Numbers

For nonprofit managers, numbers are important. Numbers define success or failure. Numbers keep the lights on or off. Numbers can show impact.

But numbers, in fundraising, are different. In fundraising, we enter an alternate universe where numbers don’t work the same way. In fundraising world, numbers are still important. But they’re important in weird ways.

Welcome to our weird world

First consider the real world. Suppose one store sells a can of Coke for $1, but with “buy one get one free.” The result: Two cans cost $1. The next store offers a 50% refund when you buy two cans of Coke for $1 each. The result: Two cans cost $1. Do people care which store they buy from? No. Either way, two cans cost $1. Math is math.

But fundraising world is weird. If you buy one and one gets added for free, that’s called a match. This works dramatically better than an identical refund. This is true in both lab experiments[1] and actual fundraising.[2] The math is the same. But the message is different.

Now suppose one store offers “buy one get one free.” The next store offers “buy one get three free.” What do people do? They stock up at the second store.

But fundraising world is weird. In fundraising world, people treat both offers the same. Offering a one-to-three match instead of a one-to-one match makes no difference.[3] The math is different. But the message is the same.

Story world, not math world

It’s not that numbers aren’t important in fundraising. They are. But giving motivation is about story. Numbers are important in giving motivation only as story. Let’s translate the math into story.

Math: I donated $100. An outside corporation matched this with their own gift of $100.

Story: I’m philanthropic. And my $100 made an extra impact. That’s a cool story.

Math: I donated $100. An outside corporation matched this with their own gift of $150.

Story: I’m philanthropic. And my $100 made an extra impact. That’s a cool story. But it’s the same story. The plot is the same. The social-emotional content is the same. The attraction of the story is the same. Thus, the motivation to give is the same.

Math: I donated $200. An outside corporation gave me a check for a cash rebate of $100.

Story: This story is different. I’m “kind of” philanthropic. But I also got some cash out of the deal. So, I benefited too. But there was some cost to me. It’s kind of a mixed bag. That’s a confusing story.

When we translate the numbers into story, the weirdness makes sense. The first story and the second story are the same story. The third story is a worse story. Experimental results match this. People donate the same for the first or second story. But they donate less for the third story.

Story characters and math

In the real world, suppose one store gives you a Coke for $1. Another gives you a Coke, and a Pepsi, and a Sprite, all for $1. What happens? People buy from the second store.

But fundraising world is weird. In one experiment, one group could donate to save one child. Another group could donate to save eight children. The cost to save one child was the same as the cost to save eight children. But people gave more when the request was for only one child.[4]

The math doesn’t make sense. But the story does. The story of one empathetic character is compelling. The story of a mixed group of different people is complicated.

How NOT to solve math problems

For “numbers people,” this weird behavior is a serious problem. Mathematically, the right answer is obvious. Acting otherwise is inefficient. But people don’t choose the “right” answer. Can these math problems be fixed? The answer is surprising. The answer is, “Yes, but it’s a bad idea.”

Researchers ran experiments to fix these fundraising math problems.[5] People were paid for another task. They were then asked to donate part of their payment. This would help famine relief in Africa.

Some people read statistics about the millions needing help. They donated 27% of their payments. Other people read about a specific child needing help. They donated 57% of their payments. This result is no surprise. Stories beat statistics. The story of one child is more compelling than statistics about millions.

For two other groups, the researchers tried to fix this problem. Before asking for a gift, they first explained the bias. They described how donors respond strongly to individual stories, but not to statistics. What happened?

As before, some people then read statistics about the millions needing help. They donated 25% of their payments. No big difference from the previous result. As before, other people read about a specific child needing help. They donated only 23% of their payments. This was less than half that from the previous experiment.

The logical message erased the bias in favor of the single victim story. It worked! But it worked by applying the brakes to giving. Further analysis showed why. Starting with the statistical explanation reduced the social emotion.[6] This reduced the giving.

Was it just a poorly worded explanation? No. In other experiments, the researchers tried other descriptions. They explained the statistics vs. story bias in other ways. These explanations also “worked.” People no longer gave more to the individual story. But neither did they give more in response to statistics.

