We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

Nonprofit Marketing for IRA Rollovers: A Strategic Guide

How to market charitable IRA rollovers to raise more money at lower costs

Welcome! If you’d like to learn about marketing for IRA rollovers, you’ve come to the right place. Whether you’re a Director of Development at a small shop, or a Gift Officer at a huge nonprofit, knowing how to market charitable IRA rollovers is an important skill. This page is filled with a lot of useful information. Enjoy, share with colleagues, and let us know your thoughts.

Want more content like this? Get our weekly newsletter!

What is an IRA and how does it work?

An IRA (Individual Retirement Account), gives people a way to build tax-deferred savings for retirement since pensions are less likely to be offered and many do not want to depend solely on Social Security. With the passage of the Setting Every Community Up for Retirement Enhancement Act (SECURE) on December 20th, 2019, anyone earning income (regardless of age) can open and invest in a traditional IRA (the most popular IRA).

Individuals can usually deduct their IRA contributions from their gross income for tax purposes, a big break that lowers their adjusted gross income so they pay tax on lower income amounts. Plus the earnings from the growth of their contributions are usually tax deferred until the money is withdrawn at retirement. Although, high earners might not be able to take advantage of these benefits.

Withdrawals cannot occur without tax consequences prior to age 59 ½. Trying to sneak funds out, with few exceptions, will result in the amounts getting taxed as ordinary income plus, in most cases, an IRS penalty of 10%.

NOTE: Generally, money can be withdrawn from a traditional IRA penalty-free before age 59½ to buy a first home, pay for higher education or extraordinary medical costs, or because of disability or death. Also penalty-free loans from an IRA are allowed, but the money must be replaced within 60 days or taxes will be levied in addition to the 10% IRS penalty.

More than $2.5 trillion held in IRAs

In 2018 Reuters reported that household net worth in the U.S. surpassed $100 trillion with $8.4 trillion saved in retirement assets including:

- IRA’s (approximately 31% of retirement savings or $2.5+ trillion);

- 401k’s;

- Annuities;

- Pension plans.

And, continued growth is expected.

Most supporters of nonprofits are likely to have IRAs and the funds in those IRAs are almost guaranteed to grow in value. Here’s why:

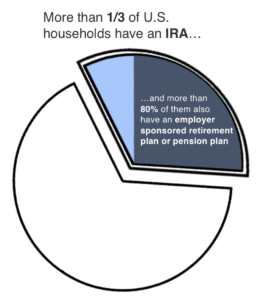

According to the Investment Company Institute, in 2017, more than one-third of US households owned individual retirement accounts (IRAs) and more than 80% of those IRA-owning households also had employer-sponsored retirement plan accumulations or had defined benefit plan coverage (pensions). Plus, many of the 80% (about 26% of U.S. households) with employer-sponsored retirement plans will likely ‘roll’ those funds into IRAs because they won’t want to leave the funds behind with their former employers. So they’ll consolidate their assets in an IRA to ensure they continue to benefit from tax deferment.

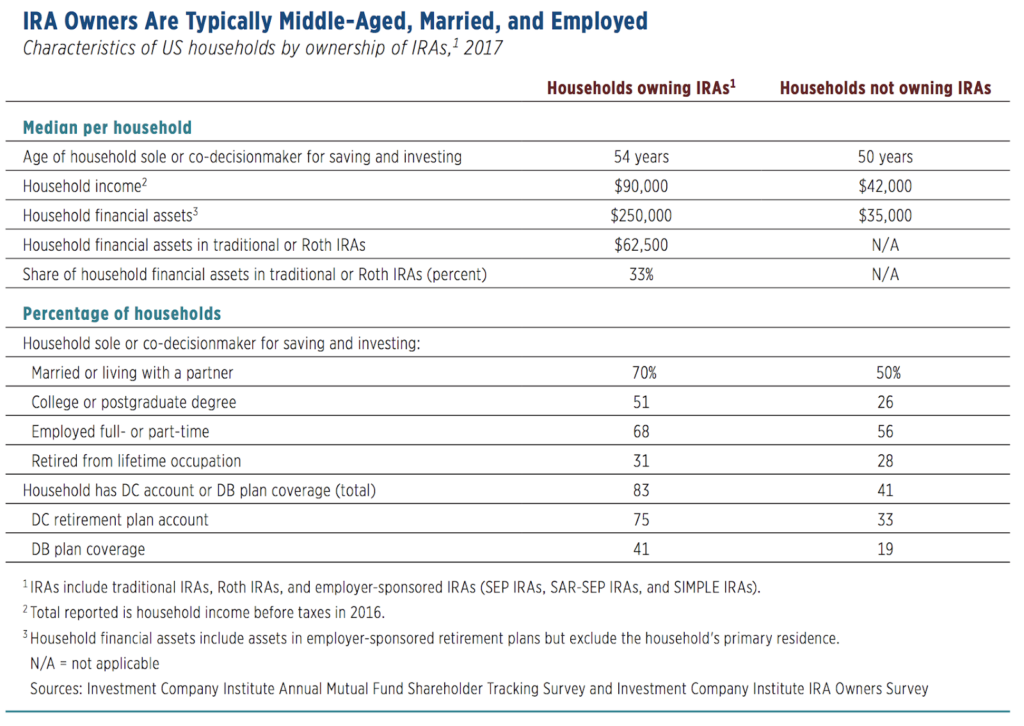

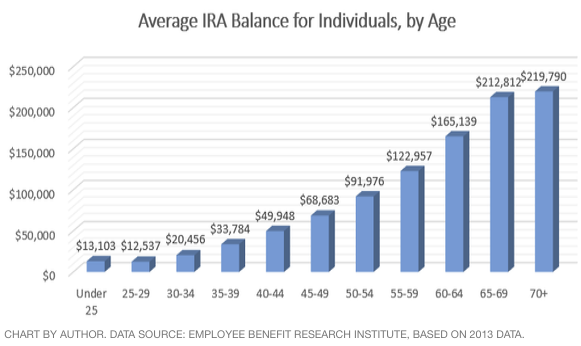

IRA households mirror hi-capacity donor profiles

IRA owners (households) tend to be savers and they seem to mirror hi-capacity donor profiles because they:

- Have higher incomes than non-IRA households ($90,000/yr vs. $42,000/yr);

- Have more financial assets than non-IRA households ($250,000 vs. $35,000);

- Are more likely to be highly educated than non-IRA households (51% vs. 26%).

