We use cookies to ensure that we give you the best experience on our website. By continuing to use this site, you agree to our use of cookies in accordance with our Privacy Policy.

Login

Login

Your Role

Challenges You Face

results

Learn

Resources

Company

How to Project Your Planned Gift Potential

“I owe a great deal of thanks to the person who invested in planned giving 15 years ago.”

I was sitting in the crowd at the 2019 ANA Chicago Nonprofit Conference, listening to the presentation titled “Retaining Your Sustaining Donors” when my ears perked up.

The presenter continued, “If it weren’t for their efforts to cultivate planned giving donors 15 years ago, we wouldn’t be as financially stable as we are today. Seriously, I thank my lucky stars that they were committed to legacy giving.”

Having started my career in the planned giving space, I couldn’t help but think to myself, “Planned giving saves the day again! If only it were easier for organizations to see the long-term benefits of developing their program…”

My thoughts dissipated, and before I knew it, the conference was over and I was on my flight back to Washington, DC.

Recently however, I’ve been reminded of that moment from last summer. As part of our sales process here at MarketSmart we conduct a database analysis and report on planned giving potential for our prospects.

Day in and day out, I am privy to how much potential exists from planned gifts for organizations of all sizes and missions. To me, it’s incredibly obvious that every nonprofit should be investing to develop their legacy giving program — I look at the data nearly everyday — however, I’ve quickly come to realize that most nonprofits don’t have the capacity to create planned gift potential models, and for this very reason, it’s less clear to them (and leadership) that investing in planned gifts will pay off.

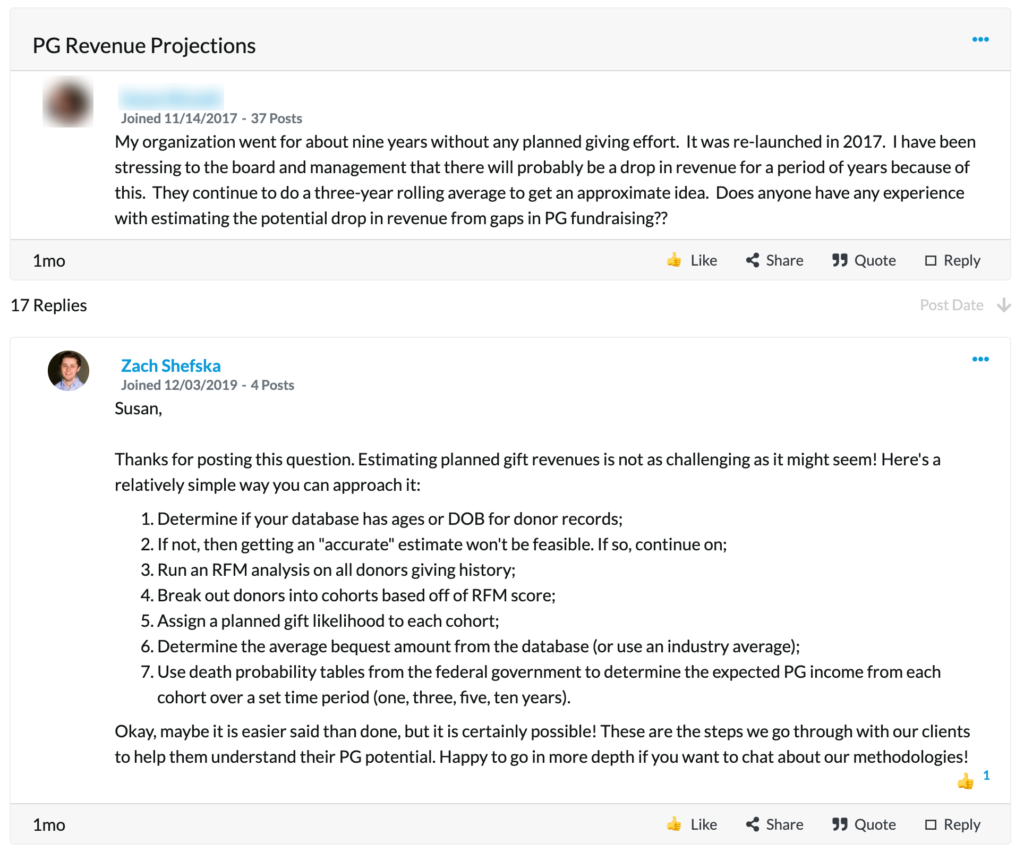

A recent forum post reminded me of this reality.

