We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Online will-making tools: My pros and cons.

Brace yourself.

This is a long post because there’s a lot to be said.

I wrote it because digital will-writing tools are popping up to help your supporters facilitate their planning conveniently online. That’s creating both opportunities and challenges for fundraisers.

A free webinar.

Also, I wrote this post partly to promote a free webinar on the subject.

My longtime pal Tracy Malloy-Curtis, Legacy Gift Director at Mal Warwick DonorDigital (quite possibly the best legacy gift marketing consultant on the planet) discussed everything you need to know as you consider using these tools. Her presentation included a lot more than what’s written below. Nonetheless, here are my pros and cons. If you disagree with them, please let me know.

First things first.

MarketSmart does not necessarily compete with online will-writing platforms. In fact, I have worked with four of them to help develop their products because, as you’ll see below, I believe they might be helpful to some of your supporters as they make their estate plans. Additionally I introduced the CEOs of FreeWill and GivingDocs to Dr. Russell James to help them get some science-backed strategies into their applications. My hope has always been that my referrals will lead to more philanthropy, and that would be good for everyone.

But I also feel strongly that online will-making applications are simply lead generation tools. They don’t generate gifts (revenue) right now. They facilitate the process of promise-making. However, in order for revenue to be realized, stewardship is the key to true success. In other words, it’s not just about simply collecting and counting ‘commitments’ that might never result in realized revenues or that can easily be broken by the ‘donors’ (promisors). Stewardship is the key to long-term success.

Commitments are not the same as donations. Commitments are vows, promises, or pledges. And if you think they are the same as donations, you, your organization’s leaders, and its board members will likely be very disappointed in the years to come.

According to Dr. Russell James’ research [The timing of final charitable bequest decisions, Russell N. James III and Christopher Baker]:

The 10-year retention rate of a charitable estate component is approximately 55% among adults over 55 (USA).

Such a low retention rate can only be improved with stewardship.

Having said that, now let’s begin.

Your supporters might be tempted to use one of the following online will-writing tools:

● 12Law.com

● DoYourOwnWill

● eForms

● Fabric

● FreeLawyer

● FreeWill

● GivingDocs

● LawDepot

● LegalTemplates

● LegalZoom

● RocketLawyer

● Total Legal

● Trust & Will

● Willing

● And others

There are essentially three ways nonprofits can employ online will-writing tools to potentially expand their legacy gift programs.

1. Suggest. Upon hearing from a donor that they’d like to make a will and aim to include your organization as a beneficiary, you could simply recommend they work with an attorney or use one of the online tools listed above. A good number of people in our industry believe that fundraisers should ONLY refer donors to qualified attorneys. I’m not an attorney so I’ll stay out of that (although Tracy will likely discuss the topic in the webinar). Of course, either way you’ll want to supply your donors with the appropriate language to include in their will, along with your organization’s tax identification number so they’re sure to get the details right.

2. Pay. You might enter into an agreement with one of the businesses listed above whereby you pay them so they might allow you to customize their digital will-creation systems. In that arrangement your supporters could be presented with a question about leaving a bequest to support your organization (and/or others) as they prepare their wills online. If the supporters say “Yes,” the system will likely ask them questions to help them decide on the amounts or percentages. Plus the system could ask them whether they want the nonprofit to be notified about their intentions or not. If the supporters agree, then you’re likely to receive notifications about their intentions.

3. Don’t pay. You might enter into a different kind of agreement with one of the online will-writing businesses listed above that do not require payment from a nonprofit. In other words, you could get the benefit of #2 (above) but at no cost. In this arrangement, the people using the online will-writing tools (your supporters) could get their will completed for free online because those will-writing companies would then make money from advertising, promoting, or recommending other products to those users (your supporters).

Full disclosure: Some of MarketSmart’s customers are partnering with us to pilot the third approach (#3) at no cost to their organizations. Those nonprofits are paying nothing for the use of the online will-making tools. However, the supplier of the application does offer those who make wills an opportunity to purchase (from them) printed versions of their documents along with binders and other accompaniments. If you’d like to learn more about how that works, just reach out to us via email at info@imarketsmart.com. Just remember, MarketSmart is a marketing software and services company. We do not make legal recommendations whatsoever. Your decision to use any online will-writing tool is entirely up to you. MarketSmart’s role is to steward the donors to ensure that their gifts remain in their plans and increase in value.

Is getting into the will all that it’s cracked up to be?

Some time ago, Dr. Russell James mentioned (in our webinar titled Wills that Won’t ) that getting written into a will doesn’t necessarily guarantee an actual gift because most of those ‘commitments’ are revocable. Because people tend to change their minds (especially if they aren’t stewarded properly or their passions change), the gifts disappear.

[You can view the webinar here or download my notes from his presentation here.]

For instance, it’s quite possible that someone interested in nature for most of their life might become much more passionate about cancer research in their later years and refocus their giving (especially if they or their loved one had to fight the disease).