Withdrawals

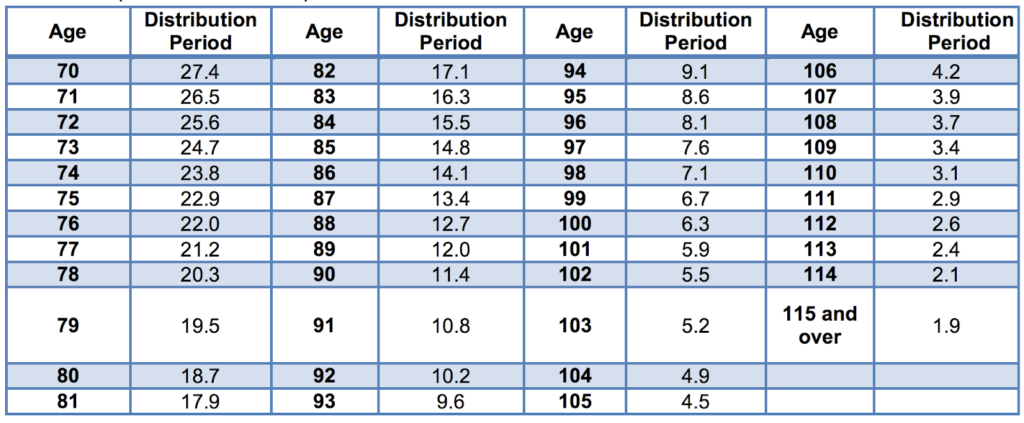

Older people tend to make up most of IRA withdrawals. In 2016, 80% of households owning traditional IRAs taking withdrawals were headed by an individual aged 70 or older. Seventy-one percent of those calculated their withdrawal amounts based on the required minimum distribution (the minimum amount they must withdraw each year in accordance with the IRS’ rules governing distributions). The required minimum distribution (RMD) is the account balance (as of the end of the immediately preceding calendar year) divided by a distribution period from the IRS’ Uniform Lifetime Table (see below). A separate table is used if the sole beneficiary is the owner’s spouse who is ten or more years younger than the owner.

A yearly lump sum

Many believe that affluent individuals tend to take one, lump-sum distribution each year with the vast majority of these occurring in the 4th quarter (October, November, or December). If this is true it suggests that these individuals don’t need the funds to support themselves. Additionally, it suggests that these people are likely to consider making a qualified charitable distribution (QCD) to avoid paying income tax on the RMD (since it will increase their adjusted gross income while a QCD transferred directly to a charity will reduce their adjusted gross income). They also might appreciate the fact that a QCD will likely simplify their tax returns.

Yearly QCDs could become habitual

Once a supporter recognizes the benefits of making QCDs, they are likely to continue them each year. Suppose, for instance, a supporter has been writing a check or donating online to an organization every year in the fourth quarter. Once they realize they can make a QCD, there’s a good chance they’ll switch to that method each year going forward, possibly resulting in much larger end-of-year gifts. Plus as the IRS’ calculations increase the amounts of their RMDs each year, the amount of their QCDs are likely to increase as well, ensuring that everyone wins (except Uncle Sam).

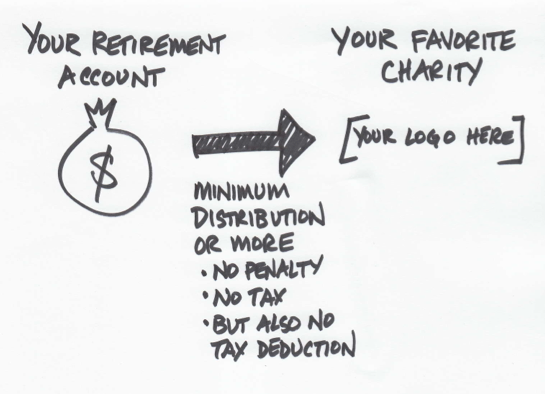

Rolling over up to $100,000 at one time

Since the U.S. Congress made the IRA Charitable Rollover permanent, individuals who are age 72 or older can donate up to $100,000 from their IRA each year (plus $100,000 from their spouse’s) as a qualified charitable distribution without having to recognize it as income.

Want to learn how MarketSmart can help you generate more Rollover IRA dollars quickly?

Learn MoreDonating more than $100,000 each of the IRA will likely cause the additional amount to be treated as ordinary income resulting in income tax to the donor. Remember, when the funds were put into the account a tax deduction was available because the funds were originally meant for retirement, not charity. Changing this paradigm by giving more than the allowable amount to charity will likely trigger a reversal in the tax benefit that was originally taken.

Having said that, the amount of the income tax could be offset by taking a deduction that might be allowed for giving the money to charity. But there could be limitations to this and any donor will probably need a calculator and/or a good CPA to determine the real benefits or penalties. Still, some might elect to give $100,000 each per year from their IRA(s). Finding those supporters could result in impactful gifts to support a cause.

Gifting an IRA by beneficiary designation

Instead of giving the IRA to a charity during their lifetime, a supporter could decide to designate the charity as a beneficiary of their retirement account. That way the donor and their estate will not owe income taxes on the amount during their lifetime yet the amount will be included in their taxable estate. This usually only matters if they have a humongous estate (worth $11.2 million or more).