Be careful what system you trigger

Why did this happen? To answer this, it helps to know how people think about money. People can do weird things with money. In fact, I teach a graduate course on this. It’s not actually called, “Why people do weird things with money.” It’s called behavioral finance.

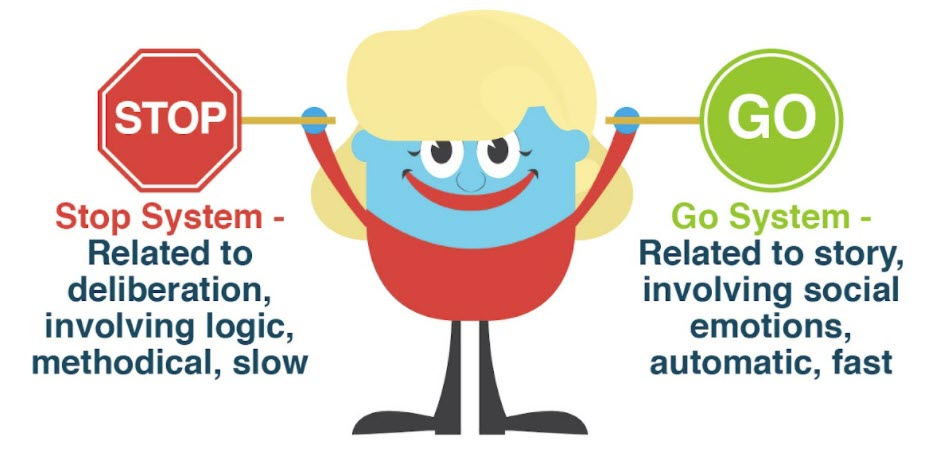

There’s a lot of research on this topic. But one fundamental concept appears repeatedly. (Different researchers use different labels, but the basic explanation is always the same.) Choices result from the interaction of two systems.[7] One system is:

- Social

- Emotional

- Automatic, and

- Fast.

The other is:

- Mathematical

- Logical

- Deliberate, and

- Slow.

The social-emotion system motivates charitable giving.[8] Social-emotional story is the engine that drives giving. The math and logic system takes part too. But it contributes only as a brake on giving.

In experiments, pointing out math and logic errors “works.” The story vs. statistics bias disappears. But this works only by applying the brakes to giving. People act more logically, but they give less. In fundraising, that’s not a great result.

Waking up the math side

Another version of the previous experiment used this two-system idea.[9] Before the donation request, some people first did math problems. Why? Because this “wakes up” the math-logic system.

Again, this “worked.” It blocked the social emotion from individual story. After doing math, those reading about one child gave only 24% of their payments. Without math, people reading about one child had donated 57%.

But math didn’t help the power of numbers. After doing math, those reading the statistics donated just over 30%. This wasn’t significantly different than those who had not done math first.

“Waking up” the numbers system killed the social emotion of the individual story. But it didn’t help the statistics argument. In charitable giving, the math system works only as a brake, not as an engine.

Others have found the same thing. Waking up the math or finance side blocks the social emotion side. In experiments, reminding people about money or finances reduces:

- Charitable giving [10]

- Willingness to help, and [11]

- Compassionate responses.[12]

More math problems: Barriers

The social-emotion-story side is the engine that drives giving. The math-logic side is only the brake.[13]

Many fundraisers understand this intuitively. But this understanding can cause a different mistake with math. Math isn’t the motivator. That’s true. But math can be critical to making a gift happen.

How is this possible? If math isn’t the motivation, how can math be good for fundraising? Math can be good because donating is not only about motivation. Donating is also about cost.

An alumnus might be 100% motivated to give $10 million for a new library. But if he doesn’t have $10 million, that gift won’t happen. A gift results not just from motivation. It results from the intersection of motivation and cost.

Bad math

Confusing motivation and cost leads to bad advice for fundraisers. This comes up most frequently in advice about tax benefits.

The misleading and oft-repeated scenario usually goes like this. A consulting group wants to learn about giving motivations. So, they ask some donors why they give. Almost nobody says that they give because of tax benefits. The group then tells fundraisers not to talk about tax benefits. This advice is readily accepted. Fundraisers are happy to avoid the hard work of understanding tax benefits.

This advice is common. And it’s wrong.