Additionally, Dr. James found that wills are more likely to be used as back-up documentation (leaving them unused). Keep in mind that I am not an attorney. I’m just a marketer and CEO. However, I believe, by law, contracts usually supersede the terms of a will.

Therefore, the beneficiary of a transfer-on-death account will receive that money even if a supporter states in their will that they are leaving the account to a charity/organization. The same holds true for all of their beneficiary designations. So, if a supporter names a spouse as the beneficiary of a life insurance policy, but states in a will that an organization should receive the death benefits from that policy, then it is my understanding that the spouse will receive the proceeds, regardless of what the will says.

If my understandings are correct, then all of this further diminishes the efficacy of these online will-writing tools for the purposes of raising money.

Should we assume younger people will be more likely to use online will-writing tools?

Let’s suppose that you agree with my point above and feel that getting into the will is not all it’s cracked up to be. Even so, you still might believe that getting into as many wills as possible could be a good thing for your organization. And, you might also believe that younger supporters will be much more likely to use online will-writing tools.

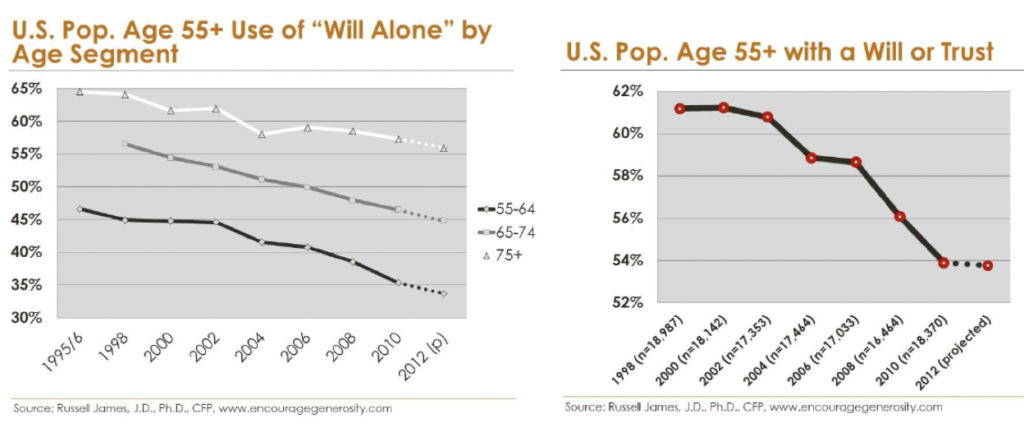

However, according to Dr. Russell James, writing a will as a whole is something that less and less people are doing. Additionally, younger people are showing less interest in writing wills.

Therefore, even if younger people might be more likely to adopt the online channel for writing a will, it might not matter much since the number of people writing a will seems to be decreasing as a result of the increased use of “transfer on death” deeds for real estate and other things normally covered by wills. Plus, don’t forget that today people easily designate their beneficiaries when they open bank accounts, retirement accounts, or purchase life insurance, etc.

Put these three facts together – decreasing use of wills, increasing use of transfers-on-death, and increasing use of beneficiary designations – and the value of the online will-writing tools becomes diminished greatly for the purpose of raising money for your cause.

Some other things to consider (while keeping in mind that I am not an attorney).

1. Many supporters might actually leave more debts than assets. In probate, debts will have to be satisfied before money can be distributed.

2. Most gifts in wills are revocable. So, even if the organization was named originally, there is no guarantee that the supporter won’t alter their decision… unless you steward them properly!