Marketing for IRA Rollovers

Why donors like Rollover IRAs

- Giving away the money they saved helps them feel good when they make a gift to support a cause they believe in;

- Many people over 72 years old find that they do not need their IRA funds to support themselves, so they might find themselves taking one, lump-sum required minimum distribution (RMD) each year (usually in the 4th quarter). Instead, they could make a qualified charitable distribution (QCD) to avoid paying income tax on the RMD (since it will increase their adjusted gross income). Then the QCD transferred directly to charity will likely reduce their taxable income, thereby lowering their taxes;

- They also might like the fact that a QCD will probably simplify their tax returns;

- Getting their ‘custodian’ (the institution responsible for safeguarding their financial assets) to transfer the funds is relatively easy (although it should be easier!);

- Plus giving a QCD might make them happier because their yearly gift from their IRA is likely to be larger than their usual end-of-year donation by check or credit card. And, they can even give up to $100,000 annually per person so they can feel good knowing they are doing more to support a cause in which they believe.

- And, leaving the IRA to a charity as a beneficiary in their estate plan is pretty darn easy and could reduce their taxable estate (if they need it to be below $11.2 million) while doing so might entitle the supporter to benefits you afford only to legacy society members.

Why fundraisers like Rollover IRAs

- Qualified charitable distributions (QCDs)

- Marketing for IRA rollovers can lead to QCDs that may be much larger than a supporter’s regular yearly (annual fund) donations;

- QCDs could be ‘gateway’ gifts leading to larger major gifts during the supporters’ lifetime or a bequest (assuming the fundraisers build relationships with the QCD donors);

- Legacy gifts by beneficiary designation

- The charity could get to keep what remains of the IRA when the donor dies if the charity is the sole beneficiary (although keeping a portion and splitting it with heirs is usually not so bad either);

- IRAs tend to hold hundreds of thousands of dollars and continue to grow. Therefore IRA gifts to charity by beneficiary designation tend to be quite large.

Inside the mind of the Rollover IRA donor

When marketing for IRA rollovers it’s important to recognize that donors want to support the causes they believe in because giving makes them feel good. But usually there is too much ‘friction’ involved in giving. Plus, in the case of an IRA, friction could arise because many don’t know that they can give their IRA money to charity, nor do they understand how to do it and the benefits they’d enjoy.

With an IRA rollover gift they could avoid paying hefty penalties they might encounter if they forget to take the RMD entirely in any given year. Plus, by giving IRA money away as a qualified charitable distribution (QCD), they could avoid paying tax on the required minimum distribution (RMD) or the increase it will add to their taxable adjusted gross income . This is a great benefit in addition to the fact that making a QCD gift could make their tax filing easier!

Additionally, since so many might feel they don’t need the funds to support their living expenses (as much as they might have originally thought), giving a QCD might make them happier. And, they might even end up wanting to do it each year (usually in the fourth quarter) so they can increase their yearly gift compared to a low-dollar end-of-year donation they might habitually make. In fact, MarketSmart we have been hearing from customers that many older monthly donors are canceling their monthly giving ‘subscriptions’ and replacing them with much larger QCD gifts, thereby upgrading low-dollar donors to become major donors and/or legacy gift prospects (potentially by beneficiary designation at the very least).

Of course, if they decide to leave the IRA to a charity as a beneficiary in their estate plan, that might make them feel even more satisfied while also potentially entitling them to benefits afforded only to legacy society members by an organization or institution.

Clearly there are a lot of benefits to QCDs. But, too often, supporters don’t make QCDs or change their beneficiary designations simply because of the friction involved including:

- No knowledge about the opportunity;

- No reminders about the benefits and gentle prodding to take action;

- Confusion about how it works.

It’s really pretty easy! Getting their ‘custodian’ (the institution responsible for safeguarding their financial assets) to transfer the funds and changing their beneficiary designation is not hard at all. Although, it does require some time and effort. Friction!

Marketing for IRA rollovers strategy: Start with the end in mind

Too often marketers/fundraisers dive into tactics prematurely resulting in lost time and money. They tend to get busy focusing their efforts on tactics without clear objectives. If only they would sit down and determine their goals first they’d save themselves and their organizations a lot of aggravation and cash. When marketing for IRA rollovers, we need to take our time and be pragmatic.

Suggested goals for charitable IRA rollovers

- Generate a certain number of QCD gifts reaching a monetary goal.

- Generate a certain number of highly qualified leads (donors with desire to take action) so outreach efforts can be undertaken by fundraising staff to support the building of relationships and the closing of QCD gifts on a 1-to-1 basis.

- Generate a certain number of additional leads that might be somewhat less qualified and only interested in gaining knowledge at this time. For these leads, you will need to supply them with information that is likely to inspire them to move themselves forward in the consideration process as they recognize the value of the QCD opportunity, build desire for making the QCD gift, and encourage them to make the QCD gift each year, request your assistance, and possibly change their IRA’s beneficiary designation to include your organization or institution.

- Build awareness among older supporters for the concept of giving some or all of their IRA away now or after their lifetime.

Hi-quality leads vs. low-quality leads

When donors make their decisions on their own, that’s great because it saves the organization the cost of facilitation (which involves fundraising staff time and effort). But in that scenario, the gift officers don’t get opportunities to build relationships that could result in more giving. So, although ‘touchless’ giving is great, highly qualified leads might be better. Plus, the higher the quality of the leads, the more easily and faster they will close— thereby optimizing staff costs.

Keep in mind that it is harder to generate highly qualified leads than leads with lower levels of interest or to simply ‘build awareness’. Thus, if the goal is to generate highly qualified leads, fundraisers should prepare themselves and others for much lower response rates.

