We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

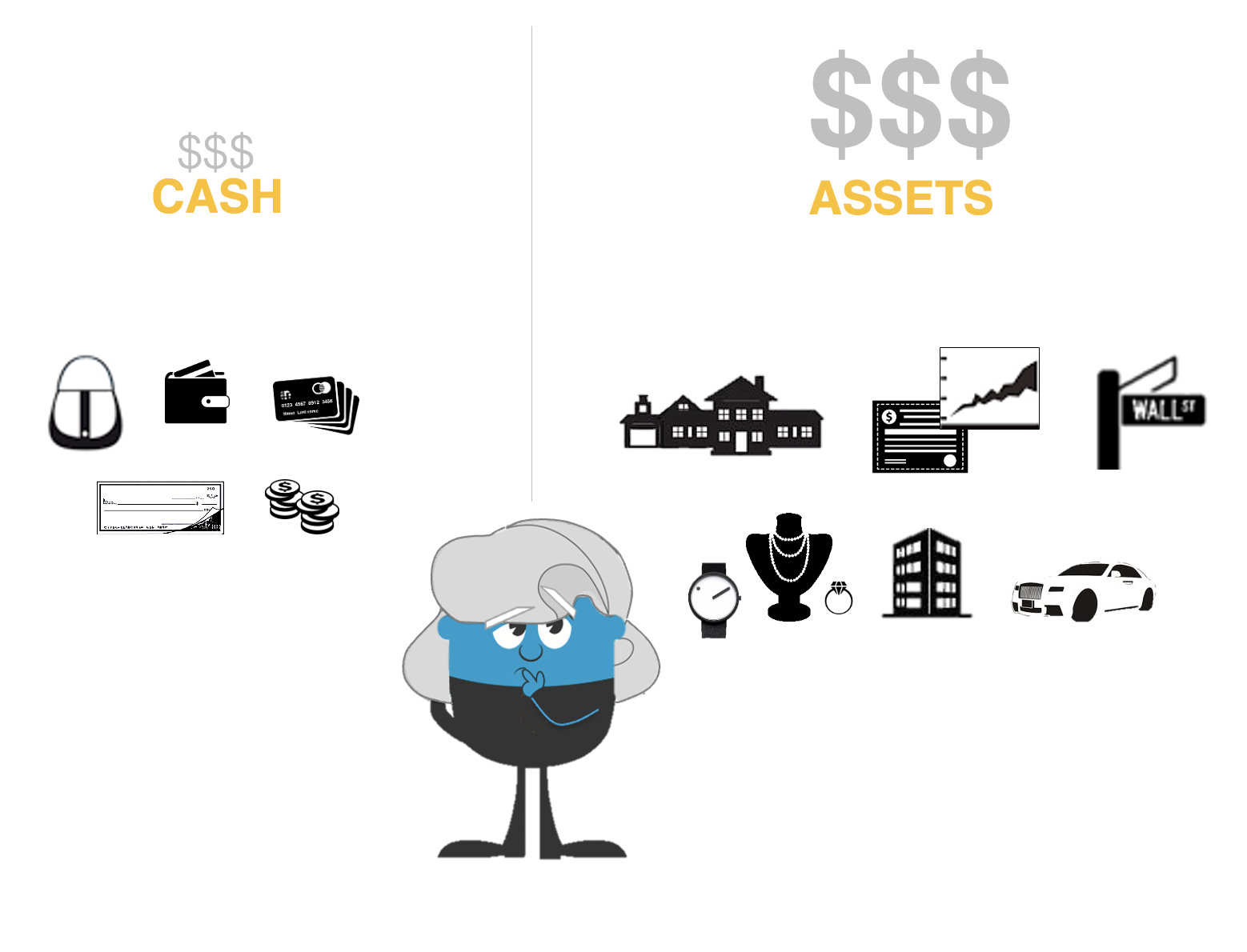

Why You Should Focus Your Fundraising Efforts on Generating Gifts of Wealth (from Assets) Not on Disposable Income (from Credit Cards, Checks, or Cash)

Gifts of wealth

A donation comes from the intersection of motivation and cost. Most of this series focuses on the motivation side. But often the secret to unlocking major gifts is on the cost side. That secret is this:

Major gifts are gifts of wealth, not disposable income.

It’s a simple distinction. But it’s powerful. Wealth is different. It’s not just a different amount. It’s a different category. It has a different origin. It triggers a different mindset.

Wealth is not income

Understanding gifts of wealth starts by understanding wealth. Wealth doesn’t come from a paycheck. Wealth comes from owning assets that go up in value.

