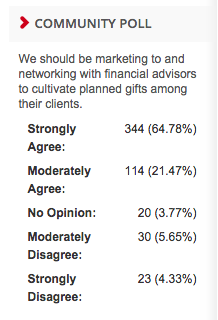

I stumbled on the following poll that left me scratching my head. Why do so many PG folks “Strongly Agree” that nonprofits should be “marketing and networking with financial advisors to cultivate planned gifts among their clients.”

I stumbled on the following poll that left me scratching my head. Why do so many PG folks “Strongly Agree” that nonprofits should be “marketing and networking with financial advisors to cultivate planned gifts among their clients.”

What do you expect to happen? How would the conversation go? What’s in it for them? How would the client feel about having a donation to the financial advisor’s recommended charity even be suggested? If I were the client, I’d object vociferously.

Just because financial advisors are talking to your donors doesn’t mean they should be cultivating gifts for you among their clients. Therefore, I think this is a fundraising unicorn! I think it’s a silly idea.

It’s not the financial advisor’s job to cultivate planned gifts that will benefit your charity among their clients. Instead, that’s your job! And besides, many advisors feel that doing so would be a conflict of interest.

If you have figured out how to get financial advisors to recommend your charity for planned gifts, I’d love to hear how you did it.

LIKE THIS BLOG POST? PLEASE SHARE IT AND/OR SUBSCRIBE

I respectfully disagree with you. Planned giving is all about planting seeds. You never know when the seed will sprout. Estate planning attorneys, financial advisors, and even insurance agents all sit in front of potential or existing donors. Why would we not want those advisors to know about our charity, our role within the charity, and how we can be of service to their clients? There is not another group of professionals whose sphere of influence touches so many of the donors we want to work with.

In a former life I was an estate planning attorney. I think most people would be shocked to know how many clients asked me what charities I’d recommend supporting and/or what charities other clients supported. Many of these donors have not done research on their own and they lean on their already-trusted advisor to give them suggestions. I always gave my clients a list of charities to think about and research on their own, but if I knew of someone that I trusted who worked at a nonprofit I believed in, why would I not make that one of my suggestions? If a client asked me for my opinion and I gave them a list to choose from, I never saw that as a conflict of interest.

I frequently meet with the advisors I mentioned above and let them know about our charity. I do not expect them to do my work for me and I have never once had an advisor tell me to go away. I just want them to have the knowledge about my charity to recognize an opportunity if it ever arises, and then to invite me to the table if the client allows.

I don’t know when the seed will sprout, but it will never sprout if I never planted it.

Thank you, Greg! Your article hits home. Financial Advisors are usually never willing to recommend one charity over another. The only reason to connect with Advisors for the charity I work for is to ensure that the Advisors get the legal name of our charity right, which they often don’t. I like Jennifer Donovan’s mention of also taking the opportunity to engage them in our organization and then cultivate them as potential donors themselves.

Greg W.,

In our field there are exceptions to just about everything. With cultivation of professional advisers leading to gifts, community foundations of all stripes fit the bill. Quite often the client isn’t sure what to do in a tax situation, combined with a passion about a given charity, or maybe even a nonprofit sector. Enter the community foundation which can offer expertise on where to donate funds, among other things. It’s a bit more complex than I present it here, but you get the general idea.

Still, I agree with you that so many of our colleagues overvalue marketing to the professional adviser community. Sure, organizations with full time legacy giving staff can put a bit more effort into this. And all organizations should send “welcome” letters with appropriate enclosures to advisers with whom the come into contact, either in person, or through a supporter or estate situation. Flag the records. Send a postcard to your advisers every year or two thanking them for their service to aiding nonprofits and reminding them of your existence. Once in awhile there will be an intersection between an adviser’s client, and your nonprofit.

However, this level of program work is third or fourth tier. There are many other things your nonprofit should have in motion marketing-wise before venturing into the adviser community beyond the general “welcome” letter.

And while I’m at it, if an organization is not making one-on-one, in-person legacy asks, outreach to the adviser community is another excuse getting in the way of talking directly with supporters.