Want to learn how MarketSmart can help you generate more Rollover IRA dollars quickly?

Learn MoreIf, on the other hand, a more measured approach to marketing is taken, it might be wise to generate more leads by widening the net (usually with offers and creative that lower the barrier to entry into the consideration process). Doing so will also build awareness as the approach will appeal to more people and result in more leads overall (hi and low quality). Those leads can then be cultivated over time to help supporters move themselves through the consideration process on their own.

Therefore, when thinking about setting goals for marketing rollover IRAs, consider the following:

- Is there pressure from leadership or the board to close gifts fast?

- Are you willing to sacrifice lead quantity in order to gain lead quality?

- Can you take a more measured approach that widens the funnel and attracts more leads that are less qualified knowing that you will cultivate them properly over time to ultimately close more gifts yielding greater ROI from your marketing investment?

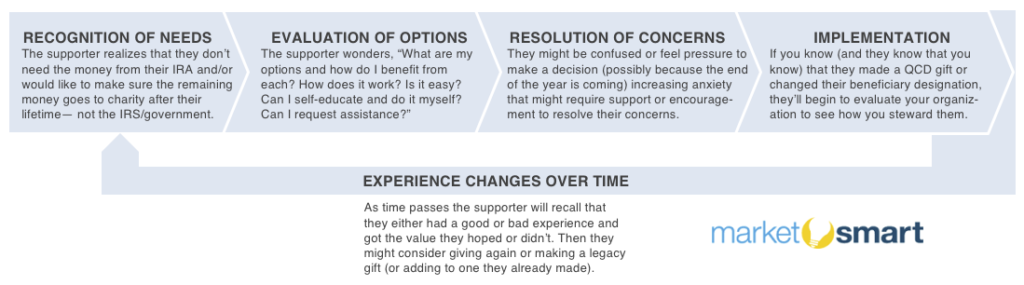

The donor’s consideration process

First the supporter might recognize that they have a need when they realize that they don’t need the money they saved for retirement using an IRA. Plus they might feel they have a need for a tax deduction and/or for a way to give (or give more) to support your cause.

Next, as they become more interested, they might try to educate themselves and evaluate their options so they can determine the value they could receive.

Then, as their desire builds, they might begin to feel pressure (especially toward the end of the year) and could feel that they need help resolving their concerns before making the final decision and signing on the dotted line. It is especially important that an organization help reduce friction at this stage of the process to ensure that the rollover occurs.

After they take action, your donor will likely evaluate the organization’s implementation (stewardship) process. If your stewardship is poor, they might decide to give their QCD to another organization the following year.

And, finally, they are likely to experience changes over time that might lead to a new stage of need recognition. Hopefully they’ll feel satisfied with how you supported them during the resolution of concerns and implementation stages. If so, they may form a habit of making a QCD gift year after year. And, they may even consider leaving all or a portion of their IRA to support your mission as a bequest.

Direct marketing basics

Too often marketers/fundraisers spend too much time deliberating about the creative aspects of their direct marketing even though it is the least important component of any outreach approach. In fact, we have found that an ugly design with the right offer sent to the right audience (list) tends to beat a beautiful, witty, creative package sent to the wrong list with a weak offer every time. In other words, if your list is bad and your offer doesn’t resonate and provide value, it won’t matter how creatively you designed your outreach and how good the timing is. That’s why MarketSmart recommends you only spend about 5 percent of your time and money on the creative component of your direct marketing efforts.

First and foremost, what makes marketing work is a qualified list. It’s the most essential component for success. Therefore, we recommend you spend about 60 percent of your effort making sure you have a great list.

If you are subscribed to MarketSmart’s System, we suggest you sort your donor survey responses to identify supporters who stated that they are interested in a making a QCD gift, that they are considering making a QCD gift, or that they have already made a QCD gift in the past to support your cause.

After that list is pulled, a quality offer will be needed to help encourage supporters to lean in and qualify themselves. We recommend you spend at least 20 percent of your time and energy developing offers that draw people in to engage. The best offers will be highly relevant and provide tremendous value in the form of good feelings, convenience and benefits.

List

When pulling your list for a rollover IRA marketing effort, consider the following:

- First focus on previous IRA rollover donors:

Most organizations that have received rollover IRA gifts in the past have pretty happy customers/donors, making that group the best for marketing outreach. Many will have benefited (enjoyed value) from the last transaction and will have had a satisfactory giving experience. Some might even have made those gifts anonymously but later informed you of their previous decisions only after taking a donor survey. No matter how you learned about their past gifts, we recommend you focus your marketing dollars and efforts primarily on previous IRA rollover donors because:

- They have already educated themselves about rollover IRAs.

- They have already experienced the benefits of rollover IRAs.

- They are likely to be very accepting of your marketing outreach;

- They might recognize that they have additional needs but probably will not need to spend much time evaluating their options and will not need much assistance resolving their concerns.

- If they only gave a QCD that equaled the minimum distribution amount, they may not have realized that they could give up to $100,000 (per person — husband and wife) per year OR leave the remaining funds in the IRA to charity by beneficiary designation.

- New rollover IRA donor prospects (in order of priority):

- Survey respondents (verbatims) – If you previously learned that a donor was considering or likely to consider making a QCD gift (perhaps using MarketSmart’s donor survey System), we recommend you focus your efforts on those leads as your next highest priority (especially if they are old enough to benefit from a rollover IRA or nearing that age).

- Tracked supporters (digital body language) – After that group, we recommend you focus your efforts on supporters who have clicked your online pages associated with rollover IRAs. Of course, you will need either MarketSmart’s or another provider’s digital tracking software to determine who (by name) is clicking on those pages.

- Age – Next, after tracked engagement (digital body language) and survey response (verbatim) data, age is the most important field to consider.

