We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

7 big ideas for raising ‘major gifts of assets’ right now from Dr. Russell James

A couple of weeks ago, my longtime friend Dr. Russell James presented his top recommendations for fundraisers to consider especially during the coronavirus era.

If you missed the event, don’t worry. You can view the recorded webinar and download the slides here.

Along with so many others, I’m very thankful to Dr. James for his research and contributions to the sector.

I am especially grateful because his science-based approach has added credibility to a strategy I’ve been championing for 10 years now. In 2012, I labeled it Engagement Fundraising. A book followed by the same name along with a webinar, podcast and tons of blog posts on the topic throughout this blog.

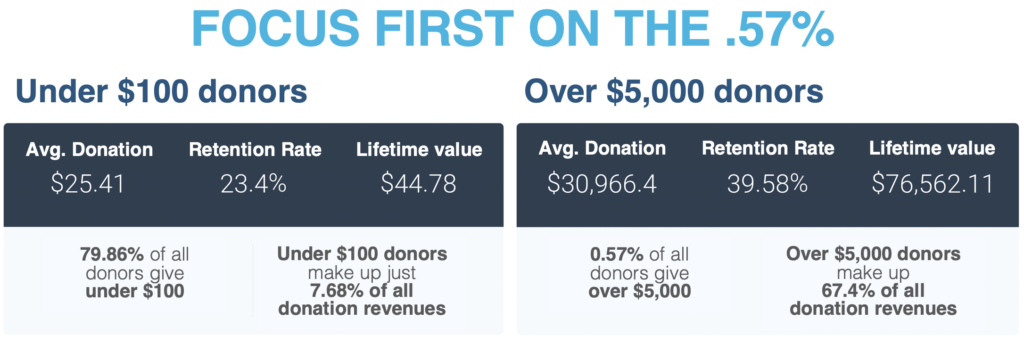

One of the key components of Engagement Fundraising is a focus on the Pareto Principle (the 80/20 Rule).

Although, nowadays the 80/20 Rule can only be found far behind in our review mirrors. It’s been replaced by the 67/.57 Rule. In other words, 67% of your organization’s revenue is likely to come from just .57% of your donors. This has been proven by my free Fundraising Report Card app (a no-cost donation data visualization tool I developed for anyone in the sector to use).

My recommendation for you

Conduct tech-enabled donor discovery by asking every supporter (including donors, volunteers, beneficiaries, staff and so on) to take a survey. Then use that data to build an extremely cost-effective and efficient, highly targeted, ongoing fundraising effort that helps supporters realize the best versions of themselves while supporting their desires to find meaning in their lives through donating major gifts of assets. That’s Engagement Fundraising in a nutshell!

Dr. James agrees.

He even decided to use my term ‘major gifts of assets‘ to replace what he previously called ‘complex gifts.’

Before the recent webinar he told me, “I am in love with your phrasing of ‘major gifts of assets’ to describe what it is that I do. This really seems to resonate with fundraisers outside of the traditional planned giving space and I’m going to adopt it permanently.”

Wow! Thanks Dr. James. What an honor!

At last, here are the seven ideas I promised in the headline:

- Just because the stock market went down doesn’t mean that high wealth individuals don’t have a lot of appreciated assets.

- Not every investment has declined; for instance, gold is up 12.6%

- Special opportunities exist in 2020 due to the stimulus packages

- Major gifts of assets feel relatively smaller, because they are usually a smaller piece of a much larger pie

- Studies show that people that feel wealthy act more charitably

- People are more generous with appreciated assets

- Focusing on a major gift from assets enhances the relationship between the donor and the fundraiser

A final note of thanks.

These seven takeaways were pointed out to me by my friend Bill Crouch, CEO and Founder of BrightDot (one of the most innovative fundraising consulting firms I’ve ever seen). Thank you Bill!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

[…] 7 big ideas for raising ‘major gifts of assets’ right now from Dr. Russell James […]