We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

3 Reasons Why You Should Market Charitable IRA Rollovers (And What They Are)

What would you do with $2.5 trillion? Retire? Buy a beach house? Travel the world? Develop a marketing strategy for Charitable IRA Rollovers? (Probably not the latter).

The options seem limitless, and, in fact, they most certainly are if you were to come across that much money! What is the significance behind $2.5 trillion? It represents the amount of wealth held in individual retirement accounts (IRAs).

What are IRAs and Charitable Rollovers

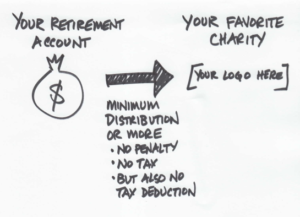

The Charitable IRA Rollover came into existence thanks to the Pension Protection Act of 2006 (PPA). With the approval of Congress and the signature of the President, starting December 18th of 2015, the Charitable IRA Rollover became permanent law, allowing individuals age 70 ½ or older to transfer up to $100,000 annually from their IRA accounts directly to charity without first having to recognize the distribution as income. Before 2006, if an individual wanted to donate money from their individual retirement account they would first need to distribute it from the account, pay taxes on those funds as income, and then donate it to charity. The Charitable IRA Rollover allows philanthropic minded individuals to donate without paying taxes on the “income.”

If you’re unfamiliar with IRAs, it’s important to understand that at 70 ½ an IRA account holder must take a required minimum distribution (more on that here). Essentially, the federal government is pleased that you elected to put money into an individual retirement account, but instead of letting you keep the funds in the account in perpetuity, you must distribute a certain amount each year once you turn 70 ½.

For savvy savers who leveraged a Traditional IRA (the type of account where you put pre-tax dollars in), that means at 70 ½ you are required to take a distribution and pay income tax on those funds. It’s important to note that the income tax rate is based on the IRA account holders current year earnings, which in theory could be quite high at that age.

However, if the retiree has a Roth IRA (which came into existence in 1997 and has income restrictions, so it is unlikely they do), then they put after-tax dollars into their individual retirement account. When they take their RMD they will not have to pay income tax because they paid the income tax before they put the money into their IRA (this is the benefit of a Roth IRA). Since these distributions do not have associated income tax, there is no added benefit from the Charitable IRA Rollover. However, since the creation of the Roth IRA was in 1997, it’s unlikely you will have any constituents currently looking to rollover funds from their Roth IRA.

What do all of these individual retirement account facts have to do with you and your nonprofit?

Want to learn how you can generate more Rollover IRA dollars quickly?

Read the guideThe creation of the Charitable IRA Rollover instantly gave philanthropic (and retirement minded) individuals a new avenue to invest in their favorite charities without having to pay more in taxes (if they have a traditional IRA). With $2.5 trillion in wealth stored in IRAs, and a growing population at the age of required minimum distribution, the stage has been set for nonprofit organizations to receive more and more IRA related donations (beyond beneficiary designations). The Charitable IRA Rollover has made IRAs a vehicle for major gifts in addition to planned gifts — a game changer for fundraisers everywhere.

3 Reasons Why You Should Market Charitable IRA Rollovers

There are a myriad reasons why your organization should market IRA Rollovers to your donors, however in the same breath, you can make the case for why you shouldn’t (resource constraints, not entirely understanding how they work, etc.). Regardless of your capacity to promote IRA Rollovers, you should be aware of the benefits derived from discussing them with your constituents. Here are three reasons you should:

1) Your donors most likely aren’t aware of the option

Although they aren’t terribly complex (relative to trusts and other financial vehicles), individual retirement accounts (and the impact they can have on charitable giving) may be unknown to your donors. Providing simple resources (a blurb on the website, a brochure, etc.), can provide the insight your constituents need to determine the efficacy of a Charitable Rollover during their annual giving.

2) You can receive major gifts today, while also discussing opportunities for legacy gifts

The traditional way to give from an IRA is via beneficiary designation. However, since 2006 we know that donors have had the option to conduct a Charitable IRA Rollover. What does this mean for you and your organization? You no longer need to “silo” IRAs as a legacy gift. Instead, fundraisers (regardless of department) can discuss IRAs with donors. If your team is educated on how IRAs work and the benefits received by taking QCDs and Rollovers, you’ll find yourself receiving more IRA major gifts than legacy gifts.

3) Qualified charitable distributions provide a lot of value to your donors

If an individual has their money in a traditional IRA they have to take a distribution (required minimum distribution) by 70 ½. Many of your donors may find that they do not need their IRA funds to support themselves, so they might find themselves taking one, lump-sum required minimum distribution (RMD) each year (usually in the 4th quarter). With this RMD the donor is paying income tax on those funds. Instead of paying taxes on a normal distribution of funds, the donor could leverage a qualified charitable distribution, where the funds go directly to a nonprofit, allowing them to not pay taxes. This “offer” is valuable to your constituents, and we all know that marketing starts with a valuable offer!

How to Market Charitable IRA Rollovers

By now you’re sold on the benefits of promoting and marketing Charitable IRA Rollovers. Great! So how do you do it? You’re in luck! Just last week our team here at MarketSmart published a free guide you can reference at your nonprofit.

Click here to read the strategic guide for marketing Charitable IRA Rollovers.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!

NOT INTENDED FOR PUBLIC POSTING

Friends,

There are a few things in this write-up that I believe are inaccurate, as well as some assumptions/generalizations that you may want to examine more closely.

1. <> If you look closely at the link you provided, you will see that the first distribution is required by April 1 of the year following the year in which the taxpayer turns 70.5. A more accurate statement would be “distribute a certain amount each year shortly after you turn 70.5”.

2. <> This ignores the fact that many wealthier taxpayers create a Roth IRA by doing a Roth IRA conversion. In any case I have seen several donors who had Roths that they created while within the income limits.

3. <> Actually, an RMD is required only in the case of inherited Roths.

4. <> How about eliminating the statements on why it is unlikely (is it, actually?) and just keep the focus on the main point: that except in the rare case of an inherited Roth, there isn’t a tax advantage to doing a rollover.

5. <> See comment under #1, above.