Of course, the media is fascinated by people with large paychecks. Athletes and celebrities make great story characters. But they rarely build wealth. In fact, they commonly go bankrupt.[1]

Wealth is appreciated assets

Wealth comes from owning assets that go up in value. People buy assets with inheritance,[2] borrowings, or savings from income. People buy assets that go up in value by,

- Picking the right assets. This usually means accepting investment risk.[3]

- Using personal effort to increase asset value. This is what successful business owners do.

This is how wealth is built. Bill Gates started a company and grew it by personal effort.[4] Warren Buffet created a new way to borrow money to buy stocks.[5] And he picked the right stocks.

The concept is the same for regular people. People borrow money from others. It’s called a mortgage. They use it to buy an appreciating asset. It’s called a house. Most middle-class wealth comes this way.[6]

Whether middle-class or ultra-high net worth, the answer is the same: Wealth comes from owning assets that go up in value.

Wealth is a different money category

In math, a dollar is a dollar. But in story, dollars are different. The story of wealth is the story of appreciated assets. Wealth is not cash. Less than 3% of household financial wealth is held in cash or checking accounts.[7]

Wealth is still money. But it’s money from a different category. It’s money with a different reference point. This affects fundraising.

Gift size is relative to the money category

Asking for gifts of cash is asking from the small bucket. Asking for gifts from appreciated assets is asking from the big bucket. This difference affects the donor’s mindset.

Compared to other cash purchases, a $100,000 gift is absurdly large. The cash gift compares with coffee at Starbucks. It compares with spending from the disposable income category.

Compared to wealth holdings, a $100,000 gift may be tiny. The asset gift compares with a different category. A stock gift compares with stock holdings. A real estate gift compares with real estate holdings. Large gifts are made possible by large reference points.

Experiments: Money categories change behavior

Reminding people of their wealth changes their behavior. One experiment asked different questions from people entering a store.[8]

- Some were asked about their wealth: Did they own stocks, bonds, certificates of deposit, etc.?

- Others were asked what was in their wallet or purse: Did they have cash, credit cards, photos, etc.?

What happened? People first asked about their wealth spent over 36% more at the store. They were reminded of a different money category. That reminder changed their behavior.

Experiments: Money categories change current donations

This is an area where small gifts and large gifts work differently. For example,

- A small ask from a small category works. It makes the whole thing seem painless. It’s a trivial ask from a trivial category. Saying “yes” is no big deal.

- A big ask from a small category does not work. It makes the ask seem unreasonably large. The request is too big relative to the category.

- A big ask from a big category does work. The ask is big. But it’s reasonable relative to the category.

One experiment illustrates this.[9] People were asked about a donation pledge. It would be deducted from their monthly paychecks. But the amounts were described either as $1/$4/$7 a day or as $350/$1,400/$2,500 a year. Changing the description format changed the comparisons. For example,

- When asked with the daily amount, people compared the gift with “routinely encountered, petty-cash types of expenditures.”[10] The money category was trivial.

- When asked with the annual amount, people compared the gift with “infrequently encountered, major expenditures.” The money category was large.

For the smallest ask, the daily amount worked better. It was a trivial ask from a trivial category. It’s just “pennies a day.”

But for anything over $1,000, the result reversed. Gifting doubled when using the annual, rather than the daily, amount. The “pennies-a-day” story worked, but only for pennies. Big gifts needed big reference points.

Experiments: Money categories change future donations

The “pennies-a-day” story creates another problem. A small reference point makes future giving small.

In one experiment, workers had a gift made on their behalf.[11] For some it was donated in small daily segments. For others, it was given in one lump sum. After this, everyone had the chance to make their own gift. People whose previous gifts had been broken into small amounts acted differently. They gave about a third less.

Why did this happen? Further questions showed the answer. People used previous giving as the reference point for their donation. When previous giving had been made in small segments, it felt smaller. This smaller reference point led to smaller donations.

But there was a solution. Showing the total of prior gifts before making the ask worked. It made the small segment gifts feel larger. This larger reference point increased donations almost 50%.[12] For bigger gifts, we need bigger reference points.

Another experiment found a similar result.[13] When prior gifts were described in total terms, people gave more. If they were described in monthly terms, people gave less.

Describing past giving as several small gifts is a small-reference-point story. Describing it as a single large total is a large-reference-point story. Choosing a larger reference point changes the giving behavior.

Another experiment showed this in a different way.[14] It tested six mailings to over 50,000 people. The top-performing headline was,

“CAMPAIGN DONOR FOR ___ YEARS

Your most generous gift was $___. Thank you.”

This sets a reference point of the donor’s largest gift. It also emphasizes the length of the relationship. It reminds the donor that they’re the kind of person who makes these gifts – especially large ones.

Real world: A money category question

Which gift is more valuable:

- A $10,000 check, or

- $10,000 of stock shares?

The charity CFO will prefer the check. It’s easier. Gifts of assets are a hassle. The charity has to retitle them. The charity has to sell them.