As I typed out my answer, I came to see that what was “easy” for me to do would be challenging and complex for someone who is wearing multiple hats, stretched a bit too thin, and tasked with other more “pressing” priorities.

That’s why today, I wanted to take some time to share with you how we project planned gift potential for our sales prospects here at MarketSmart, and how you can do it too. And, to show you how committed we are to making this knowledge more accessible, we’re hosting two webinars next week, one on Tuesday the 4th at 2pm EST (with a focus on healthcare and disease research & treatment organizations), and the other on Wednesday the 5th at 2pm EST (with a focus on higher education). During both webinars we’ll be going even more in depth than this blog post, and we’ll be offering a free analysis for five organizations that attend each session. Even if you can’t attend, we’ll be sending out the recording.

Without further adieu, here’s how to project your planned gift potential.

Do you have constituent ages on file?

When it comes to projecting planned gift revenues, one of the most vital pieces of information you’ll need is accurate ages for your constituents. If you don’t have ages or dates of birth in your database, it’s going to be challenging to come up with any type of realistic planned gift projection.

There are a few ways you can capture age information if you don’t have it on file. You can survey your donors, or, purchase data from a vendor, like ConsumerView, for example.

Obviously we’re a bit biased (since donor surveys are one of our areas of expertise), but regardless of how you capture this data, you’ll absolutely need it on record to effectively project your organization’s planned gift potential. Keep in mind that buying this data can lead to data hygiene issues (ie not the right age for each person). That’s the nature of the beast when you buy demographic data, it’s not 100% accurate. That’s another reason we like surveying your donors instead, but that’s a topic for a different day.

If you’re interested, we published our donor survey guide for free here. Check it out.

RFM, RFM, RFM

Recency, frequency, monetary value (RFM) — if you’re in our industry, you’ve certainly heard these words before. Some may proclaim that with the advent of machine learning and artificial intelligence, “RFM is dead,” however in our estimation, those people would be wrong.

Yes, RFM has been around for decades, yet to this day it can still provide value in segmenting your database for direct marketing purposes. In our use case we’ll leverage RFM as a proxy for planned gift potential.

Over the years we’ve been able to partner with hundreds of organizations to conduct legacy gift marketing for them. In doing that, we’ve been able to determine which RFM characteristics show an inclination to make a planned gift. Unfortunately I can’t give out our “secret sauce” (we’ve got to keep some things for our clients!), however I can say that the frequency of giving to your organization carries a lot of weight, where as amount and recency do not (at least relative to frequency). Again, this is with respect to the likelihood that an individual will make a legacy gift to your organization, not that they’re a major gift prospect, or anything like that.

At this point in the process you’ll want to codify your database with RFM scores (that means you take each constituent and score their recency of giving, frequency of giving, and amount of giving on a five or six point scale). We’ll be going more in depth on this topic during our webinar presentation, so I highly recommend you sign up to attend that (you’ll receive the recording even if you can’t make it). And for the sake of brevity for this blog post, I’d suggest you read this article from Marianne Pelletier on RFM in development. It’s a good primer for what we’ll review during the webinar. As a brief aside, Marianne’s blog is truly one of the best in the industry if you’re into analytical “stuff” like this. I highly recommend you subscribe.

What’s the average bequest?

At this point we have codified our database based off of RFM scores, and we’ve confirmed that we have ages on file for each donor. Great, what’s next? We need to know your organization’s average bequest amount.

If you have this data readily available, that’s fantastic. If not, you may need to do some digging in your database to confirm what the number is. Or, if you’d prefer, you can rely on some industry benchmarks. For example, this white paper from Katherine Swank at Target Analytics reports an average bequest amount in the US and Canada to be around $35,000. If you’re unable to determine your organization’s average bequest amount you can certainly rely on Katherine’s research.

Actuarial Life Table

The sad reality of legacy giving is that it relies on individuals to die for their gift to be received by your organization. I know I’m stating the obvious, but it’s important to not take the humanity out of the model we’re creating!

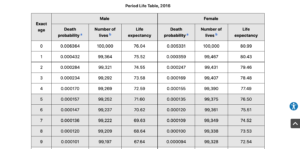

Remember those ages that we have on file? This is where they come into play. Thanks to the US government, we can look at an actuarial life table to project when an individual is likely to pass away. Again, this is a bit morbid, but we’re trying to take a pragmatic approach to legacy giving, and this is what it requires.