- Board members – Offer the rollover IRA option at your next board meeting to board members over the age of 72. Many will not have realized they could give from their IRA and, once they learn about the benefits, they will be thankful for your suggestion.

- Volunteers – Quite often, volunteers are older and willing to consider a rollover IRA gift too. So be sure to include those over 72 in your list and promote the giving option to them in your volunteer communications.

- Further refinements – Look for the following characteristics to group your prospect pool together:

- Evidence of retired status (for instance, we might ask in our survey or other lead generation forms if the supporter is employed or retired in subtle and/or direct ways);

- Faithful donors and loyal constituents making annual gifts less than $100 and/or subscribing for membership, season tickets, etc. (although, of course, loyalty is probably the least important data point).

NOTE: Absent any verbatims or digital body language, age is really the next best data point to use when pulling a list.

Offer

You can’t just ask supporters to give from their IRAs. That would be like asking them to get married on the first date. And besides, giving money away is not easy for most. Plus, rolling over an IRA or making it part of an estate plan is not an impulse decision. Rather, it is a highly-considered concept and potential QCD donors will seek to educate themselves in a low-pressure, safe and convenient environment as they ask themselves:

- How does this work?;

- What’s in it for me (what are the benefits)?

- How can I make a greater impact?

- How can I feel good?

- How do I win?

- How do I take action?

- Will anyone help me (if needed)?

To help your supporters make determinations about QCD gifts, it is best to provide opaque offers. That way they only see what is right in front of them and they don’t have to worry about making a big leap. Instead, they get a chance to lean-in and explore the concept safely, without worrying about making a final decision right away.

Opaque offers make certain that we don’t push too hard too fast. Instead, we help supporters educate themselves safely and conveniently as their engagements with those offers help fundraisers qualify and prioritize them for outreach (so only the most interested supporters get contacted). In other words, opaque offers deliver value in line with your donors’ consideration processes. They are like sugar that helps medicine go down more easily at just the right time.

If you’re doing it right, an opaque offer will serve to:

- Generate highly qualified leads among supporters already in the desire stage.

- Generate interest (less qualified leads) among those who might already know about giving from their IRA but had not seriously considered the opportunity yet.

- Build awareness among those who were previously unaware that the opportunity existed.

Remember, your offers should seek to draw engagement among people who:

- Don’t need the money they saved for retirement using an IRA;

- Would like to find a way to give (or give more to make greater impact) to support a cause they care about now or after their lifetime;

- Might like to benefit from a tax deduction;

- Would benefit from doing something to prevent a penalty before the end of the year (either by taking their required minimum distribution or making a qualified charitable distribution).

Offer information online using a microsite

MarketSmart recommends offering rollover IRA donor prospects an online microsite so they can educate themselves no matter where they reside along the consideration continuum. That microsite should be designed to:

- Help supporters learn more, move themselves forward in the consideration process, ask for assistance, or take action on their own;

- Generate leads for you and your fundraising staff;

- Qualify and prioritize the leads so you spend most of your time with the best leads.

The microsite might include the following:

- A free report (the title could be, for instance: How to Turn Your Unneeded Retirement Savings Into Impact or How You Can Make the World a Better Place with Unneeded Retirement Savings.

- An instructional cheat-sheet or checklist that shows supporters the simple steps to get the job done.

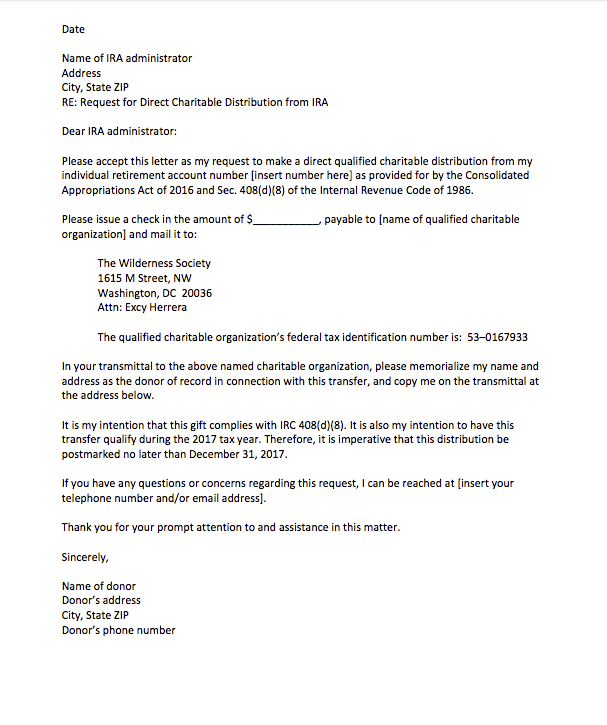

- A downloadable sample letter template that can be altered and sent to a fund administrator (here’s The Wilderness Society’s sample letter available on their website for download and customization).

- A frequently-asked-questions (FAQ) tip-sheet that might include the following:

- What is the QCD limit?

- An individual 72 or older can transfer up to $100,000 annually from his or her IRA directly to an eligible charity. For married taxpayers, the QCD limit increases to $200,000, as each spouse can transfer up to $100,000.

Tip: There is no carry forward provision. Each year, the limit is a maximum of $100,000 regardless of whether a QCD was used in a prior year.

- An individual 72 or older can transfer up to $100,000 annually from his or her IRA directly to an eligible charity. For married taxpayers, the QCD limit increases to $200,000, as each spouse can transfer up to $100,000.

- How do QCDs affect RMDs?

- The QCD can satisfy an RMD for the year, but, again, it is capped at $100,000.

Which retirement plans are eligible for QCD treatment?

QCDs are available from IRAs only. QCDs are not available from employer-sponsored plans (e.g., 401(k), 403(b), 457(b) or TSP). In addition QCDs are not eligible from active SEP and SIMPLE IRAs.