Bad math reporting

Even if tax benefits were a motivation, it couldn’t be discovered this way. People report more socially acceptable motivations.[14] Donating to change the world is admirable. Donating to get tax benefits is not. No surprise, people don’t tell the tax benefit story about themselves.

Bad math comprehension

But there’s another problem. Cost cannot be the motivation for wanting something. Suppose you asked a friend, “Why do you smoke?” He answers, “Because it’s cheap.”

Does this make sense? No. Regardless of how cheap cigarettes are, it’s cheaper not to smoke. In the same way, regardless of tax benefits, it’s cheaper not to donate.[15]

Does this mean cost isn’t important? No. If cigarettes go on sale, smokers will buy more. If tax deductions increase, donors will give more. But the cost of cigarettes has nothing to do with why a person wants to smoke. The cost of donations has nothing to do with why a person wants to donate.

Cost can influence if, when, and how much a person will donate (or smoke). But cost is not about motivations. Cost is about the barrier to acting on those motivations.

Math works in statistics

Tax benefits lower the real cost of donations. This increases giving. National economic research repeatedly proves this. More tax benefits mean more giving.[16] Even getting tax benefits a little sooner means more giving.[17] If we know anything from objective statistics on charitable giving, it is this: tax benefits matter.

Math works in experiments

Experiments show the same result. Referencing tax benefits makes people more willing to donate.[18] For example, people are more willing to “Avoid capital gains tax by making a gift of stocks or bonds to charity” than simply, “Make a gift of stocks or bonds to charity.”[19]

Adding tax benefit references increases willingness to make all sorts of donations. This includes

- Donor advised funds

- Charitable gift annuities

- Retained life estates, and

- Charitable remainder trusts.[20]

Both experiments and national data agree. Tax benefits matter. Cost matters.

Conclusion

We’re left with a dilemma. Numbers, math, and finance can be a problem. They can interfere with the social emotion that motivates giving. But they can also be a solution. They can lower the cost barrier for making the gift.

We’ve got a problem: a math problem. So, what’s the answer? Fortunately, the next article begins everyone’s favorite part of a math book. The answer key!

Footnotes:

[1] Eckel, C. C., & Grossman, P. J. (2003). Rebate versus matching: does how we subsidize charitable contributions matter? Journal of Public Economics, 87(3-4), 681-701; Eckel, C. C., & Grossman, P. J. (2006). Subsidizing charitable giving with rebates or matching: Further laboratory evidence. Southern Economic Journal, 72(4), 794-807; Gandullia, L. (2019). The price elasticity of warm-glow giving. Economics Letters, 182, 30-32; Gandullia, L., & Lezzi, E. (2018). The price elasticity of charitable giving: New experimental evidence. Economics Letters, 173, 88-91; Peng, H. C. (2020). Effect of cognitive ability on matching and rebate subsidies. Research in Economics, 74(1), 19-25.

[2] Eckel, C. C., & Grossman, P. J. (2008). Subsidizing charitable contributions: a natural field experiment comparing matching and rebate subsidies. Experimental Economics, 11(3), 234-252.

[3] Karlan, D., List, J. A., & Shafir, E. (2011). Small matches and charitable giving: Evidence from a natural field experiment. Journal of Public Economics, 95(5-6), 344-350.

[4] Kogut, T., & Ritov, I. (2005). The singularity effect of identified victims in separate and joint evaluations. Organizational Behavior and Human Decision Processes, 97(2), 106-116. Table 1.

[5] Small, D. A., Loewenstein, G., & Slovic, P. (2007). Sympathy and callousness: The impact of deliberative thought on donations to identifiable and statistical victims. Organizational Behavior and Human Decision Processes, 102(2), 143-153.

[6] In a more technical analysis, the donations for the high giving group (using a specific child + no statistics nor statistical de-biasing intervention) were driven largely by social emotions such as sympathy, but this connection was broken for the three low giving groups (using a statistics and/or statistical de-biasing intervention).

[7] Ashraf, N., Camerer, C. F., & Loewenstein, G. (2005). Adam Smith, behavioral economist. Journal of Economic Perspectives, 19(3), 131-145; James, R. N., III. (2011). Applying neuroscience to financial planning practice: a framework and review. Journal of Personal Finance, 10(2), 10-65; Kahneman, D. (2011). Thinking, fast and slow. Macmillan.