My charity has an advisory board composed of lawyers, financial planners, and associated professionals. We educate the members about our mission and needs and hope but do not expect that they will share this information with their clients and peers when possible and appropriate. Many of them are also trustees or DAF advisors, so some direct gifts have come from this relationship to us. As the other commenter noted, it is about engagement and should not be the primary focus of our work, but one way to get the word out further and sometimes to supporters we cannot otherwise reach.

Wow! Talk about a “lightning rod”….

Thank you all for your enthusiastic comments. This is terrific!

Greg Lassonde- I especially agree with your comments:

1 – “this level of program work is third or fourth tier. There are many other things your nonprofit should have in motion marketing-wise before venturing into the adviser community”

2- “if an organization is not making one-on-one, in-person legacy asks, outreach to the adviser community is another excuse getting in the way of talking directly with supporters”

Also, I think I should mention that I DO believe that community foundations should be engaging with advisers. But that’s a whole different category. I believe that community foundations exist to serve the advisers, the nonprofits in the community, and the donors.

This conversation is an important one and reminds me of standing in the exact center of the “Four Corners” where the State lines of Colorado, New Mexico, Arizona and Utah meet.

1. Advisors have the ear of our constituents and planned giving concepts may appeal as a financial strategy while also providing an outlet for philanthropic interests. Respected advisors can open the door for us.

2. Short-term success in planned giving isn’t going to happen by focusing time on visiting financial advisors however. Personal interactions with loyal constituents must be our #1 strategy if we’re to fund the future-mission activity of the charity we work for (and assumingly care deeply about).

3. Long-term success in planned giving requires planning and execution that lasts not only through our tenure but well-beyond it. I see it as my legacy to put a systematic program in place that lives beyond my time in the planned-gift officer chair. Relationships with the constituent(s) that are meaningful, direct and involve more one person at the organization are essential to this strategy.

4. Institutional goals for deferred revenue (and possibly endowment growth) won’t be achieved if our main strategy is to focus on gift-officer-to-advisor relationships. This is neither a Tier 1 fundraising strategy nor a sustainable plan.

While each of these “States” is needed to support the “Four Corners” reality – eventually, you have to choose which State you’re going to walk through in order to move along with your plans to raise funds from planned gifts.

I think it’s rare that clients would approach their financial advisor for recommendations of WHICH charities to include in their planning. More likely they would solicit advice as to HOW to incorporate them. Certainly advisors have discussions with their clients about the charitable interests and intents, but I suspect most advisors see their role as helping clients determine how to accomplish their charitable objectives, not determining what their objectives should be.

In the case where multiple donors from a particular cohort use the same advisor, connecting with that advisor couldn’t hurt. And connecting with advisors in general can’t hurt. But as Katherine elegantly says, this is not a Tier 1 fundraising activity.

Ok, weighing in here…

I think there is some merit to “marketing to advisors” in certain cases — but like everything else in this effort to effectively communicate information about PG — it comes down to budget, and how you choose to spend it.

Here’s a case where it might be a good choice for spending some budget; colleges located in areas where a great amount of alumni live. You could reach out to alumni who ARE advisors and make sure they have the info they need to help their alumni clients include the college in their plans. Share info about opportunities for naming a scholarship, etc. Many would be surprised to learn that a named scholarship at their alma mater requires just $25,000. from a bequest or other deferred gift.

So while a poll might show “Yes, we should do this!” it comes down to your budget and what’s the best way to spend your marketing dollars. I feel you should always go “niche” and it’s hard to narrow your audience when your audience is a vast group of advisors with no commonality.

Cheers, Greg, and thanks once again for the lively conversation and forum!

Greg, with all due respect, I think you are speaking of authority on a topic that you do not have experience or researched. When 458/531 who work in the field and have experience with donors and successful gifts agree charities need to work closely with advisors, maybe they are onto something. And I believe you misinterpreted the question. It simply says to cultivate planned gifts – not planned gifts for your own charity. We gift planners often find donors are unaware of the ability to include us in their will, or the benefits of using an IRD asset to donate to charity vs. cash from their estate. What the poll is saying is we need to network with advisors and share that this indeed is possible, to remember to ask their clients if they have any charitable intent when planning their estate, and to be of service to the charity when complicated questions come up that a gift planner might want some quick advice about. I’d recommend running all future articles by Russell James before posting.