Tip: There is also a special rule for those IRA owners who have accumulated nondeductible (aftertax) dollars. A QCD is deemed to come first from the pretax portion of an individual’s IRA, instead of from pretax and aftertax funds proportionately. In other words, QCDs are not subject to pro-rata distributions rules.

- The QCD can satisfy an RMD for the year, but, again, it is capped at $100,000.

- How does an individual donate QCD assets?

- Payment must be sent directly to a public charity via a trustee transfer. Notably, the proceeds can be mailed directly to an IRA owner—as long as the check is made payable to the qualifying charity, not to the IRA owner. If the check is made out to the IRA owner, the donation would not qualify as a QCD.

- Additional QCD rules to consider are:

- QCDs are not included in taxable income.

- QCDs do not qualify for a charitable deduction. However QCDs satisfy RMDs without increasing adjusted gross income, thus lowering or eliminating Social Security benefit taxation, Medicare premiums, alternative minimum tax, 3.8% investment surtax and medical expense deductions, or being bumped into a higher marginal tax bracket.

- QCDs can be taken from an inherited IRA however, the beneficiary must be 72 or older.

- Roth IRAs, although QCD-eligible, generally aren’t appropriate. Roth IRAs have no lifetime RMDs. In addition, only taxable funds can be used for QCDs. A majority of Roth distributions will be tax free—there’s no (tax) benefit to donating previously taxed funds.

- Donor-advised funds and private foundations do not qualify for QCD treatment. Instead, the proceeds must be sent to a public 501(c)(3) charity.

- What is the QCD limit?

- A reminder widget they can click so they can put a reminder on their calendar;

- A way to share the information with a loved one or friend.

- Another similar share tool so they can let their tax preparer know that they made the QCD (so they remember when tax time comes around).

- A quiz to help them decide if this kind of gift is right for them.

- A direct phone line, chat tool or email link that will get a message to a gift officer.

- A brief and easy-to-understand explainer video.

- A simple explainer graphic.

Of course some of these items might be ‘gated’ (requiring an email address for download or access) so you generate leads. While others should be easily accessible, with no ‘friction’ whatsoever.

IMPORTANT POINTS: Help people do it on their own by including the following points.

- It is essential that the contribution be made directly from the IRA to the 501(c)3 organization, without passing through the donor’s hands at all.

- The donor may not make the IRA charitable gift to a foundation, donor-advised fund, or supporting organization. It must be made directly to a charity.

- The donor will wonder about ‘proof.’ So, the organization’s microsite should make clear that they will craft a specific acknowledgement for receipting purposes, detailing the account from which the gift was made (i.e., the financial institution on the check) and acknowledging the donor as having directed it from that account.

Timing

Remember, the QCD rollover IRA charitable giving option will appeal mostly to affluent people who feel they don’t need the money they saved. Many will not be focused on the fact that the money is lingering in their account. After all, this audience will be busy, retired and enjoying their lives. Many will delay taking a distribution until the last quarter of the year because of procrastination or because they want the money to grow tax free. But, as the end of the year approaches annually, they’ll remember that they must take their minimum required distribution or they will face a penalty.

It’s annoying to them, for sure! Plus the penalty could amount to a tremendous loss since it’s 50% of the minimum distribution amount they were supposed to take out. And on top of that, they’ll still have to pay the income tax owed on the required distribution amount. So, since their affluence will likely put them in a high tax bracket, they could pay well over 75% of the required distribution amount to the IRS. Ouch!

Want to learn how MarketSmart can help you generate more Rollover IRA dollars quickly?

Learn MoreSo, let’s say someone has $500,000 in their IRA or spread among several IRA accounts. At the age of 72 they’ll have to take out over $18,000 and pay income tax on it. If they don’t do that, the penalty will be around 50% of the RMD or approximately $9,000. Plus they’ll still have to pay the income tax in addition to the penalty. And, there’s no statute of limitations on this. In other words, if the IRS doesn’t catch it one year but they catch it later on, they’ll be forced to pay the penalty no matter how much time has passed.

The penalty is a stinger for sure and, believe it or not, a lot of seniors fail to take their RMD’s. According to Kiplinger, a report by the Treasury’s Inspector General estimated that more than 250,000 people failed to take approximately $348 million in 2006 and 2007. That’s old data so the figures are surely higher today.

Most people simply forget to do it while others get confused because they have so many IRA accounts in several different places, with various banks. Plus they have to do their own calculations to determine the appropriate distribution amount and, as retirees get older, that chore only becomes more daunting.

Provide value, educate, remind, reduce friction

Because of all the reasons mentioned above, clearly it will be important to remind supporters about this giving option and what could happen if they don’t take their RMD. Therefore we recommend a 5-touch-initiative starting each year in late springtime.

- May – Learn about making a gift from your IRA or If you didn’t take advantage of it last year, perhaps try it this year.

- Aug – Testimonial or learn how it works with this explainer video / report, etc.

- Oct – Do it now version A

- Nov – Do it now version B

- Dec – Do it now version C (by 1st week of Dec to allow the custodian enough time to complete the transfer by the end of the year)

Creative

Although creative is less important, the components involved in developing your creative must still be understood. They might include:

- Goal review;

- Conversion selection;

- Marketing channel selection;

- Copy and design development;

- Conversion optimization;

- Support option selection.

Goal review

The first step in the development of your creative is always to refer to your goals. If you aim to only generate highly qualified leads that are likely to take action soon and want to work with a gift officer on a donation, you will want to develop creative that focuses on asking people to contact you. But, we do not recommend that strategy because it will likely result in very few leads. Instead, we recommend setting a goal of generating both high- and low-quality leads while also helping donors take action on their own.