The donor’s financial advisor will prefer the stock. Giving stock avoids capital gains taxes. It’s cheaper for the donor.

Which gift should the fundraiser prefer? The gift of stock. If the fundraiser cares about the donor, the answer is already obvious. One gift costs the donor less. That’s the gift the donor should make.

But there’s another reason: categories matter. If gifting comes from a tiny category, future gifting stays tiny. If the same gift comes from a big category, future gifting can become big.

A checking account is where disposable income lives. Disposable-income gifts come from the small category. This keeps future gifts small.

Appreciated assets is where wealth lives. Asset gifts come from the big category. Asset gifts can lead to transformational donations.

Real world: Money categories and “mental accounting”

In math, a dollar is a dollar. In story, people put labels on money. They then treat the dollars differently based on those labels.[15] In experiments, when a new category of money becomes donation relevant, giving increases.[16]

Suppose a person gives furniture or clothes to a charity shop for the first time. From that point forward, the category becomes donation relevant. Whenever redecorating happens, charity comes to mind.

Suppose a person gives shares of stock for the first time. They learn that capital gains taxes are avoidable. From that point forward, the category becomes donation relevant. Whenever a sale is contemplated, charity comes to mind.

Real world: Money categories and fundraising success

Experiments and theory are fine. But how powerful is this in the real world? An analysis of over a million nonprofit tax returns showed the answer.[17]

Raising money from noncash assets predicts current and future fundraising success. This was true for every charitable cause. It was true for every charity size. And the difference was massive.

Consider this comparison. Suppose there were two otherwise identical charities. Both raised the same amount of contributions in year one. But there was a difference. One had raised these gifts only from cash. The other had raised gifts from both cash and stocks.

Fast-forward five years. What was different about the cash-and-stocks charity? It’s total contributions, on average, grew twice as fast. One little fact doubled fundraising growth. Doubled!

This is a big deal. This isn’t just academic theory. This isn’t just a little experiment. This is years of data from most American nonprofits. This is as “real world” as it gets. And the difference is massive.

Real world: How to start

Fundraisers can start by sharing stories. These can be stories of others like the donor who have made gifts of assets. Donor stories can include stocks, bonds, real estate, or businesses.[18]

In conversation, this might begin with saying, “I help our donors give smarter.” When asked for an explanation, the fundraiser can share a story that teaches.

Marketing materials can regularly teach the benefits of such gifts. (Of course, fundraisers should also educate themselves.)[19]

Fundraisers can also listen. They can listen for upcoming financial events. A sale, a retirement, an inheritance can all be times when charitable planning works well. By learning, listening, and sharing, fundraisers can become a valuable advisor for donors. They can also change the donor’s mindset.

Mindset matters

Most donors think of donations as something that comes from regular disposable income. Gifts come from “pocket change.” These donors will give small. They will give small today. They will give small tomorrow.

But if a donor begins to think of donations as something that comes from wealth, things change. These donors will give big. They will give big today. They will give even bigger tomorrow.

The transformational estate gift

Legacy gifts are transformational. They can be transformational for the charity because of their size. For people worth over $2 million, estate giving averages 20, 50, or 100 years of their annual giving.[20] This multiple increases with increasing wealth. Legacy gifts from the wealthy can be enormous.

But legacy gifts are also transformational for the donor. Current giving increases dramatically after adding charity to an estate plan. Annual donations jump over 75%.[21] These are the same donors before and after. They just behave differently after changing their estate plans. Even eight years later, this higher level of giving persists.

Why does this happen? An estate gift is a gift from wealth, not disposable income. For many, putting charity in their will is their first commitment to donate from their wealth, rather than from their disposable income. This first gift from wealth can be transformational for the donor. It mentally reclassifies their wealth as donation relevant. This changes the reference point for donations. It opens the way for larger donations in the future.

Conclusion

The key to fundraising growth is changing the donor’s mindset. That starts by understanding the secret: Major gifts are gifts of wealth, not disposable income.

Footnotes

[1] Carlson, K., Kim, J., Lusardi, A., & Camerer, C. F. (2015). Bankruptcy rates among NFL players with short-lived income spikes. American Economic Review, 105(5), 381-84; See also, Campbell, J. C. (2005). Who owns Kim Basinger: The right of publicity’s place in the bankruptcy system. Journal of Intellectual Property Law, 13, 179-204. p. 185. (“The list of celebrities who have filed bankruptcy is not only long, but also surprising given the commercial success of those celebrities.”)

[2] Harbury, C., & Hitchins, D. (2012). Inheritance and wealth inequality in Britain. Routledge; Wolff, E. N., & Gittleman, M. (2014). Inheritances and the distribution of wealth or whatever happened to the great inheritance boom? The Journal of Economic Inequality, 12(4), 439-468.