Dear “Gift Planner”-

Wow! Oof! So sorry to see that this post angered you so terribly. I hope your day improves soon.

First, I won’t be running all future articles by my dear friend Russell James. That’s just silly.

Second… back to the question: Should gift planners be marketing and networking with advisors to cultivate planned gifts among their clients?

I’ll refer you to Bard Malovany’s response in this thread. He is one of the brightest and most successful financial advisors I have ever met. He is highly respected. And, he backs up my claim. Others on this thread do too.

Third, with regard to Dr. James. His friend’s research in London (not his research) proved that more planned gifts resulted when the British “financial advisor” mentioned that many people include a charity in their plans. So maybe you’re saying that nonprofits need to inspire advisors to do just that? “Marketing” and “cultivating” are fairly generic terms. Therefore, I’m not sure “marketing” and “cultivating” means specifically saying those words to clients.

Fourth, I certainly hope that financial advisors avoid saying those words to their clients because I wonder if they might get sued years later by the children of the deceased who wonder why their dear mom or dad left all of their money to the advisor’s favorite charity.

Fifth, I simply don’t think that this is a “first tier” opportunity to generate planned gifts. But if you have data that proves otherwise, I’d be glad to look at it. I, and my firm, and my relationship with Dr. James… are all about data. We provide our marketing recommendations and make our marketing decisions based on what we know to be true. We test everything we can and we review the data. Our clients will attest to that.

Lastly, if you don’t like my blog (even though I’m simply trying to provide a forum for engaging conversations about marketing planned gifts— oh yeah, and many of my clients would say that I AM an expert in that area) you can always unsubscribe. Or, if you’ll post your name (instead of the anonymous “Gift Planner” title) with the next reply, I’ll be happy to unsubscribe you.

But then you’ll miss lots of great opportunities to learn from Dr. James’ cutting-edge research. As many of my subscribers know… in most cases, we get to present it FIRST because this blog and my groups on LinkedIn have so many subscribers.

I agree with almost everyone’s comments including Greg Warner’s original posting. I particularly like Greg Lassonde’s statement. So, how can I agree with everyone’s position when they appear to be contradictory? Easy. It’s all about balance as Katherine Swank creatively illustrated.

In my book, “Donor-Centered Planned Gift Marketing” (https://www.amazon.com/dp/0470581581/?tag=mlinn-20), I devoted an entire chapter to working with advisors, and wrote:

“A 2008 survey of professional advisors from seven leading financial institutions revealed that ’90 percent of wealth advisors ask clients about their interest in philanthropic planning or charitable giving,’ while 53 percent report ‘always’ raising the issue with clients and 41 percent report that

they only feel comfortable bringing up the subject with certain clients. The nonprofit sector should help the advisor community to: (1) have the most meaningful conversations about philanthropy that are possible with their clients, and (2) help advisors feel more comfortable talking about philanthropy

more often with their clients.

“Just as nonprofit organizations must educate and cultivate the support of prospects and donors, they should also educate and cultivate the advisor community. Doing so will benefit the planned giving program in a number of ways:

–Advisors who are better educated about planned giving can better assist their clients when it comes to philanthropic planning.

–Advisors can generate new prospects and new gifts for organizations.

–Advisors can assist development professionals with complex gift arrangements.

–Advisors can provide educational programs for prospective donors.”

I also outline the six exchanges of value that must be involved when educating and cultivating the advisor community. In addition, I discuss some ways in which nonprofit organizations can work with the advisor community given the maturity of the organization’s planned giving program.

Nonprofit organizations that have the staff and budget resources can certainly benefit from developing relationships with the advisor community. However, developing these relationships should not be done to the exclusion of other, more effective, tactics such as actually talking with prospective donors about making a planned gift. Again, it’s all about marketing balance given the resources of the nonprofit organization.

Incidentally, I think our professional associations can and should do more to cultivate and educate the advisor community. When I was President of the Partnership for Philanthropic Planning of Greater Philadelphia, we implemented a two-day fundamentals of gift planning workshop. A significant number of attendees came from the advisor community so they would be better equipped to work with their clients and the charities their clients support. We also worked to enhance the relationship with our local Estate Planning Council.

