflation nearly as much as the rest of us will.

I’m not the only one who’s worried.

Twitter co-founder Jack Dorsey recently tweeted, “Hyperinflation is going to change everything.” Of course, he’s also a crypto advocate, so he may have a vested interest in scaring folks into finding safety in alternative assets.

However, the Wall Street Journal agrees. On June 11, 2021, they predicted, “Higher inflation is here to stay for years,” and they recently added, “Uncomfortably high inflation will grip the U.S. economy well into 2022, as constrained supply chains keep upward pressure on prices and, increasingly, curb output, according to economists surveyed this month.”

The problem as I see it.

First, remember this: When the economy falters, charitable giving takes a hit.

According to Patrick Rooney, an economist at the Indiana University Lilly Family School of Philanthropy, and Jon Bergdoll, a philanthropy statistician, “During economic downturns, more people are out of work and need a hand. But individuals, along with other sources of philanthropy, including foundations, typically are making less income and have reduced wealth available, and so they decrease their giving accordingly. The Great Recession was an extreme example. Total giving dropped by 7.2% in 2008, and then decreased by another 8% in 2009.”

Unfortunately, many believe the next economic downturn will be much worse as the reverberations from the pandemic combine with inflation. Additionally, our monetary policy figureheads have put themselves in a corner. They have left very little wiggle room for remedies. Interest rates are already extremely low by historical standards, so there isn’t much left in the tank to cushion the shock of an economic tumble.

Here’s my big fear.

As inflation settles into the mix, it might be the catalyst for an economic nosedive. Then things could get super-stormy for fundraisers pretty darn quick because, again, inflation makes everyone poorer. But it hurts regular folks more—especially the people making low-dollar donations. Additionally, inflation increases costs for fundraising operations. That’s my big fear! Everything related to your low-dollar donation-generating engine will soon cost more. That includes printing and postage. Labor too.

As price increases hit your staff’s wallets, they’ll want higher wages. If you won’t yield to their appeals for raises, they might leave. That’s been happening to us here at MarketSmart. Turnover will cost you money too, as you’ll have to find replacements. Recruiting, hiring, training, and managing new staff will cost you a ton of donor dollars.

Soft costs related to advertising and recruitment fees will take a toll on your bottom line—not to mention the discontinuity that occurs when the relationships your best fundraisers built with major donors evaporate.

So inflation devalues what charities can do and what a charity’s supporters can do. It’s truly insidious. And I worry that it’s coming. Are you ready?

The solution.

If you’ve been following my blog posts and comments on social media, you probably already know what I’m about to say next. Don’t leave. Read on! Especially right now.

We could be on the precipice of an industry-changing episode in the charitable sector’s existence. Although you might have heard these ideas before, they bear repeating.

It’s time for organizations to change!

It’s time for fundraising operations to finally reject high-cost populist fundraising methods that fail to produce reasonable returns on their investments, and instead frequently drive well-meaning supporters away.

I understand that many fundraisers feel uncomfortable with that notion. Me too! All of us want to make sure our organizations work to become more equitable in how we operate. But at what cost? That’s the question.

After all, fundraising is a business. In most cases it’s not a political endeavor. Morality costs money. That’s why I believe, unless you can afford to take a moral stand during times of economic hardship, it’s probably time for organizations like yours to embrace technology. Only technology will save the day for you!

Technology can scale your ability to build meaningful relationships with donors at low cost. It can increase your return on investment to at least 10-to-1 initially, and 100-to-1 over several years.

Don’t believe me?

Want proof? No problem.