Conversion selection

Conversions are points at which donor prospects take action to move themselves forward in the decision-making process. Inline with the goal of generating highly qualified leads that are likely to take action soon, we recommend encouraging donor prospects to convert by:

- Filling out a form requesting a free report;

- Downloading an instructional cheat-sheet or checklist that shows the simple steps to get the job done;

- Downloading a sample letter template that can be altered and sent to a fund administrator (here’s The Wilderness Society’s sample letter available on their website for download and customization);

- Downloading a checklist;

- Viewing an explainer video;

- Employing a calendar reminder widget;

- Calling a gift officer;

- Emailing a gift officer;

- Sharing the information with a loved one or friend.

It is important to recognize that supporters will feel more pressure when asked to convert using some of these options. They know that they signal to you and your staff that they are interested in taking action soon, making them highly qualified. If they are not ready for that level of engagement, they may decide to take no action at all instead. That is precisely why marketing efforts designed to generate more highly qualified leads result in fewer conversions. It is also why we recommend offering other options that involve less pressure and align with where most supporters reside in the consideration process, since it is unlikely that most will be ready to take action precisely when they receive your outreach.

Copy points to consider including:

Headlines

- Have your IRA retirement investments and savings grown beyond your expectations, exceeding your needs?

- Forced to take a required minimum distribution (RMD) from your IRA and don’t need the income?

- Don’t need your IRA retirement savings as much as you once thought you might?

Benefit statements

- QCD gifts count toward satisfying the amount of money you must withdraw each year according to the IRS’ required minimum distribution (RMD) rules.

- The amounts distributed as a Qualified Charitable Distribution (QCD) each year can be excluded from your taxable income, thereby reducing the amount of tax you must pay.

- It might also decrease the amount of Social Security that is subject to tax and could potentially lower your Medicare premiums.

Perhaps a better way to say all this is as follows:

QCDs always deliver tax benefits while ‘regular’ charitable donations might not. The Qualified Charitable Distribution (QCD) amount you decide to give will count toward your Required Minimum Distribution (RMD). In other words, you can arrange to donate all or part of your RMD (up to $100,000 per individual). Keep in mind that you would otherwise be forced to pay tax on the RMD amount. Plus, the QCD amount can be excluded from your adjusted gross income (AGI) each year while other charitable donations might not. So a QCD is a good way to reduce your tax burden annually.

For example:

Let’s suppose you are married, both you and your spouse are over 72 years old, you fall into the 24% tax bracket, and together you have an annual required minimum distribution (RMD) of $24,000. Instead of taking the RMD and paying tax on the income, as a couple you can instead direct $10,000 of the $24,000 to charity as a QCD. By doing so, you will reduce your taxable income by $10,000 and you’ll still get to claim the same $26,550 standard deduction allowed by the IRS. In this case, by using this strategy, you will have saved $2,400 in federal taxes alone ($10,000 X 24% tax bracket = $2,400) — and potentially more in state tax savings.

Quizzes

Take The Quiz: See if a QCD is right for you

Yes / No Are you over 72 years old?

Yes / No Do you have a spouse?

Yes / No Is your spouse over 72 years old?

Yes / No Will you be itemizing deductions this year

Yes / No Do you feel that you do not need the money you saved as much as you once thought you would and, therefore, would be financially secure after giving some of it away?

Etc, etc…

[After they hit ‘SUBMIT’ an answer pops up letting them know if they should consider doing it or not.]

Marketing channel selection

Since nonprofits usually need to market rollover IRAs with a hyper-targeted approach, direct mail and email would seem to be the best options. But, if your budget is lean, email and other digital channels might be the most cost-effective options for you. Although, it is important to remember that the value of a rollover IRA gift and/or beneficiary designation bequests is likely to be exponentially greater than other any other donations you receive. Therefore, you might consider investing more in marketing rollover IRA gifts because your return on that investment could be 10:1 or even 100:1.

Also, it is important to realize that email is not how most people are accustomed to seeing financial marketing. Therefore, you must prepare yourself, your team, and your leadership for somewhat low email open rates, click-thru rates, and conversion rates. Educate them about the fact that people make financial decisions slowly and infrequently. These are not impulse decisions. Rather, they require inordinate amounts of consideration and evaluation.

Plus, engagement and response rates are vanity metrics. It might make you or your leadership feel good to see lots of clicks. But it is essential that you stay focused on the potential for huge returns on your marketing investment and the goals you set when you began the initiative.

Also, you might want to consider digital advertising aimed at older people who ‘like’ your Facebook page or digital retargeting ads. Digital channels could be a great way to support your direct mail and email efforts.

And, lastly, try placing advertisements in your organization’s publications to support your direct mail and email efforts too.

Here is a list of channels we suggest you consider:

- Although direct mail is more expensive, sending letters is a good idea (since most of these donors will be older and likely to be responsive to traditional direct mail);

- Send emails too but be sure to segment your list so you’re not sending irrelevant messages to people that can’t take advantage of this opportunity.

- Headers, buttons or pop-ups on your website

- Retargeting ads

- Social media posts and ads

- Ads in your organization’s publications

- Signage at events and board meetings (especially where older legacy society members or volunteers are present)

Copy and design development

Since most donor prospects will not take action right away by making a QCD gift on the spot, the communications should focus primarily on enlightening and reminding them. The best way to do that is with education-oriented content that helps them make sense of the complex and sometimes confusing topic.

People generally appreciate assistance in the form of information and illustrations. Think of your marketing as a gentle guide or counselor, helping facilitate the education process as your donor prospects moves themselves through the consideration process. That will engender trust.

If you have special initiatives, projects or programs that you know your donor prospects might want to support (as a result of their verbatims or digital body language found in your dashboard), consider mentioning them. For instance, you might want to highlight specific naming opportunities, building needs, etc.