Finally, I want to thank Greg Warner for starting this conversation. I understand and share his frustration with the nonprofit sector’s endless hunt for unicorns. Instead of always questing for the latest/greatest fundraising ideas, many fundraising professionals will derive great benefit from simply mastering the basics and actually speaking with prospective donors. Greg is someone who gets it, and I tip my hat to him for generously sharing his expert insights. While I might not always completely agree with him, I most certainly continue to value him as a trusted colleague who informs, inspires, and provokes.

Didn’t Russell James tell us that when the estate planner ASKS, “do you want to leave a gift to a charity” more than 30% say yes, as opposed to the 8% currently leaving legacy gifts? Cast your bread upon the waters–help our professional advisor colleagues realize this is part of the service they should offer–it’s not about marketing YOUR charity, it’s about charity.

Victoria- I believe that study was done with one company talking to their clients in London. It’s not something a firm in the U.S. can do in the same way because it might open them up to lawsuits. Yet, the results are “directional” meaning… Yes! It would be terrific if each individual advisor asked that question.

But here’s one advisor’s opinion on the subject. -> Bard states in this thread: “I think it’s rare that clients would approach their financial advisor for recommendations of WHICH charities to include in their planning. More likely they would solicit advice as to HOW to incorporate them. Certainly advisors have discussions with their clients about the charitable interests and intents, but I suspect most advisors see their role as helping clients determine how to accomplish their charitable objectives, not determining what their objectives should be.”

Fascinating discussion. I just left a luncheon packed with CPAs, Financial Planners and Estate Planning Attorneys. I asked if anyone in the room had ever directed a client to a charity of the professional’s choice because of an existing relationship with the charity’s fundraiser. Some laughed. Most just shook their heads back and forth. I value my relationship with each of those professionals, and most of those relationships have benefitted our organization in other ways. But we do not receive gifts from their clients because of their relationship with me.

Thanks to everyone posting and a great conversation.

Both points of view have merit. As PG professionalls we can’t “depend” on financial advisors to do our job. But they have a place in the cycle of philanthrophy. The better aware and educated financial folks are about our charities the more likely they are to either ask their clients what there philanthropic interests are as well as be ready to respond when asked by their clients to reccommend worthwhile non-profits that they know well.

A few years ago a fellow BOD member from the financial sector I was serving with at a private high school was asked by a client to reccommend charities for their family foundation that his father managed before his passing. After a tour of the school and learning about the programs to help the neediest students, the son now running the foundation gave a $250,000.00 gift.

We need to leverage all of our relationships and resources to initiate as well as build donor relationships.

Happy St. Patrick’s month to all!!!

Let’s keep trying to find that pot o’ gold.

All the best,

Dennis

One of the challenges here is that (as so many have said in one way or another) charities are not all alike. Should a small charity with limited resources spend time and money raising their profile with professional advisors? Probably not. Should a charity with a well-established program show leadership by cultivating relationships with advisors who serve their donors? Probably. There are additional variables that would influence any individual charity’s decision to invest in building awareness of gift planning amongst advisors.

As so often, I defer to Michael Rosen’s elegant ability to parse a problem down to its root: “The nonprofit sector should help the advisor community to: (1) have the most meaningful conversations about philanthropy that are possible with their clients, and (2) help advisors feel more comfortable talking about philanthropy more often with their clients.”

Not everyone can invest the time to do that. But it is essential for the sector that those who can, help everyone out by doing so.

And a final comment: Many advisors are well-versed in helping their clients implement strategic philanthropic plans — but a surprising number are not. There remains work to be done, whoever does it!

Great discussion. I am with Jill and Michael. I make it my business to network with advisors, not because I expect them to solicit gifts for my organization, but because I want to encourage advisors to conduct a philanthropic conversation with their clients, particularly the high net worth ones.

Many will be familiar with Dr. Paul Schervish at Boston College and his research into the motivations of high net worth individuals and the challenges they face in determining how to distribute their wealth. Many of them report a frustration that no one is having that conversation with them. And interestingly, while many advisors report it is they who initiate these conversations with their clients, surveys show that it is the clients who must initiate an in-depth conversation. A disconnect for sure, and an indication we have work to do, as Jill says.

