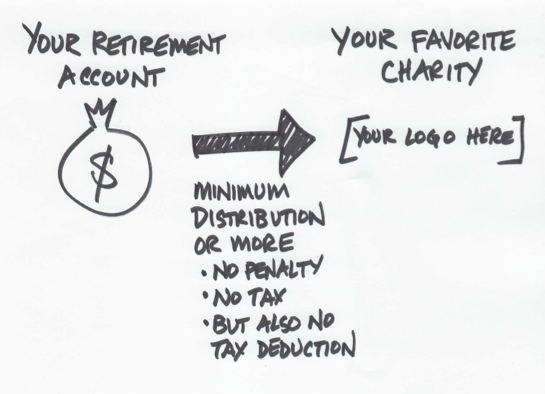

In case you forgot, the American Taxpayer Relief Act of 2012 reinstated the Charitable IRA Rollover through December 31, 2013. So, at the risk of oversimplification, your donors (age 70½ and older) can transfer up to $100,000 from their retirement accounts to your charity. While they will not be hit with any tax for making the withdrawal, they also will not get an income tax deduction either. This only applies for an IRA— not for a 401(k), 403(b), etc.

What does this mean for you and your organization? Here’s the deal. Donors over 70 1/2 that have retirement accounts must take a certain amount of money out each year. They can’t just let it sit there or they’ll face stiff penalties. We’re marketers, not tax advisors at MarketSmart. So, if you want more on the legal details, go to the IRS site here.

But this post is about marketing. And marketing is about keeping it simple and motivating people to act. Urgency is one of the greatest motivators in marketing. The December 31st deadline creates urgency and presents an opportunity for you and your organization. Of course you and I know that Congress seems to reinstate this law each year, but your donors don’t. And one day, Congress won’t reinstate it.

So what should you do? Well first let me say that the best way to mess it up is to post really confusing legalese on your website. Sadly, I just looked at a half dozen charity’s sites and all of them overcomplicated the issue. 99% of your donors simply will not understand the kind of goblygook I just read.

#1 – Don’t confuse your prospective donors. Again, most planned giving websites are completely confusing when it comes to this issue. Make sure your focus is on getting folks to consider the option and seek help.

#2 – You should make yourself the resource for assistance.

#3 – Try to get prospects to call you for help by promoting the urgency of the deadline.

#4 – Send letters (since most of these donors will be older and likely to be responsive to traditional direct mail) and be sure to include a response form, a reply envelope and a url for more information online.

#5 – Send emails too but be sure to segment your list so you’re not sending irrelevant messages to people that can’t take advantage of this opportunity.

#6 – Drive respondents to a landing page that includes a bit of information and a very simple form for prospects to request a call or a free report or white paper.

#7 – Make your copy simple! Otherwise your donors eyes will cross, they’ll get bored or they’ll fall asleep. Make sure it’s consistent in your letters and everywhere else.

#8 – Use an illustration to help simplify the message.

#9 – Share information on Facebook (but be sure to sound “helpful”… not promotional).

#10 – Talk about it at meetings, webinars or wherever potential donors gather.

#11 – Make sure the message is on the main page of your website (especially as the deadline gets closer).

#12 – Include the message on your “thank you letters” and tax receipts.

#13 – And, of course, point out the urgency of the matter everywhere by emphasizing the deadline and including copy such as: “Act now!” or “Deadline approaching!”