Do not over-explain and confuse your donor prospects with jargon and legalese. Make sure your focus is on helping them, not talking down to them. In fact, make yourself the resource for assistance if they want to engage 1-to-1. Encourage them to call or email you, especially as the yearly deadline approaches.

Conversion optimization

Conversion optimization is all about reducing friction for your donor prospects. Once we have helped a donor prospect become interested, it is essential that we make it easy for them to take action. The best way to achieve this result is to examine the steps required for conversion and then remove friction at every point.

It goes without saying that landing pages, emails, and direct mailers should be clear and absent clutter. Eliminate confusing images and make sure the words you select make sense. Use large fonts. Always omit needless copy and delete fluffy sentences that sound introductory in nature, seemingly designed to set the stage for your pitch. They only serve to ‘clear your throat’ before the presentation of what you really want to say. And, they bore recipients driving their attention away before they get to the core of your message. Avoid overly clever subject lines. Donor prospects don’t want to play games and solve riddles.

Also, recognize that hardly anyone reads marketing communications. Everyone skims. Therefore, you should employ bolding, underlining, and even highlighting (usually in yellow) to help the recipients of your messages graze over your them first to get the jist. If you help them do what comes naturally, they’ll take a second look. Making them read every word and every line will force them to work too hard and encourage them to decamp promptly.

Support options

If you’ve removed enough friction and captured your donor prospects’ attention for more than a second or two, you will likely need to support their decision to take engage further and finally make the gift. When marketing rollover IRAs, one of the best support mechanisms we have employed is the testimonial. Social norms are powerful influencers. People like to see that others have done what they are considering.

Testimonials reduce friction because they provide your donor prospects with comfort in knowing that they’ll be ok if they move themselves forward. Use them but be sure yours are from real people. It’s important to always be honest with your supporters. Never lie or mislead them or you might get outed by the media. For example, in 2009 Forbes Magazine wrote an article about a planned gift marketing company that acknowledged that the name they used in most of the promotions they placed on hundreds of websites developed for their customers, Valerie Green, was completely made up. The CEO said at the time that the details were based on reality yet he revised the pages quickly.

Acquire that lead

After your prospective donor understands your message and has gained comfort from your support mechanisms, it’s time to acquire the lead. At this point it is essential that you give supporters as many options as possible so they can move themselves forward in a way that suits their needs.

Remember, it’s about them, not you or your organization. Make it easy, convenient, and comfortable and you’ll acquire more leads. Try to pigeon hole your donors into only one conversion option and you’ll lose those that find what suits you to be unappealing or worse, disagreeable.

Here is a list of conversion options we recommend you include in all of your communications to reduce friction both online and offline:

- Contact information – Provide your direct email address (not info@), direct phone line (not a switchboard), and you might even consider including your LinkedIn URL and Twitter. Remember, it’s all about them. Some supporters prefer communicating via Twitter. So why not open up that line of communication?

- Reply via email – Some donor prospects will want to simply reply to your email. Let them reply directly to you, not to info@.

- Reply forms and envelopes in direct mailers – Sending a direct mailer with a response form and envelope implies that you seek a response. To reduce friction, make sure the form is easy to tear off and fits into the envelope you provided.

- Online forms and buttons – Make the forms and buttons on your landing pages and microsites clear and easy to use on smartphones, tablets, and computers. Remember that your supporters might have ‘mature’ eyes and arthritic fingers. Be kind by making your fonts big, your forms even bigger, and your buttons easy to find. Plus, we recommend placing the form so it begins above the fold so your donor prospects don’t need to scroll down to find it.

- Online chat tools – If your donor prospects have questions, they’ll want them answered instantly. Online chat tools provide convenience and amazing customer service (donor service) precisely at the make or break point in the conversion process.

CAUTION

- Top 4 things you should know about marketing Rollover IRAsLow-pressure engagements work better – Larger gifts are usually highly considered, not impulse decisions. Therefore, fundraisers and their leaders must understand that their marketing strategies and tactics be patient, polite, and persistent. Pressuring supporters is akin to yanking the line too hard too early in the process, causing the ‘fish’ to be lost.

- Expect low response rates – Most supporters that are likely to consider a rollover IRA gift are smart. They will be perfectly capable of educating themselves. So your goal should be to guide, help and make yourself available to them. But doing so might disappoint some staff or board members. They might want to see a high response rate. If that is the case, they should read this guide and recognize that the amounts donated (and bequeathed) from rollover IRAs is usually much greater than amounts raised from regular ‘annual fund’ donations. Fewer leads is not a bad thing if the gifts are large.

- There is no silver bullet – Many fundraisers hear success stories at conferences or read about them on blogs. But rarely do they get to examine the real results. Too often they are myths or highlight reels focusing solely on an organization’s successes without mentioning the failures that preceded them. Don’t be fooled or misled. There is no silver bullet and, since their list is different from yours (and that’s at least 60% of what makes a marketing effort successful), what has worked for one organization is highly unlikely to work for yours. Simply stated, be careful when you hear water cooler stories you cannot verify.

- Testing is the key to success – In marketing, the absolute truth can only be determined through testing. Yet, unfortunately, most nonprofits don’t have the time, patience, and funding required to test what works and doesn’t over a long period of time. So, they try one-size-fits-all strategies and tactics or swing the bat only once hoping to hit a home run on the first try. At MarketSmart we recognize and understand the pressures fundraisers face. But we must be vigilant and stand firm reminding them that testing is the only pathway to success. Therefore, we recommend fundraisers test our recommendations thoroughly with different audiences (lists), different offers, varied timing, different creative. But even once you think you determined what works, remember that moving objects (donor prospects) change over time. So what might work now is definitely not guaranteed to work later.

Want more content like this? Get our weekly newsletter!

The information in this guide is not intended as tax, legal or financial advice and is provided on an “as is” basis with no guarantees whatsoever. Any marketing actions you take are strictly at your own risk.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!