Life expectancies are different for men and women, so at this point, if you’re able to, cross reference your constituent age with their gender to get a more accurate projection of when they may pass away.

Where are they in the consideration process?

Lastly in our model, we need to know where each constituent is in the consideration process of making a legacy gift. What do I mean by this? We need to know how likely someone is to have made a legacy gift to your organization but not yet disclosed it, show future interest in making it, or show little to no interest in making a legacy gift.

To do this you’ll cross reference your RFM scores with a projected likelihood of the constituent being in one of those three categories (left a gift, interested, not interested). Unfortunately this is another area where I’m unable to give away our “secret sauce,” however you can imagine that a donor who has a high RFM code will correspond with a greater likelihood to have made a planned gift.

For our clients, we’re able to analyze the millions of anonymous records we have on file from the hundreds of organizations that we’ve partnered with to create realistic probabilities of RFM score mapping to the three categories. However, for our purposes here, I’d highly recommend starting with arbitrary values, running the model, looking at your outcome, and then adjusting accordingly. This may not sound “scientific,” but based off of our available data, it’s a great place to start.

Bringing it all together

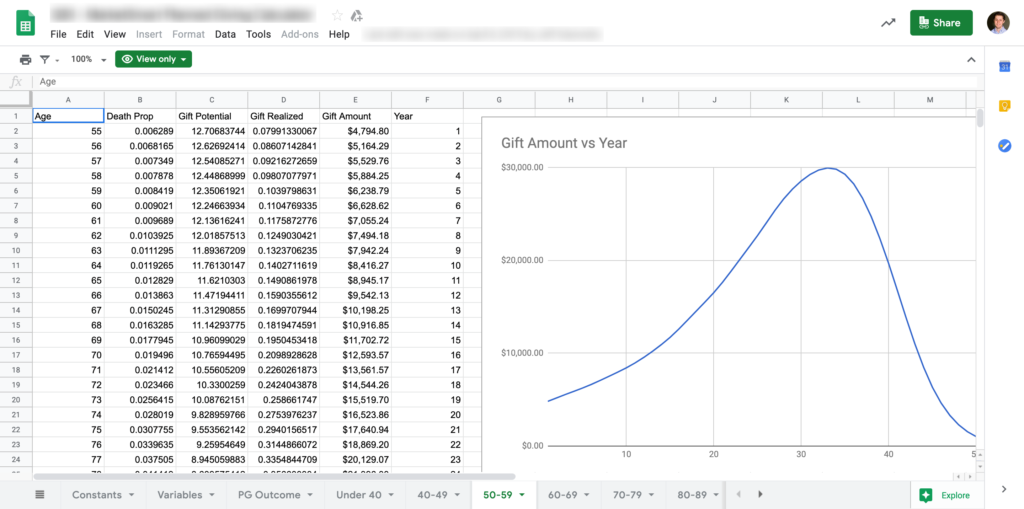

With all this information in hand, what do we do next? We open Excel! I wish I was kidding, but for the purposes of this walk through, Excel is certainly your friend.

In Excel you’ll want to take the actuarial life table values, your constituent records (including RFM values), your consideration probability values, and your average bequest amount to produce your model.

For each constituent record, you’ll map them based off of their RFM score to consideration probability. For example, a record with a score of 111 may be placed in the .005% bucket for “left a gift.” Then, once you have all your constituents in their probability segment, you’ll take each individual age and multiply it by the death probability amount. After that, you’ll multiply the remaining values by the average bequest amount and plot it out over a series of time (years), based off of when each individual is expected to die.

Yes, that doesn’t sound easy, and I can assure you it isn’t, but it’s certainly doable. Here’s an example of what it might look like:

What to do next?

This is a lot of information. Possibly even too much, but it’s what our industry needs in order to build a compelling case for investing in legacy giving. With that in mind, consider joining us for one of our upcoming webinars on Tuesday the 4th at 2pm EST (with a focus on healthcare and disease research & treatment organizations), or the other on Wednesday the 5th at 2pm EST (with a focus on higher education). We’ll continue to demystify the process of projecting planned gift potential, and we’ll even be offering a free analysis to some attendees, so be sure to register. And, if there’s interest in this subject, we’ll certainly expand the webinar offerings to touch on other sectors as well. Leave a comment, or send me an email (zshefska at imarketsmart.com) to let us know if you’re interested in that.

Get smarter with the SmartIdeas blog

Subscribe to our blog today and get actionable fundraising ideas delivered straight to your inbox!