[3] Finke, M. S., & Huston, S. J. (2003). The brighter side of financial risk: Financial risk tolerance and wealth. Journal of Family and Economic Issues, 24(3), 233-256. See also, Aka, P. C., & Oku, C. (2016). Black retirement security in the era of defined contribution plans: Why African Americans need to invest more in stocks to generate the savings they need for a comfortable retirement. Rutgers Journal of Law & Public Policy, 14, 169-195.

[4] Wallace, J., & Erickson, J. (1992). Hard drive: Bill Gates and the making of the Microsoft empire. Wiley.

[5] This was done by acquiring ownership in a retail stamps company, Blue Chip Stamps, and using the float to purchase shares of other companies. See, The Science of Hitting. (2017, July 17). Berkshire and Blue Chip stamps, https://www.gurufocus.com/news/543005/berkshire-and-blue-chip-stamps

[6] “home equity remained the primary source of wealth for most households, especially for lower income homeowners, with home equity comprising 42% of the total household net wealth of all homeowners and 77% of the total net wealth of lower income homeowners”

Turner, T. M., & Luea, H. (2009). Homeownership, wealth accumulation and income status. Journal of Housing Economics, 18(2), 104-114. p. 105. Citing to Di, Zhu Xiao, 2003. Housing wealth and household net wealth in the United States. Working Paper 03-8. Joint Center for Housing Studies.

[7] Board of Governors of the Federal Reserve System. (2019, June 6). Financial Accounts of the United States – Z.1, https://www.federalreserve.gov/releases/z1/20190606/html/b101h.htm

In 2018, $113,094.2 billion in total financial assets were held by households and $1,375.9 billion were held in checkable deposits and currency held by households. Thus 1.2% of total financial wealth is held in “cash” by that definition. Adding money market fund shares adds another $1,701.4 billion. Combined, this adds to 2.7% of household financial wealth. This excludes wealth from real estate. Thus, the share of total wealth held in these categories is actually much smaller.

[8] Morewedge, C. K., Holtzman, L., & Epley, N. (2007). Unfixed resources: Perceived costs, consumption, and the accessible account effect. Journal of Consumer Research, 34(4), 459-467.

[9] Gourville, J. T. (1998). Pennies-a-day: The effect of temporal reframing on transaction evaluation. Journal of Consumer Research, 24(4), 395-408.

[10] Id at p. 400.

[11] Hmurovic, J., & Lamberton, C. (2017). Does repeating prompt retreating? How the structure of initial charitable contributions impacts the magnitude of subsequent support. North American – Advances in Consumer Research, 45, 661-662, http://www.acrwebsite.org/volumes/1023996/volumes/v45/NA-45

[12] Id. Experiment 3

[13] Id. Experiment 1

[14] Khan, H. & Hardy, E. (2019). Using behavioural insights to encourage charitable donations among repeat donors. Privy Council Office: Impact Canada. https://www.canada.ca/content/dam/ih-ci/documents/pdfs/HS-eng.pdf

[15] Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199-214.

[16] LaBarge, M. C., & Stinson, J. L. (2014). The role of mental budgeting in philanthropic decision-making. Nonprofit and Voluntary Sector Quarterly, 43(6), 993-1013.

[17] James, R. N., III. (2018). Cash is not king for fundraising: Gifts of noncash assets predict current and future contributions growth. Nonprofit Management & Leadership. 29(2), 159-179.

[18] James, R. N., III. (2019). Using donor images in marketing complex charitable financial planning instruments: An experimental test with charitable gift annuities. Journal of Personal Finance, 18(1), 65-73.

[19] For details, see James, R. N., III. (2018). Visual planned giving in color: An introduction to the law & taxation of charitable gift planning. Version 5.1. Createspace Independent Publishing. www.encouragegenerosity.com/VPG.pdf

[20] James, R. N., III. (2020). American charitable bequest transfers across the centuries: Empirical findings and implications for policy and practice. Estate Planning and Community Property Law Journal, 12, 235-285. p. 271.

[21] “Thus, using these 8,891 “before and after” observations from 1993-2016, inflation-adjusted giving was, on average, about 77% greater after the charitable estate planning component was added than it was before ($7,699 versus $4,355).” James, R. N., III. (2020). The emerging potential of longitudinal empirical research in estate planning: Examples from charitable bequests. UC Davis Law Review, 53, 2397-2431. p. 2422.

Related Resources:

- Donor Story: Epic Fundraising eCourse

- The Fundraising Myth & Science Series, by Dr. Russell James

- 7 big ideas for raising ‘major gifts of assets’ right now from Dr. Russell James

- How to Lower the ‘Cost’ of Philanthropy So Your Supporters Donate Major Gifts of Assets

LIKE THIS BLOG POST? SHARE IT AND/OR LEAVE YOUR COMMENTS BELOW!

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!