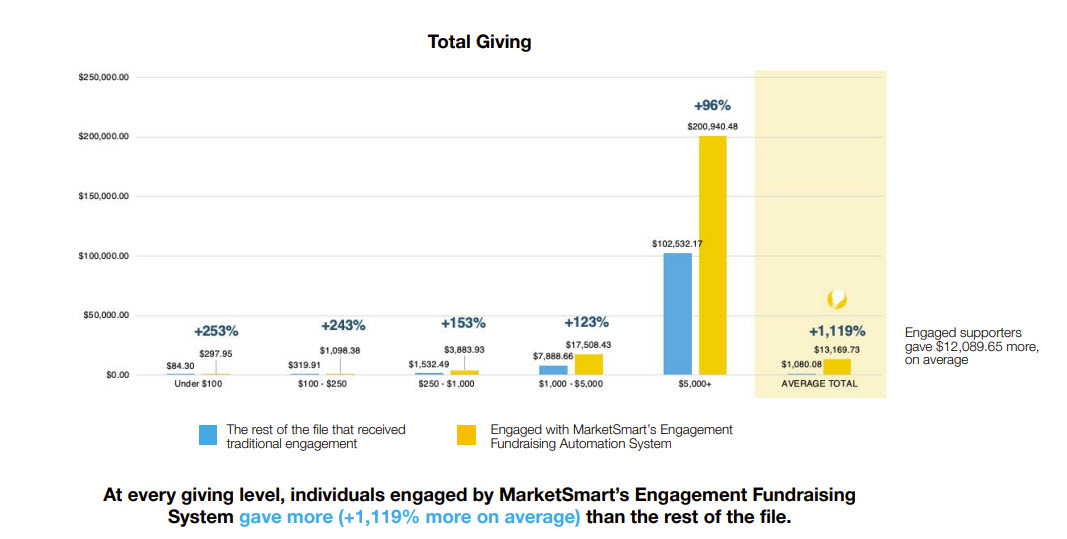

Here’s an example: Benedictine College began investing in tech-enabled donor discovery and automated cultivation (Engagement Fundraising) in 2015.

Now, just a few years later, the results speak for themselves. In comparison to donors who received traditional fundraising communications, those who were engaged with an innovative methodology gave +1,119% more.

That’s not a typo! That’s +1,119%! Plus, Benedictine College reduced their fundraising costs a lot—driving up their return on investment to 100-to-1.

Of course, their major donors led the way; the enormity of their donations drove the bulk of the revenue increases. However, the greatest percentage increases were found among the low-dollar donors. What’s not to like about that?

- Under $100 donors – Average gift +253%

- $100 – $250 donors – Average gift +243%

- $250 – $1,000 donors – Average gift +153%

- $1,000 – $5,000 donors – Average gift +123%

- $5,000+ donors – Average gift +96%

Note: If you want the complete case study, just email us at info@imarketsmart.com.

Benedictine College read the writing on the wall.

Back in 2015, they recognized that they couldn’t do more with less. They couldn’t keep pummeling supporters with more and more direct mail and email. That would only take them so far, and at great cost.

Instead, they realized they had to embrace technology to grow giving at low cost

You can do it, too!

Don’t delay!

The time is now.

The longer you delay, the longer you impede success.

Hyperinflation is likely to affect most of your donors. The ones in the middle class. The ones you’re mass mailing and emailing incessantly, and sometimes driving away because you’re only engaging with them transactionally. The ones you’re spending a fortune on to attract and retain.

Focus on the 70/.7

On average, just seven tenths of 1% of donors make up 70% of charitable giving. Those are the wealthy. Hyperinflation won’t affect them nearly as much. Those are the ones who want (and warrant) a highly personalized, relational approach that technology can support at scale.

However, by embracing and implementing an advanced, tech-enabled methodology, you can increase giving and retention rates among the wealthy and the regular folks.

I call it Engagement Fundraising.

You can implement the system yourself. You probably already have the tools to do it. But, as I’ve said over and over, tools can be used to break things as much as build them. Plus, you’re too busy! Why not let an expert with experience handle it for you?

Engagement Fundraising can help you raise more money at low cost. It can help your staff be the fundraisers they always wanted to be. And it can ensure that your organization continues to make a positive impact for generations to come.

If you haven’t heard about Engagement Fundraising before, now’s your chance to learn about it for free. Or, talk to my staff. They’ll help you learn about it at no cost whatsoever—and no pressure.

Related Items:

- 7 Data Points That Prove ‘Fundraising Climate Change’ Is Real And Happening Now

- Jim Langley’s 4-Step Process for “Reimagining Fundraising Operations”

- FREE Report: Fundraising Climate Change and What You Can Do about It