[8] See Article 2: Understanding fundraising story with a brain scanner.

[9] Small, D. A., Loewenstein, G., & Slovic, P. (2007). Sympathy and callousness: The impact of deliberative thought on donations to identifiable and statistical victims. Organizational Behavior and Human Decision Processes, 102(2), 143-153.

[10] Roberts, J. A., & Roberts, C. R. (2012). Money matters: Does the symbolic presence of money affect charitable giving and attitudes among adolescents? Young Consumers, 13(4), 329-336; Vohs, K. D., Mead, N. L., & Goode, M. R. (2008). Merely activating the concept of money changes personal and interpersonal behavior. Current Directions in Psychological Science, 17(3), 208-212.

One unusual experiment found this effect was particularly high for men with high testosterone levels. Dinsmore, J. B., Stenstrom, E. P., & Kunstman, J. W. (2021). Baseline testosterone moderates the effect of money exposure on charitable giving intent. Psychology & Marketing, 38(2), 328-337.

[11] Vohs, K. D., Mead, N. L., & Goode, M. R. (2006). The psychological consequences of money. Science, 314(5802), 1154-1156; Wang, L., Zhong, C. B., & Murnighan, J. K. (2014). The social and ethical consequences of a calculative mindset. Organizational Behavior and Human Decision Processes, 125(1), 39-49.

[12] Molinsky, A. L., Grant, A. M., & Margolis, J. D. (2012). The bedside manner of homo economicus: How and why priming an economic schema reduces compassion. Organizational Behavior and Human Decision Processes, 119, 27-37.

[13] In neuroscience, this “braking” function is called error detection. Effective fundraising story needs both parts: It must produce social emotion, but it must also avoid logical error detection that will otherwise counteract the social emotion.

[14] Nederhof, A. (1985). Methods of coping with social desirability bias: A review. European Journal of Social Psychology, 153, 263-280; Jidin, R., & Monroe, G. S. (2017). Social desirability in behavioural accounting research. In T. Libby & L. Thorne (Eds.), The Routledge Companion to Behavioural Accounting Research (pp. 132-145). Routledge.

[15] Although true in 99.9% of cases, there are a few circumstances where this general rule doesn’t apply. The following academic journal article demonstrates that it is better to donate appreciated assets to fund a Charitable Remainder Trust for retirement planning than to simply sell them. Yeoman, J. C. (2014). The economics of using a charitable remainder trust to fund a retirement portfolio. The Journal of Wealth Management, 17(1), 40-50.

[16] One reason we can tell this is because tax benefits for donating change abruptly at each tax bracket. The value of a deduction is the the amount of the deduction multiplied by the marginal tax rate. These abrupt changes allow a separation of the effects of greater income from the effects of greater tax benefits. See e.g., Backus, P., & Grant, N. (2016). Consistent estimation of the tax-price elasticity of charitable giving with survey data (Economics Discussion Paper No. 1606). http://hummedia.manchester.ac.uk/schools/soss/economics/discussionpapers/EDP-1606.pdf ; Clotfelter, C. (1985). Federal tax policy and charitable giving. University of Chicago Press; Schiff, J. (1985) Does government spending crowd out charitable contributions? National Tax Journal, 38, 535-546; Steinberg, R. (1994). Taxes and giving: New findings. Voluntas, 1, 61-79.

[17] Hickey, R. D., Minaker, B. & Payne, A. A. (2019, January 31). The sensitivity of charitable giving to the timing and salience of tax credits. Melbourne Institute Working Paper No. 02/19. https://ssrn.com/abstract=3333600 or http://dx.doi.org/10.2139/ssrn.3333600

[18] James, R. N., III. (2018). Describing complex charitable giving instruments: Experimental tests of technical finance terms and tax benefits. Nonprofit Management and Leadership, 28(4), 437-452.

[19] Id at 447.

[20] Id.

Related Resources:

- The Fundraising Myth & Science Series, by Dr. Russell James

- At last, the one big thing every fundraiser needs to know to be successful

- 4 big ideas Dr. Russell James got from scanning donor brains with neuroimaging equipment

LIKE THIS BLOG POST? SHARE IT AND/OR LEAVE YOUR COMMENTS BELOW!