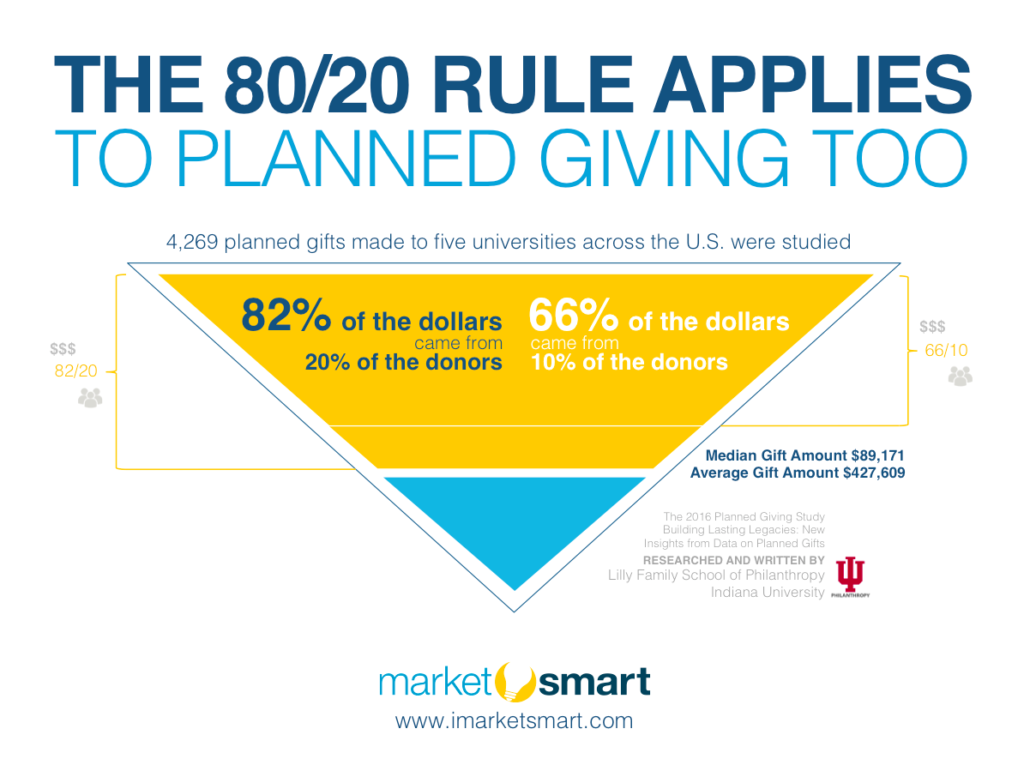

3. Although you might get some large legacy gifts from people of modest means, in general it is unlikely that the types of people attracted to using online will-writing tools will be wealthy. Very affluent donors tend to work with professional advisors to handle their assets — especially if they’re complex. This is important because according to the Lilly Family School of Philanthropy at Indiana University, 82% of the dollars from legacy gifts come from just 20% of the people (66% of the dollars come from just 10%).

Therefore, it would seem to be wiser to focus on fewer (very wealthy) people to generate more dollars at lower cost, not the other way around — focusing on the masses (80% of the people) to generate just 18% of the dollars.

My bottom line for now.

Any organization opting to use an online will-writing tool (especially if they pay for it) can win in a big way if they recognize that these kinds of tools are supplements to robust strategic legacy gift marketing initiatives, not replacements.

If they are used, stewardship is key to ensuring that donors will not alter their decisions later.

Always remember, legacy gift marketing is a marathon, not a sprint. It’s not just about getting into as many wills as possible— as quickly as possible. It’s about making donors feel good over time and helping them make more gifts, in addition to just gifts in wills.

Therefore, after your supporters use an online estate planning platform, we recommend you follow up with them properly using a well-conceived, highly strategic cultivation/stewardship approach that is likely to ensure that the ‘promises’ you generated also turn into realized revenues in the distant future.

In other words, you should think of the use of any online will-writing tool as lead generation effort— not as a fundraising drive.

Once you do that, you’ll be more likely to think of the ‘commitments’ you generate as leads, not donations.

Leads, of course, need to be qualified and prioritized for outreach based on passion and capacity first since you won’t have time to build deep, one-to-one, face-to-face relationships with everyone who promises a gift in their will. Your time is precious. In order to use it wisely, you’ll want to zero-in on the most passionate and wealthiest supporters.

Next, we recommend sending your ‘leads’ offers (such as MarketSmart’s donor survey, of course) to help you qualify and prioritize them for outreach. And, we believe you should cultivate/steward them too. But that’s as far as I’ll go on that subject. After all, I benefit if you agree with me and employ my System.

I strongly suggest you take a look at Tracy’s webinar.

She’s an objective source of information since she is an attorney, a former fundraiser, and now works as a legacy gift consultant.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

excellent words!! even tho I’ve retired from the active FR world, I’ve sure walked those paths. Keep up your good advice…and thanks!! here’s my new sig block:

Margie McCurry The McCurry Group

MARGUERITE MCCURRY, Ph.D., Certified Fund-Raising Executive

Publicist for nonprofits and authors — ‘They won’t contact you – if they don’t know who you are! 10500 Academy Rd. NE, # 132, Albuquerque NM 87111

Cell 831-601-5243 margiemccurry@gmail.com

I’m Margie McCurry, publicist for nonprofits and authors. As a certified fundraising executive, over the last 25 years I have successfully supervised the raising of more than $100million for universities, health agencies and other nonprofits…and it took a lot of “public relations!” Now “in retirement,” I concentrate on helping selected, area nonprofits and authors get thousands of dollars in free publicity — and tell their story to the world. My proven motto: “They won’t contact you, if they don’t know who you are!”

Our experience in England and Wales is slightly different. In a test campaign by Macmillan Cancer Support, supporters were offered a free online will or a free solicitor will. At the Institute of Fundraising Conference in July, the charity reported that 54% of the 18,000 consumers who registered for the offer chose an online option. It’s clearly not about expense for consumers. It’s about the convenience and accessibility of online, just like it has been in the shift from branch banking, local insurance brokers and High Street retailers.

You make very good points about debts and revocation of wills, but at http://www.bequeathed.org we do not find that gifts in wills are getting smaller. This might just be a UK phenomenon.

We offer free wills and so price isn’t a consideration. We also find that most wills are started by people over 55 with a peak at about 65 years old.

I am looking forward to the seminar and seeing what we can learn from across the pond.