There is certainly value in networking with financial advisors (financial planners, accountants, estate attorneys, etc.)

First, these folks are the experts in their fields and can prove to be a valued resource for the most complicated planned gifting. Having a roladex of area experts, and knowing when to reach out, makes you a better professional.

Second, I agree that working with these individuals to market YOUR cause might be leading down the “conflict road”. However, we have a responsibility as “PG folks” to create an awareness with our financial planning colleagues of the important resources and trends in gift planning as a potential solution to their clients needs.

You may not be seeing direct results of client referrals, but the big picture is more synergy between Estate Planning professionals and their Gift Planning counterparts.

It is possible that a client would ask their advisor to make a recommendation. Since their advisor is trusted, they may rely on the advisor to perform research or provide due diligence. With this possibility, I do from time to time meet with these financial advisors with two goals – the primary being to cultivate them as a potential donor themselves and once they are engaged in our organization, there is a chance they could make a recommendation to a client or a colleague.

Greg, with all due respect, I think you are speaking of authority on a topic that you do not have experience or researched. When 458/531 who work in the field and have experience with donors and successful gifts agree charities need to work closely with advisors, maybe they are onto something. And I believe you misinterpreted the question. It simply says to cultivate planned gifts – not planned gifts for your own charity. We gift planners often find donors are unaware of the ability to include us in their will, or the benefits of using an IRD asset to donate to charity vs. cash from their estate. What the poll is saying is we need to network with advisors and share that this indeed is possible, to remember to ask their clients if they have any charitable intent when planning their estate, and to be of service to the charity when complicated questions come up that a gift planner might want some quick advice about. I’d recommend running all future articles by Russell James before posting.

Dear “Gift Planner”-

Wow! Oof! So sorry to see that this post angered you so terribly. I hope your day improves soon.

First, I won’t be running all future articles by my dear friend Russell James. That’s just silly.

Second… back to the question: Should gift planners be marketing and networking with advisors to cultivate planned gifts among their clients?

I’ll refer you to Bard Malovany’s response in this thread. He is one of the brightest and most successful financial advisors I have ever met. He is highly respected. And, he backs up my claim. Others on this thread do too.

Third, with regard to Dr. James. His friend’s research in London (not his research) proved that more planned gifts resulted when the British “financial advisor” mentioned that many people include a charity in their plans. So maybe you’re saying that nonprofits need to inspire advisors to do just that? “Marketing” and “cultivating” are fairly generic terms. Therefore, I’m not sure “marketing” and “cultivating” means specifically saying those words to clients.

Fourth, I certainly hope that financial advisors avoid saying those words to their clients because I wonder if they might get sued years later by the children of the deceased who wonder why their dear mom or dad left all of their money to the advisor’s favorite charity.

Fifth, I simply don’t think that this is a “first tier” opportunity to generate planned gifts. But if you have data that proves otherwise, I’d be glad to look at it. I, and my firm, and my relationship with Dr. James… are all about data. We provide our marketing recommendations and make our marketing decisions based on what we know to be true. We test everything we can and we review the data. Our clients will attest to that.

Lastly, if you don’t like my blog (even though I’m simply trying to provide a forum for engaging conversations about marketing planned gifts— oh yeah, and many of my clients would say that I AM an expert in that area) you can always unsubscribe. Or, if you’ll post your name (instead of the anonymous “Gift Planner” title) with the next reply, I’ll be happy to unsubscribe you.

But then you’ll miss lots of great opportunities to learn from Dr. James’ cutting-edge research. As many of my subscribers know… in most cases, we get to present it FIRST because this blog and my groups on LinkedIn have so many subscribers.

Victoria- I believe that study was done with one company talking to their clients in London. It’s not something a firm in the U.S. can do in the same way because it might open them up to lawsuits. Yet, the results are “directional” meaning… Yes! It would be terrific if each individual advisor asked that question.

But here’s one advisor’s opinion on the subject. -> Bard states in this thread: “I think it’s rare that clients would approach their financial advisor for recommendations of WHICH charities to include in their planning. More likely they would solicit advice as to HOW to incorporate them. Certainly advisors have discussions with their clients about the charitable interests and intents, but I suspect most advisors see their role as helping clients determine how to accomplish their charitable objectives, not determining what their objectives should be.”

I get asked this question all the time as a gift planning consultant. Unfortunately, there is not a great deal of empirical evidence available on this topic. A more robust study on the subject with real data could be tremendously helpful to determine why, despite all of the gift planning outreach and marketing in the nonprofit sector the last 20 years, we have not moved the needle on the percentage of donors who include nonprofits in their estate plans.

Overall, our experience has been that nonprofits with a local or regional donor base tend to find value when working closely with professional advisors while those with national constituencies (unless they have lots of local and regional offices) find this to be a less effective effort. We have also noted that most organizations that get benefit are spending a lot of time working with advisors and bringing the knowledge level in their community, regardless of what nonprofits the donors will support. It is the basic idea behind the “Leave a Legacy” concept–but it requires active work to bring that information to advisors. When building a three-year gift planning marketing plan, we generally put outreach to advisors in year three, unless there is something about the organization that warrants pursuing it sooner. This reflects the comments of others that it is not a Tier 1 activity.

That said, we believe it is helpful to consistently question what is the highest and best use of a fundraiser’s time. When we complete gift planning program assessments (for those with dedicated gift planning staff of one or more), we often suggest that gift planners be focused on gift planning, and by that we mean actually working with donors. There are fewer and fewer gift planning specialists each year (just look at the membership in PPP). This means that those specialists really need to spend their time working directly with donors first. Other folks on the team should manage the gift planning back office and gift planning marketing. This is the highest and best use of a person with gift planning skills. Meeting with advisors can be a useful pursuit, but not to the exclusion or detriment of donor visits.

Even so, select advisor meetings are useful. In most small and mid-sized communities, there is a limited pool of professional advisors who specialize in the estate planning space. It is relatively easy to identify this group and ensure that charitable planning is a part of their regular work with their clients. If they are asking charitable questions as part of the interview, all nonprofits will benefit. It is not a huge lift to add these visits along with donor visits for a full-time gift planner. But if that gift planner also has to manage the office, send out CGA checks, update the website, post to social media, send out marketing postcards, attend non-gift planning related events, oversee a task force on the theme for the next gala, etc., adding professional advisors to that list only further dilutes the ability to see donors. As has been suggested before, it is about balance, coupled with the highest and best use of staff with specialized skills, if you have staff with those skills.

But it would be great to research the issue and determine if there is an opportunity or wasted time here. I suspect that PPP has some data from the Leave a Legacy effort that may prove to be a helpful starting point.

Great discussion. I am with Jill and Michael. I make it my business to network with advisors, not because I expect them to solicit gifts for my organization, but because I want to encourage advisors to conduct a philanthropic conversation with their clients, particularly the high net worth ones.

Many will be familiar with Dr. Paul Schervish at Boston College and his research into the motivations of high net worth individuals and the challenges they face in determining how to distribute their wealth. Many of them report a frustration that no one is having that conversation with them. And interestingly, while many advisors report it is they who initiate these conversations with their clients, surveys show that it is the clients who must initiate an in-depth conversation. A disconnect for sure, and an indication we have work to do, as Jill says.

The 2013 US Trust study of the relationship between potential donors and advisors showed a huge discrepancy in perception by advisors who thought they spoke to clients. The study showed that client perception was that their advisors would only talk about philanthropy if they brought it up first. There are also national groups, like Advisors in Philanthropy, that have emerged to educate peers because advisors do not typically engage in philanthropic conversations. As gift planners, it seems to me that it is important to continue reaching out to advisors to educate them. I have encountered too many advisors “veto” donors’ charitable gift ideas because they did not understand what the donor was trying to accomplish. When the day comes that advisors talk about philanthropy as part of every client’s goals, when they agree to allow charities “at the table” when making plans, and when they do not veto philanthropy out of hand I think our outreach to advisors may not be needed. Until then I think we still have some work to do, whether it is primary, secondary, or in between.